1

Asset Management Consulting

SM

Truist Advisory Services, Inc. Wrap Fee Programs

AMC Advisor Managed Programs

• AMC Advise

• AMC Allocation Plus

• AMC Annuity

Truist Advisory Services, Inc. and Third-Party Managed Programs

• AMC Fund Select Tactical

SM

• AMC Fund Select Tactical Focus

SM

• AMC Pinnacle

SM

• AMC Pinnacle – Sleeve Select

• AMC Premier

SM

o Envestnet Sentry

• AMC Truist Invest

Truist Advisory Services, Inc. Model Manager, Research and Other Services

Truist Advisory Services, Inc.

303 Peachtree Center Avenue, Suite 140, Atlanta, GA 30303

SEC File Number 801-107729

August 22, 2024

This wrap fee brochure provides information about the qualifications and business practices of Truist Advisory

Services, Inc. If Client has any questions about the contents of this brochure, please contact Truist Advisory

Services, Inc. at (855) 815-9688 Option #2, then #4. The information in this brochure has not been approved or

verified by the United State Securities and Exchange Commission or any state securities authority.

Registration as an investment adviser does not imply a certain level of skill or training.

Additional information about Truist Advisory Services, Inc. is also available on the SEC’s website at

www.adviserinfo.sec.gov.

Investment and Insurance Products:

•Are not FDIC or any other Government Agency Insured •Are not Bank Guaranteed •May Lose Value

https://www.truist.com/wealth/tas-disclosure

MATERIAL CHANGES

The last update was July 2, 2024.

The following material changes were added to the Disciplinary Information section:

On August 14, 2024, the SEC announced the settled administrative order entered into by Truist Securities, Inc.,

Truist Investment Services, Inc. and Truist Advisory Services, Inc. (collectively, “Truist”) following the firm's Offer

of Settlement. The order was entered following Truist’s identification and self-disclosure of the unauthorized use

of off-channel communications to conduct SEC-regulated business. The order stated that certain employees of

Truist used off-channel communications against Truist policies. In addition, the order noted that Truist did not

maintain the off-channel communications or reasonably supervise employees in relation to off-channel

communications. Truist admitted the SEC's findings of fact, acknowledged that its conduct violated the federal

securities laws, agreed to retain a compliance consultant to review relevant policies and procedures, and agreed

to the making, keeping and preserving of certain required books and records. The order censured the firm,

required that the firm cease and desist from violating the federal securities laws cited in the order, and imposed a

civil money penalty in the amount of $5,500,000.

On August 14, 2024, Truist Bank consented to entry of a CFTC Order instituting administrative and cease-and-

desist proceedings and imposing remedial actions, following its identification and self-disclosure of substantially

similar conduct, Under the CFTC Order, Truist Bank paid a civil penalty of $3,000,000 on August 21, 2024, and

agreed to undertake a similar compliance review.

Table of Contents

Cover Page 1

Material Changes 2

Table of Contents 3

Services, Fees and Compensation 7

Account Requirements and Types of Clients 22

Portfolio Manager and Model Manager Selection and Evaluation 23

Conflicts of Interest 24

Advisory Services 33

Methods of Analysis, Investment Strategies and Risk of Loss 46

Voting Client Securities 54

Client Information Provided to Portfolio Managers 55

Client Contact with Portfolio Managers 56

Additional Information 56

Disciplinary Information 56

Other Financial Industry Activities and Affiliations 58

Code of Ethics, Participation or Interest in Client Transactions and Personal Trading 59

Review of Accounts 60

Payment for Client Referrals 61

Index 63

Truist Advisory Services, Inc. Wrap Fee Programs Brochure

Investing in securities and other investment products involves risk of loss that Clients should be prepared to bear.

The investment performance and success of any particular investment cannot be predicted or guaranteed, and

the value of a Client’s investments will fluctuate due to market conditions and other factors. Investments are

subject to various risks, including, but not limited to, market, liquidity, currency, economic and political risks, and

will not necessarily be profitable. Past performance of investments is not indicative of future performance.

SERVICES, FEES AND COMPENSATION

Truist Advisory Services, Inc. (“TAS” or the “Firm”) is an investment adviser registered with the U.S. Exchange

Commission (“SEC”) and a separate, wholly owned, non-bank subsidiary of Truist Financial Corporation (“TFC”)

and an affiliate of Truist Bank (“TB”). TAS became an investment adviser under the Investment Advisers Act of

1940 (“the Advisers Act” or “the Act”), as amended, in April 2016. TAS is a fiduciary under the Investment Advisers

Act of 1940 and is subject to the fiduciary standard imposed by the Act, SEC Regulations and other applicable

laws and regulations.

This Truist Advisory Services, Inc. Wrap Fee Programs Brochure (“brochure”) covers information about certain

Asset Management Consulting (“AMC”) investment advisory Programs described in this brochure (“AMC

Programs”, each an “AMC Program” or “Program”) wrap fee programs offered by TAS. Wrap fee programs are

those investment advisory programs in which the Client is charged one fee (the “Program Fee”), based on the

assets in a Client’s investment advisory account subject to an investment adviser’s management services. The

total Program Fee includes (i) the investment advisor’s compensation for management and the execution and

clearing costs associated with the trades the investment adviser recommends or submits on behalf of the Client

related to the assets being managed by the investment adviser, and (ii) any additional fees paid to unaffiliated

investment managers (each a “Third Party Managers”) and unaffiliated investment model providers (each a “Third

Party Model Providers” or “Third Party Models”) and the custody of those assets.

TAS makes a wide variety of securities and other investment products available to AMC Program

accounts. TAS, however, does not offer all available investment types and investment products to AMC

Program accounts. Instead, each AMC Program offers AMC Program accounts only securities and other

investment products reviewed and selected by TAS, a TAS Advisor or another model provider or

investment manager and determined to be eligible investments for each Program. The limitation of

investment products available to AMC Program accounts creates a conflict of interest for TAS in

connection with the management of AMC Program Accounts. See Conflicts of Interest - Other Investment

Products Available Section below.

TIS Brokerage Account Enrollment Required

Unless otherwise expressly permitted by the terms of the applicable AMC Program, investment in any of the AMC

Programs described in this brochure requires that Client separately maintain or open an underlying brokerage

account with TAS’s affiliated broker-dealer and insurance agency, Truist Investment Services, Inc. (“TIS”).

Client’s TIS brokerage account is governed by a TIS Brokerage Account Customer Agreement (“Brokerage

Agreement”). However, under certain circumstances, assets can be held at another financial institution, such as

Truist Bank. TIS is a member of the Financial Industry Regulatory Authority (“FINRA”) and Securities Investor

Protection Corporation (“SIPC”). TIS is an introducing broker-dealer which in the ordinary course of business

generally clears its equity and option trade orders related to the AMC Program accounts described in this brochure

through National Financial Services LLC (”NFS”). However, in an effort to obtain best execution for Clients, in

certain cases TIS may route certain larger equity and option orders and orders with special handling instructions

to other market centers and broker-dealers. TIS does not receive any compensation related to the alternative

routing of such orders. TIS acts as Non-Bank Custodian for most IRA accounts which are advised and/or managed

by TAS and through NFS, acting as TIS’ agent, has custody of securities held by AMC Program accounts. Fidelity

Management Trust Company, an affiliate of NFS, currently serves as Non-Bank Custodian for all AMC Program

IRA accounts not presently serviced by TIS in this capacity (“FMTC Custodian Accounts”).

For the AMC Annuity Program TAS has entered into a tri-party agreement with TIS and the selected annuity

carrier(s). The annuity carrier provides clearing, custody and execution services for the Client’s annuity. The

requirement to open a brokerage account with an affiliated broker is made by TAS for purposes of efficiently

administering its Programs and this requirement also provides additional benefits to TAS and its affiliates which

creates additional conflicts of interest with respect to TAS’s management of AMC Program Accounts. See

Conflicts of Interest –Use of Affiliated Broker Dealer Section below.

Inconsistent Brokerage Account Risk Tolerance and Investment Objectives

Client risk tolerance and investment objectives of a Client’s underlying TIS brokerage account do not in all cases

specifically match the investment advisory account risk profile of the Client’s AMC Program account within the

Envestnet system which TAS utilizes to manage how account investment risk classifications are captured and

monitored. In the case of any discrepancy in risk ratings, each Client AMC Program account is managed by TAS

in accordance with the risk rating applicable to the Client’s AMC Program investment advisory relationship and

not in accordance with any risk rating applicable to Client’s pre-existing brokerage relationship.

Balance of this page intentionally left blank

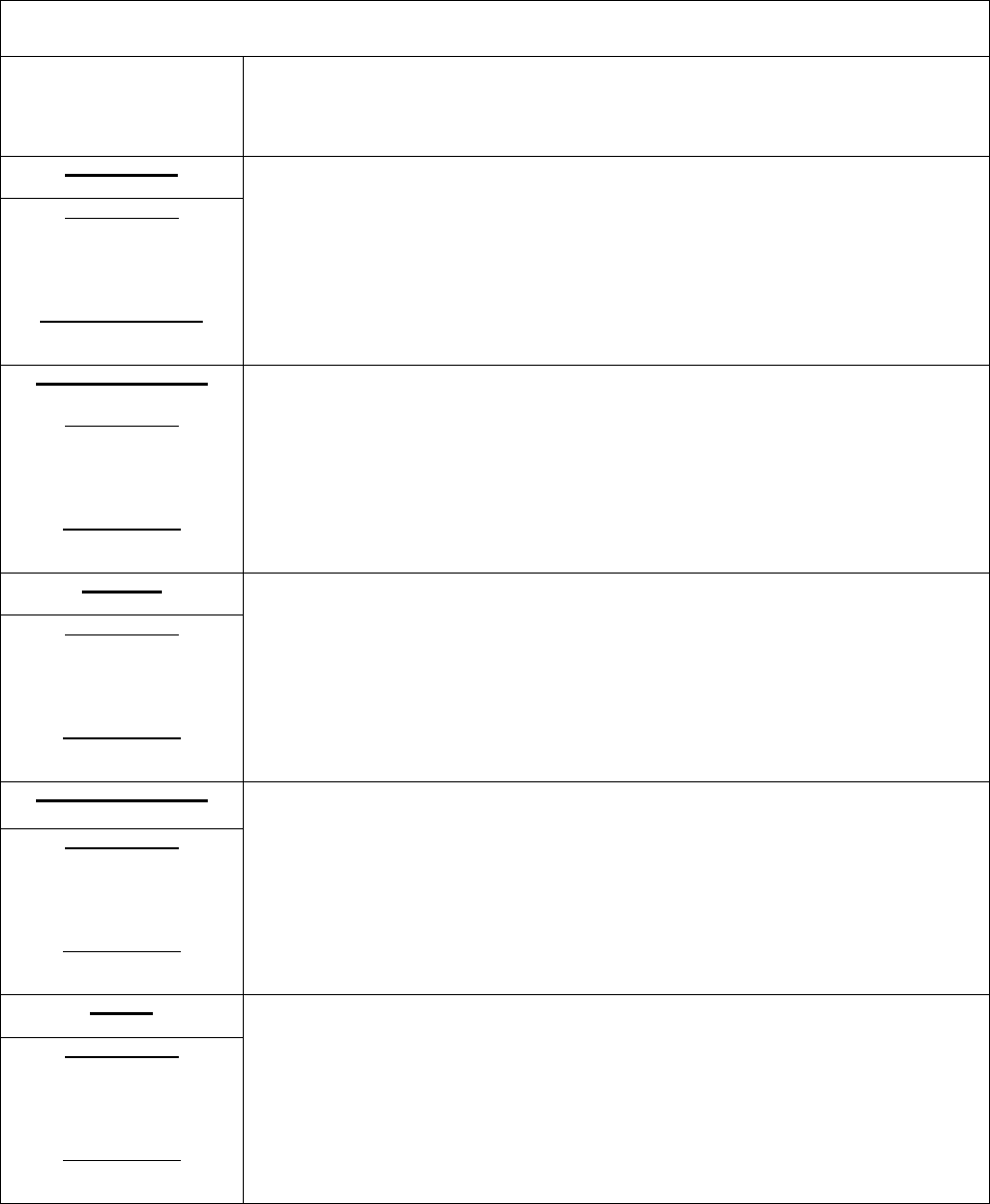

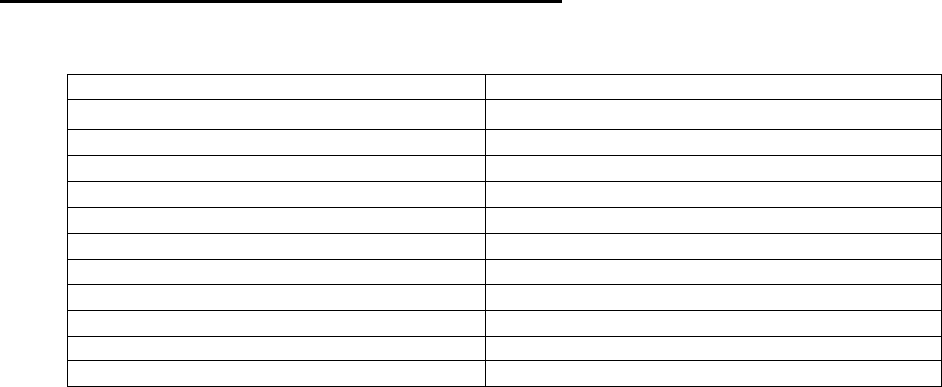

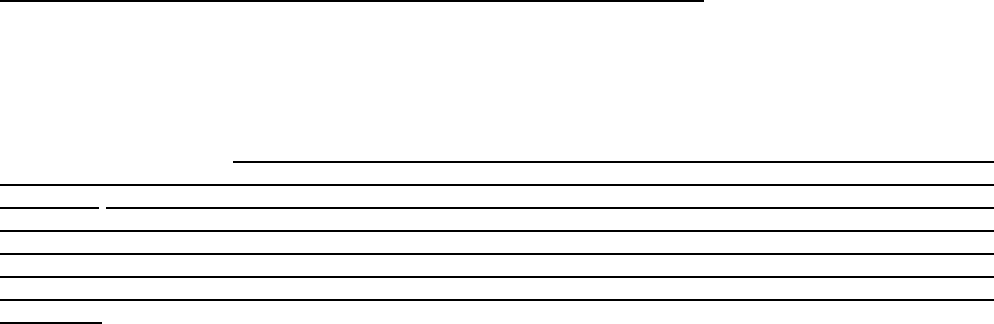

The following chart lists the descriptions of each risk rating Conservative, Income with Growth, Balanced, Growth

with Income and Growth in the TAS Envestnet platform (used by all Programs other than the AMC Truist Invest

Program).

ENVESTNET PLATFORM*

Risk Rating

with Asset Allocation

Ranges

Risk Descriptions with Equity (EQ) / Fixed Income (FI) Allocation Ranges

Conservative

This investment objective is generally focused on the production of current income

with some protection of purchasing power expected over the long term. Portfolios

will typically be significantly invested in high quality income investments with some

equity and non- traditional investment exposure in order to protect capital over the

longer term.

AMC Pinnacle

EQ: 0% - 40%

FI: 60% - 100%

AMC Advise and

AMC Allocation Plus

Maximum Equity Exposure

40%

Income with Growth

AMC Pinnacle

Eq: 15% - 55%

FI 45% - 85%

AMC Advise and AMC

Allocation Plus

Maximum Equity Exposure

55%

This investment objective is generally focused on providing current income, while

also providing an opportunity for modest capital appreciation over the long term.

Portfolios will typically have a greater exposure to fixed income securities with

some equity and non- traditional investment exposure in order provide growth and

diversification over time.

Balanced

This investment objective is focused on balancing the goals of both the growth of

principal and purchasing power protection with current income production.

Portfolios are typically allocated across major asset categories.

AMC Pinnacle

EQ: 30% - 70%

FI: 25% - 65%

AMC Advise and AMC

Allocation Plus

Maximum Equity Exposure

70%

Growth with Income

This investment objective is focused on capital appreciation while providing a low

to moderate level of income. Portfolios are typically allocated more heavily to

equity investments with some fixed income and non- traditional investment

exposure in order to protect capital over the longer term.

AMC Pinnacle

EQ: 50% - 90%

FI: 10% - 50%

AMC Advise and AMC

Allocation Plus

Maximum Equity Exposure

90%

Growth

This investment objective is focused on capital appreciation. Portfolios will typically

be concentrated in equity investments with portfolio enhancing fixed income and

non-traditional investments.

AMC Pinnacle

EQ: 60% - 100%

FI: 0% - 30%

AMC Advise and AMC

Allocation Plus

Maximum Equity Exposure

100%

*This chart does not reflect the AMC Truist Invest Program Risk Rating Allocations.

SERVICES AND PROGRAMS DESCRIBED IN THIS BROCHURE

TAS offers wrap portfolios managed by TAS advisors (AMC Advisor Managed Programs) or TAS and/or affiliated

or non- affiliated third-party managers (TAS and Third-Party Manager Programs).

AMC Advisor Managed Programs include the following Programs described below in general and in more detail in

Section ADVISORY SERVICES below:

• AMC Advise

• AMC Allocation Plus

• AMC Annuity

AMC Advise

The AMC Advise Program is a discretionary, investment management Program offering individualized investment

management by approved TAS Advisors for an asset-based fee. Clients do not direct transactions for their

accounts enrolled in this Program. Instead, the Client authorizes an approved TAS Advisor to manage the Client’s

designated assets on a discretionary basis by purchasing and/or selling individual stocks, bonds, mutual funds,

closed-end funds, exchange-traded funds, certificates of deposit, money market instruments, depository receipts

or other similar instruments relating to any of these securities within guidelines set by the TIS/TAS Policy

Committee for portfolio construction and limitation of risk. Limited types of options transactions are permitted in

the Program.

AMC Allocation Plus

The AMC Allocation Plus is a non-discretionary investment advisory Program offering individualized investment

recommendations by TAS Advisors for an asset-based fee. Investment decisions for accounts enrolled in this

Program are those of the Client and not their TAS Advisor or TAS. The TAS Advisor will be primarily responsible

for making investment management recommendations, in accordance with Client’s investment objectives as

stated in the Client’s Client profile, which the Client can elect to use to invest and reinvest the assets in securities

which includes various types of investment vehicles, such as common and preferred stocks, shares of mutual

funds, closed-end funds, exchange-traded funds, alternative investments, public and private, including hedge

funds and fund of funds, corporate, municipal or governmental bonds, notes, or bills and private equity. Margin and

limited types of options transactions are permitted in the Program.

AMC Annuity

The AMC Annuity Program is a non-discretionary investment advisory Program account offering individualized

investment recommendations by TAS Advisors. Investment decisions for accounts enrolled in this Program are

those of the Client and not their TAS Advisor or TAS. The TAS Advisor will be primarily responsible for making

recommendations in accordance with Client’s investment objectives as stated in the Client’s Client profile, which

the Client can elect to use in connection with selecting an annuity product to purchase and investing in investment

options made available by the annuity provider.

Variable annuities (“VAs” each a “VA”) are deferred annuities offered by insurance companies that provides

investment returns based on the performance of market-based subaccounts or indexed-linked segments. VAs are

flexible contracts that can provide Clients with variety of solutions, including the option to provide for guaranteed

living and death benefits. VAs are market based and can lose value based on market performance. Before

purchasing a VA, Clients are encouraged to review each VA’s prospectus in detail for a complete description of all the

features, risks, and benefits associated with the product. Annuities are not FDIC insured and all guarantees are

subject to the claims paying ability of the issuing insurance company. Annuity contracts are subject to federal

income tax penalties for withdrawals prior to age 59 ½. Additionally, VAs held in a tax-qualified account (including

IRAs) receive the same tax benefits as those held outside of a tax-qualified account. No additional tax benefits

result from purchasing or holding an annuity in a tax qualified account.

Fixed Index Annuities (“FIAs” each a “FIA”) are deferred annuities offered by insurance companies that provide

investment returns based on the performance of an underlying index. FIAs are flexible contracts that can provide

Clients with variety of solutions, including the option to provide for guaranteed living and death benefits. FIAs are

market based but offer a floor to protect a Client against market-related losses if contracts are held for the entirety

of the surrender period. If contracts are liquidated prior to the end of a surrender period or if partial withdrawals

are taken prior to the end of a surrender period, Clients can experience a loss. Before purchasing a FIA, Clients

are encouraged to review each FIA’s offering document in detail for a complete description of all the features, risks,

and benefits associated with the product. Annuities are not FDIC insured and all guarantees are subject to the

claims paying ability of the issuing insurance company. Annuity contracts are subject to federal income tax

penalties for withdrawals prior to age 59 ½. Additionally, FIs held in a tax-qualified account (including IRAs) receive

the same tax benefits as those held outside of a tax-qualified account. No additional tax benefits result from

purchasing or holding an annuity in a tax qualified account.

TAS and Third-Party Managed Programs include the following Programs described below in general and in more

detail in Section ADVISORY SERVICES below:

• AMC Fund Select Tactical and AMC Fund Select Tactical Focus

• AMC Pinnacle

• AMC Pinnacle – Sleeve Select

• AMC Premier

o Envestnet Sentry

• AMC Truist Invest

AMC Fund Select Tactical

The AMC Fund Select Tactical Program is a discretionary investment management Program offering Client

accounts enrolled in the Program an array of Exchange Traded Fund (“ETF”) portfolios, mutual fund portfolios

and Third Party Models based on risk-based modeling using asset allocation for an asset-based fee. Clients do

not direct investment transactions for their accounts enrolled in this Program. Instead, Client accounts will be

invested in accordance with Client’s investment objectives as stated in the Client’s Client profile on a discretionary

basis utilizing ETF asset allocation model portfolios provided by TAS’ IAG or Third Party Model Providers which

reflect differing risk profiles. Third-Party Models may also include mutual funds, as well as other securities. TAS

is granted discretionary investment authority over account assets.

AMC Fund Select Tactical Focus

The AMC Fund Select Tactical Focus Program is a discretionary investment management Program offering Client

accounts enrolled in the Program an array of Exchange Traded Fund (“ETF”) portfolios or Third Party Model

Provider model portfolios and are based on risk-based modeling using asset allocation for an asset-based fee.

Clients do not direct investment transactions for their accounts enrolled in this Program. Instead, Client accounts

will be invested in accordance with Client’s investment objectives as stated in the Client’s Client profile on a

discretionary basis utilizing ETF asset allocation model portfolios provided by TAS’ IAG or Third Party Model

Providers which reflect differing risk profiles. Third-Party Models may also include mutual funds, as well as other

securities. TAS is granted discretionary investment authority over account assets. TAS is granted discretionary

investment authority over account assets.

The principal difference between the AMC Fund Select Tactical Program and the AMC Fund Select Tactical Focus

Program are that the Fund Select Tactical Focus Program 1) offers fewer available models/investment options

and 2) has a lower minimum required funding amount than the AMC Fund Select Tactical Program.

AMC Pinnacle

The AMC Pinnacle Program is a unified managed account program, (“UMA”) that allows Clients to open and/or

maintain multiple advisory strategies in one underlying TIS brokerage account resulting in one investment account

for reporting the Client’s assets, performance and management fee processing. Clients elect the investment

transactions for their accounts enrolled in the Advisor Managed Non-Discretionary Sleeve Program but do not

direct investment transactions for their accounts enrolled in the Advisor Managed Discretionary or SMA Sleeves

of this Program. Client accounts enrolled in the Program can select multiple advisory strategies (each a “Sleeve”)

from the following: Strategist Sleeve, Advisor Managed Sleeves, Manager Model Sleeve and Fixed Income

Manager Sleeve (each described more fully below). Clients can move assets from one Sleeve to another within

the Program without having to complete additional account documentation.

For certain previously established AMC Pinnacle accounts, Advisors may, in the exercise of their discretion (1)

elect to allocation contributions or make withdrawals from a specific Sleeve and/or (ii) elect to allocate

contributions or make withdrawals from the entire portfolio based on the overall weights to each Sleeve.

AMC Pinnacle – Sleeve Select

All accounts in the AMC Pinnacle – Sleeve Select Program grant Advisors discretion to (i) elect to allocate

contributions or make withdrawals from a specific Sleeve and/or (ii) allocate contributions or make withdrawals

from the entire portfolio based on the overall weights to each Sleeve.

AMC Premier

The AMC Premier Program is a discretionary investment management Program offering Client accounts enrolled

in the Program the portfolio management services of a select, pre-screened group of investment managers, which

are made available to Client Program accounts through TAS which contracts both directly with some investment

manager(s) to provide separate account management services to Client Program accounts and with Envestnet

who contracts directly with additional investment managers. In either instance, Clients do not direct investment

transactions for their accounts enrolled in this Program. Instead, TAS manages each Client’s designated assets

in accordance with Client’s investment objectives as stated in the Client’s Client profile on a discretionary basis

utilizing affiliated and unaffiliated investment managers selected by each Client. Program Clients grant

discretionary portfolio management authority to the investment manager(s) they select. Each Third-Party

Investment Manager(s) offered to Clients is evaluated by either TAS’ due diligence and research process in an

identical manner or Envestnet.

One or more Third-Party Investment Managers (“Options Managers”) offer concentrated stock, index call and put

writing (income), Put Buying (protection) and/or Enhanced Income Yield option overlay management services to

Program Clients. Options Managers only trade in option contacts and do not manage the underlying stock or

other securities contained in the Client’s Program account. Clients electing Options Managers services will need

to contact their TAS Advisor when transaction in underlying securities are needed for cash flow to support option

contract margin requirements, settle options transactions or for other investment reasons. Enrollment in Options

Managers services will require Clients to complete additional documentation and acknowledge their

understanding of the risks associated with option investing. Clients must also agree to the terms of an options

account agreement and will receive separate options disclosure material. Both TIS and Clearing Broker must

approve the Client’s account for option trading prior to the implementation of Options Managers services. If margin

loan capabilities are required in connection with the establishment of Client’s options account Client must enter

into a margin agreement with the Clearing Broker. Clients should carefully review the margin disclosure in the

Program Fees Section of the General Terms and Conditions before electing margin capabilities.

Upon termination of an advisory agreement with an Options Manager or a change to a different Options Manager

that does not utilize overlay portfolios, the applicable option and/or margin agreements may be removed from the

Program account. To employ an option strategy at a later date, either in the TIS brokerage account or a TAS

advisory account, new agreements would need to be submitted for review and approval.

Program Fees applicable to Client’s option positions will be charged based on collateral value rather than the

market value of the options held in Client’s account.

AMC Fund Select Tactical and AMC Premier and Sentry– Fidelity Investments® Charitable Gift Fund

TAS has entered into an agreement with Fidelity Investments® Charitable Gift Fund (“Fidelity Charitable®”) to

offer charitable “Giving Accounts” established with Fidelity Charitable to its Clients. In accordance with the terms

of the agreement with Fidelity Charitable, the TAS AMC Fund Select Tactical and AMC Premier Programs are

presently the only AMC Programs eligible for investment of Giving Accounts.

Giving Accounts established with Fidelity Charitable are irrevocable charitable gifts to the Fidelity Investments

Charitable Gift Fund. The assets of each Giving Account are held and remain the sole property of the Trustees of

Fidelity Investments Charitable Gift Fund, who have exclusive ownership and legal control over the balances, as

well as complete and sole discretion over investment decisions regarding each Giving Account. However, Fidelity

Charitable allows the donor of a Giving Account or their designee (“Account Holder”) to have certain advisory

privileges over the Giving Account with respect to distributions and investments.

Envestnet Sentry

TAS has contracted directly with Third Party Managers and with Envestnet, which contracts directly with additional

Third Party Managers, to offer Envestnet’s or TAS’ separate managed account program, Envestnet Sentry.

In connection with the AMC Premier, Envestnet Sentry, AMC Pinnacle and AMC Pinnacle – Sleeve Select

Programs. Envestnet’s services include:

• Providing access to SMA investment managers (“Envestnet Managers”). These managers have

entered into sub- management agreements with Envestnet to provide discretionary account

management services;

• Providing administrative and /or trading services as directed by an Envestnet Manager;

• Rebalancing services to maintain an account’s asset allocation; and

• Acting on any reasonable restrictions that a Client elects to impose on the management of an account

including designation of particular securities or types of securities that Client does not want purchased.

TAS will recommend an appropriate asset allocation among the investment managers in the Envestnet Sentry

Program and recommend investment manager(s) for Client’s Program accounts. In recommending investment

managers for the Program accounts, TAS will consider factors it deems relevant, including but not limited to, the

investment goals and objectives of Client, and any reasonable restrictions imposed by Client on management of

the Program accounts, including the designation of particular securities or types of securities that should not be

purchased for the Program accounts, or that should be sold if held in Program accounts.

AMC Truist Invest

The AMC Truist Invest Program is an automated electronic discretionary investment advisory program offering

individualized investment recommendations by TAS Advisors for an asset-based fee. Clients do not direct

investment transactions for their accounts enrolled in this Program. Instead, the AMC Truist Invest Program is

offered by a Truist Advisor and utilizes a computer algorithm (“Algorithm”) to generate projections and make

discretionary investment decisions separately for each Program account. The TAS Advisor is primarily

responsible for making investment management recommendations, in accordance with Client’s investment

objectives related to one of the following goals: Retirement, Major Purchase or General Investing and the type of

portfolio which is limited in number and based on the Client’s risk tolerance. Each Program account may only

have a single selected goal.

In order to participate in the AMC Truist, Invest Program, Clients are required to agree that all records and

disclosures for the Program will be delivered, and all account agreements will be signed, electronically.

Financial Planning Services

Clients invested in AMC program accounts may also request that TAS and their TAS Advisor provide them with

additional complimentary Financial Planning Services (“Financial Planning Services”) utilizing Firm approved

computerized financial planning software. Clients with advanced financial planning needs may also separately

contract with the Firm for additional services. Financial Planning Services are also in certain circumstances

provided by the Firm’s affiliate, Truist Bank.

In preparing a financial plan or report for Clients, information deemed relevant to the particular service is gathered

through personal interviews and through documents and/or other information supplied by the Client. Each service

includes an analysis of the Clients’ information which may, but is not necessarily required, to include such things

as their current assets and investments, liabilities,

The results and other information generated by the Firm’s financial planning software regarding the likelihood of

various investment outcomes (“Reports”) are educational and hypothetical in nature, are not reflective of any

specific product, do not include any fees or expenses that may be incurred by investing in specific products, do

not reflect actual investment results, are not specific investment advice or recommendations and are not

guarantees of future results. The Reports are dependent on information provided by each Client with respect to

the Client’s income, current assets and investment, retirement and or spending goals, as applicable.

The actual returns of a specific investment product may be more or less than the returns used in the Reports

forecasts, rates of return, risk, inflation, and other assumptions may be used as the basis for illustrations contained

int he Reports and should not be considered a guarantee of future performance or a guarantee of achieving overall

financial objectives. Past performance is not a guarantee or a predictor of future results of any specified

investment index or any particular investment. Report results may vary with each use and over time.

Truist Wealth

Information presented in the Reports is for educational and illustrative purposes only and is not intended to

constitute or offer legal, accounting, tax, or other professional advice. For advice on these aspects of an overall

financial plan Clients must consult a qualified professional. TAS and Truist Bank, and their respective employees)

do not offer tax, accounting or legal advice.

In connection with Financial Planning Services, strategies may be proposed that include acquisition of securities,

insurance and other financial products. Should a Client accept the Firm’s Financial Planning Services and decide

to implement any financial planning option contained in any Report through TAS and/or its affiliates Client

represents and warrants to TAS and Truist Bank that Client is aware that:

• Clients have sole discretion whether to accept or reject wholly or partially, any such proposals and are

free to select any bank, trust company, investment advisory firm, broker/dealer or insurance agency for

implementation of advice or recommendations provided in the Report or by TAS or Truist Bank.

• The TAS Advisor (or Truist Bank representative) providing Financial Planning Services who prepared your

financial plan will receive compensation for AMC Program Accounts and other investment products

offered to you by TAS and its affiliates you based on the Reports.

• TAS’s affiliate, Truist Investment Services, Inc. (“TIS”), is a registered broker-dealer and an insurance

agency and that the TAS Advisor (and, except in certain cases, Truist Bank representative) providing a

Financial Planning Services who prepared your financial plan is also registered as a securities

representative for TIS and may also be licensed insurance agents of TIS and that is such capacities the

TAS Advisor s (or Truist Bank representative) will receive commissions and other remuneration resulting

from Client transactions effected through TIS (other than in the case of AMC program accounts).

• A conflict of interest exists when TAS or Truist Bank personnel receive a commission or other

remuneration for providing investment advisory or other investment management services and/or

effecting securities and/or insurance transactions relating to advice given and that any investments,

insurance and investment advisory and investment management services recommended by TAS or Truist

Bank may be available from other firms at higher or lower charges. See Conflicts of Interest - Section

below.

Financial Planning Services are offered as b TAS and Truist Bank upon Client request. After a Report is delivered

to a Client all Financial Planning Services TAS (or Truist Bank) will no longer maintain a financial planning

relationship with Client and any investment advisory relationship created thereby will cease and any Client’s

financial plan or Report will not be monitored or updated except upon Client’s further specific request and TAS or

Truist’s Bank subsequent agreement to again provide Client with Financial Planning Services.

Should Client elect to engage TAS or any of its affiliates for investment products or services related to any financial

plan and/or Report, the investment products and services offered to client by TAS and/or its affiliates relationship

with its Clients will be governed exclusively by the terms and conditions of the account and/or products agreements

applicable to the products or services purchased by Client.

Key TAS, Affiliate and Third-Party Service Providers

Services Provided by TAS’ Investment Advisory Group (“IAG”)

Model Provider Services

TAS’ Investment Advisory Group designs and monitors on a continuous basis, model portfolios and asset

allocation models meeting the investment objectives provided by TAS, TAS Advisors and TB.

TAS IAG provides investment recommendations for each model portfolio or asset allocation model, initial and

ongoing due diligence with respect to sub-advisers, investment managers, model portfolio providers and their

models and mutual fund and ETF investments for all of TAS’ AMC Programs. IAG also provides research on

certain individual equity and fixed income securities that is used by TAS Advisors in advising and/or managing

Client portfolios in connection with the AMC Advisor Managed Programs.

IAG provides similar research services to TB related to its general trust department investment management services

and TIS for use in connection with its general brokerage services. Use of TAS’s IAG model provider services by TIS

and TB creates conflicts of interest in connection with the management of TAS AMC Program Accounts. See

Conflicts of Interest Models Created by IAG for Management of AMC Program Portfolios and Affiliate’s Usage

of the Models for Client Portfolio Management (TB and TAS Advisors) Section below.

In addition, IAG provides report updates and alerts related to its due diligence; creates or negotiates with third parties

related to advertising, marketing and research materials, monitors and updates as needed the capital market

assumptions and provides consultative services to TB on a regular or as needed basis.

AMC Truist Invest Program Investment Algorithm

TAS has contracted with a third-party investment research and financial technology firm to provide the investment

algorithm used by TAS to manage accounts invested in the AMC Truist Invest Program.

Envestnet Asset Management, Inc.

TAS has contracted with Envestnet Asset Management, Inc. a SEC registered investment adviser (“Envestnet” or

“Platform Manager”) for administrative services related to the AMC Programs including access to their platform

system that creates proposals based on TAS’ models and those of other investment managers pursuant to

agreements, ongoing monitoring of account positions to investments selected, submission of trade details to NFS

and performance reporting.

In the case of the AMC Fund Select Tactical, AMC Fund Select Tactical Focus, AMC Premier and Envestnet

Sentry Programs, the Platform Manager places trade orders with NFS on behalf of TAS via model updates

provided by TAS’ Investment Advisory Group (“IAG”) and model providers pursuant to an agreement with TAS

with pre-set initial transactions and periodic rebalancing triggers for transactions, where applicable.

In the case of the AMC Pinnacle Program and AMC Pinnacle – Sleeve Select, Envestnet acts as the overlay

manager and determines, in their sole discretion, the trading triggers from the initial investment through portfolio

updates and rebalancing triggers for transactions.

In the case of the AMC Fund Select Tactical and in certain situations, where Envestnet Managers are utilized, in

the AMC Pinnacle, AMC Pinnacle – Sleeve Select and Premier Programs, Envestnet is a co-adviser along with

TAS, and Envestnet conducts overlay management with respect to the trading within Client Program accounts.

Envestnet combines the securities into a composite model and calculates security weightings for each security in

the composite model. This procedure helps minimize the trading activity based on the security weights by

adjusting account holdings when trading events such as a request for cash from an account which results in sells

of overweight positions or an additional investment into an account which results in investments in underweighted

positions occur and helps to reduce portfolio costs, unnecessary trading and taxable events.

In the case of the AMC Truist Invest Program, TAS contracted with Envestnet for administrative services related

to the billing of AMC Truist Invest Program accounts.

See Envestnet’s Form ADV, Part 2A for more specific information.

Model Provider and other Research Services Provided to Truist Bank

• TAS has entered into an agreement with Truist Bank to also provide these services to Truist Bank for use

in its trust department asset management functions. See OTHER FINANCIAL INDUSTRY ACTIVITIES

AND AFFILIATIONS Section below.

• TB has sole and complete discretion to make investment recommendations and manage TB trust

department accounts in accordance with TAS’ IAG models. TAS’ IAG provides investment research and

model provider services to TB for its general use and not as recommendations to specific TB trust

department accounts. TB does not provide TAS with any individual Client information relating to Client

suitability or ongoing TB Client account reviews with respect to TB Client accounts invested in connection

with TAS’ IAG models and other investment research. TAS’ IAG updates research, model portfolio and other

investment and asset allocation models as requested by TB.

• Capital Market Assumptions

• TAS’ IAG designs, monitors and updates as needed on a continuous basis, the capital market assumptions

used by TAS and TB.

A conflict of interest exists when IAG research is shared with TAS affiliates TIS and TB for use in management of

their Client’s portfolios. See Conflict of Interest – Research Reports Created by IAG and Usage of Reports by

IAG and Affiliated Firms Section below for details; See also Conflict of Interest – Different Advice Section below

for details. See OTHER FINANCIAL INDUSTRY ACTIVITIES AND AFFILIATIONS Section below regarding

agreements TAS has with TB and TIS related to Research and Other Advisory Services. Also see Conflicts of

Interest - Models Created by IAG for Management of AMC Program Portfolios and Affiliate’s Usage of the

Models for Client Portfolio Management (TB and TAS Advisors) Section below related to conflicts associated

with usage of research created and used by multiple affiliated firms and Advisors.

Sterling Capital Management, LLC (“Sterling”)

Sterling, provides TAS IAG with fixed income research and investment support on an as needed basis. IAG is

solely responsible for implementation of such research and investment support and is not required to follow

Sterling recommendations.

Truist Investment Services, Inc.

In addition to the TIS Brokerage Account requirement noted above, TIS acts as Non-Bank Custodian for IRA

accounts advised and/or managed by TAS and through NFS, acting as TIS’s agent, has custody of securities held

by AMC Program accounts.

TAS also selected the Truist Investment Services, Inc. Sweep Program’s TIS Level Rate Multibank Sweep Feature

(taxable accounts) and TIS Level Rate Single Bank Sweep feature, see Advisory Services – All AMC Programs

– Core Account – TIS Sweep Program. and creates conflicts of interest in connection with the management of

TAS AMC Program Accounts Conflicts of Interest – Truist Investment Services, Inc. Sweep Program Sections

below for details.

Truist Securities, Inc.

TAS’ affiliate, Truist Securities, Inc. (“TSI”), makes equity research reports available for TAS advisors for use in

the management of their Client’s portfolios. See Conflict of Interest – Research Reports Created by TSI and

Usage of Reports by TAS Section and Conflict of Interest – Different Advice Section below for details.

Institutional Capital Network, Inc. and CAIS

TIS has contracted with both Institutional Capital Network, Inc. (“iCapital Network”) and their affiliates and CAIS

and its affiliates and has granted TAS Advisors access to the iCapital Network and CAIS alternative investment

platforms, software and services for the AMC Allocation Plus and AMC Advise Programs.

iCapital Network and/or its affiliates and CAIS and its affiliates conduct the initial and on-going due diligence

(investment and operational) on private equity and hedge fund offerings available on their platform. TAS relies on

the due diligence provided by iCapital Network and CAIS related to the offerings available on either platform.

Fidelity Personal Trust Company, FSB

Fidelity Personal Trust Company, FSB (“FPTC”) offers Clients administrative trust services for AMC Programs,

Clients can request information related to the available services from their TAS Advisor.

Client Advisory Center (“CAC”)

TAS has established a centralized Client Advisory Center (“CAC”). The CAC consists of approximately 40 TAS

Financial Advisors (“CAC FAs”) who assist Clients in meeting their financial needs with financial planning and

access to TAS’ AMC Fund Select Tactical Focus or AMC Truist Invest Programs, where appropriate. The AMC

Fund Select Tactical Focus and AMC Truist Invest Programs is more fully described below.

CAC FAs work individually and as a team and the CAC’s primary advisor brochure supplement describes the.

CAC FAs working individually have their own advisor brochure supplements. Clients who wish to receive a copy

of a specific Advisor team member’s brochure supplement should contact the CAC at (844) 206-8900 and receive

this information free of charge.

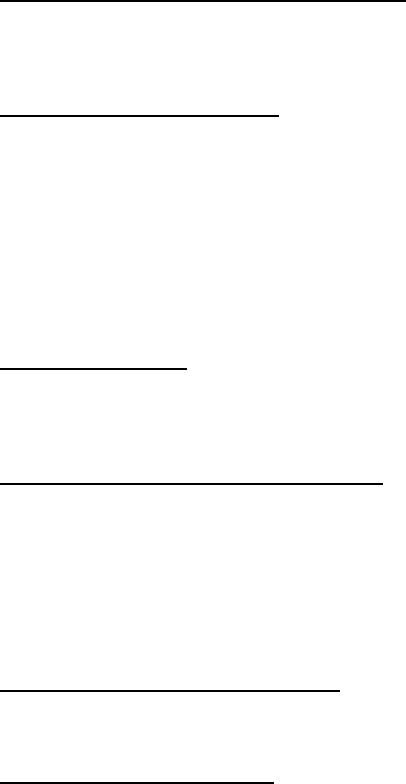

Total TAS AMC Program Accounts and Assets Under Management as of December 31, 2023:

Accounts AUM

Discretionary 109,523 $ 48,528,680,981

Non-Discretionary 14,678 $ 12,841,175,564

124,201 $ 61,369,856,545

FEES

AMC Program accounts are charged a single asset-based fee (the “Program Fee”) that includes our ongoing

Client advice and service and the execution and custodial services of TIS and NFS except those charges that, as

described in the Other Fees and Charges Section below, will be paid by the Client. If Client elects to engage

Third-Party Model Provider(s) and Third-Party Managers in the connection with the management of Client’s

eligible AMC Program account(s), Client’s Program Fee will be corresponding increased by applicable Third Party

Model Provider and Third Party Manager fees. See Additional Model Provider or Investment Manager Fee,

below.

Additional fees and expenses can be charged in the AMC Annuity Program by the issuing company that are also

described in the Other Fees and Charges Section below. The Program Fee is tiered, based on the market value

of the Client's assets calculated on the last billing day of the previous quarter and paid in advance for accounts

opened prior to September 1, 2023. The Program Fee for new accounts established after that date is based on

the average daily asset balance over the prior quarter and paid in arrears. The Program Fee is either deducted

from the AMC Annuity contract, if the insurance company has obtained an IRS Private Letter Ruling, or an AMC

Program account (or designated TIS Brokerage Account for AMC Annuity Program Accounts) or Client may agree

to have the Program Fee deducted from another account owned by the same Client. If TAS is unable to collect

the Program Fee from any such separate account for any reason TAS shall be entitled to deduct the Program Fee

from the original account, or from any other AMC Account (or TIS Brokerage Account with the same registration

if in the AMC Annuity Program) without obtaining additional authorization from the Client.

How TAS Program Fees are deducted from the allocations of an annuity contract, specifically or proportionally is

determined by the specific insurance company and can vary. Clients should discuss the specific annuity’s process

with their TAS Advisor. The annuity contract value declines by the Program Fee amount deducted.

If no account is available to pay the Program Fee for any AMC Annuity Program account and the insurance

company has not obtained an applicable IRS private Letter Ruling, the Client’s AMC Annuity Program investment

advisory relationship will end. Options available upon termination of an AMC Annuity Program investment

management relationship are described below in the section “Termination of AMC Annuity Relationship”.

The Program Fee is negotiable and TAS enters into different fee structures with its’ Clients. AMC Program Fees

will vary from Client to Client as agreed with each Client by TAS, in its sole discretion. Factors considered by TAS

in making Program Fee modifications include, but are not limited to, the type and size of the Client’s account, the

range of services provided to the Client, and the total relationship between TAS and the Client in terms of assets

under management or supervision and the date the Client’s AMC Program account was established.

The following fees are, as applicable, charged in addition to the TAS Program Fee and apply to AMC Fund Select

Tactical, AMC Fund Select Tactical Focus, AMC Pinnacle, AMC Pinnacle – Sleeve Select, AMC Premier and

Sentry Programs:

• Additional Model Provider or Investment Manager Fee. In addition to the Program Fee, in the case of

AMC Fund Select Tactical, AMC Pinnacle, AMC Pinnacle – Sleeve Select, AMC Premier and Envestnet

Sentry Program accounts, if a Third Party Model Provider or a Third Party Manager is selected by the Client,

Client’s Program Fee will also include an additional Third Party Model Provider or Third Party Manager fee.

TAS will collect any applicable model provider or investment manager fee from AMC Program Client

accounts in the same manner as its Program Fee and separately remit payment to the applicable model

providers and investment managers.

• AMC Fund Select Tactical, AMC Pinnacle and AMC Pinnacle – Sleeve Select model portfolio provider fees

range from 35 to 75 basis points and AMC Premier, AMC Pinnacle – Sleeve Select SMA investment

manager fees range from 0 to 75 basis points.

• Envestnet Sentry Manager fees are more fully described in Envestnet’s Form ADV, Part 2A.

Additional Envestnet Administration Fee. This fee is included the model provider or investment manager fee.

Envestnet charges an administrative fee for the Envestnet Sentry Program and certain Third Party Model Provider

model portfolios in the AMC Fund Select Tactical Program. This fee ranges from two (2) to five (5) basis points of

the assets under management and is included in the manager fee.

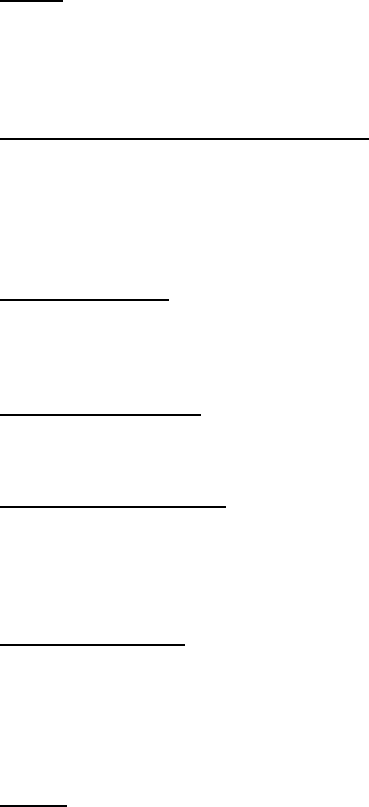

Fee Schedule

Assets Under Management

TAS Maximum

Program Fee

First $0 - $100,000

2.25%

Next $100,001 - $250,000

2.20%

Next $250,001 - $500,000

2.15%

Next $500,001 - $1,000,000

2.00%

Next $1,000,001 - $2,000,000

1.85%

Next $2,000,001 - $5,000,000

1.75%

Next $5,000,001 - $10,000,000

1.65%

Next $10,000,001 - $25,000,000

1.50%

$25,000,001 and Over

1.45%

TAS Advisors are able to offer advisory services at fees lower than those noted above.

Please refer to each Third Party Model Provider and Third Party Manager’s Form ADV Part 2A Brochure for more

information on charges and expenses. See Additional Model Provider or Investment Manager Fee Section

above.

Annuities in AMC Annuity Program Accounts. For purposes of calculating the Program Fee, the annuity account

value is determined by the aggregation of the values of subaccounts or index segments and does not include any

additional rider or death benefit values.

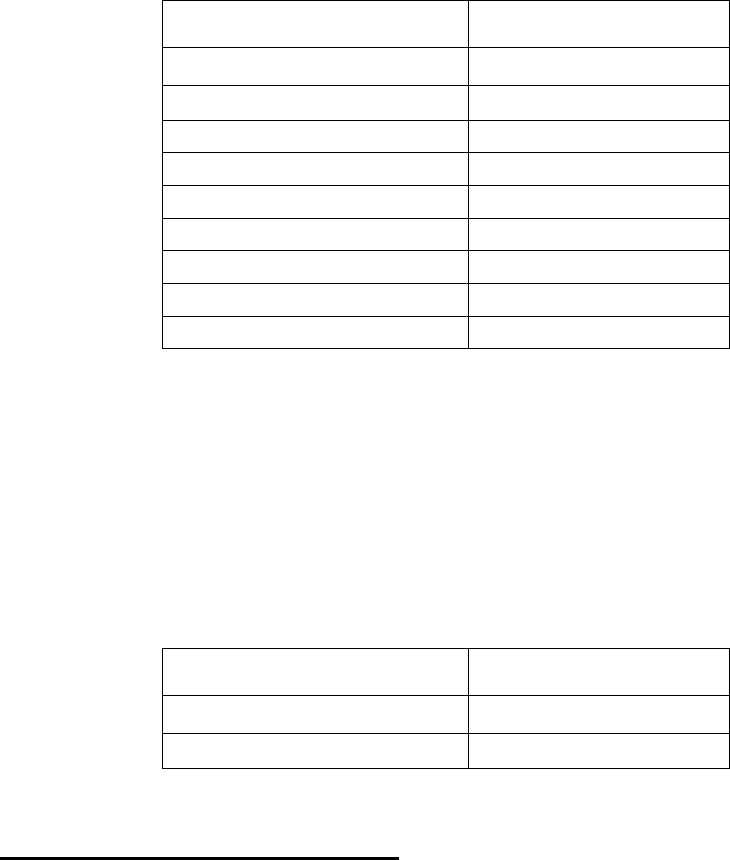

AMC Annuity Fee Schedule

Assets Under Management

TAS Maximum

Program Fee

Up to $25,000,000

1.50%

Above $25,000,000

1.45%

TAS Advisors are able to offer advisory services at fees lower than those noted above.

Example of Overall Tiered Fee Calculation

AMC Allocation Plus, AMC Advise, AMC Fund Select Tactical and AMC Fund Select Tactical Focus Programs:

Portfolio of $1,000,000 would have an effective overall fee of 2.0925%:

First $100,000 at 2.25% would be an annual fee of $ 2,250

The next $150,000 at 2.20% would be an annual fee of $ 3,300

The next $250,000 at 2.15% would be an annual fee of $ 5,375

The remaining $500,000 at 2.00% would be an annual fee of $10,000

The total Program fee of $20,925 equates to 2.0925% of the total portfolio value of $1,000,000.

AMC Premier Program: Portfolio of $1,000,000 managed by a Third Party Manager would include the additional

manager fee (example 0.45%), thus raising the effective overall tiered fee to 2.5425%.

TAS base equity fee of $20,925 PLUS the Third Party Manager fee of $4,500 equals $25,425 or 2.5425%.

AMC Pinnacle or AMC Pinnacle – Sleeve Select Program Account with Multiple Sleeves

The Program Fee is based on the total value of the assets in the AMC Pinnacle or AMC Pinnacle – Sleeve Account

and includes an additional model provider or investment manager fee if a Third Party Model Provider or a Third

Party Manager is selected by the Client, See Additional Model Provider or Investment Manager Fee Section

above.

Example:

AMC Pinnacle total account asset value:

$500,000

SMA Sleeve – 3

rd

Party Manager

$300,000

TAS Program Fee plus 3rd Party Manager fee on $300,000

Advisor Managed Sleeve

$100,000

TAS Program Fee (no 3rd Party Advisor)

Strategist Sleeve

$100,000

TAS Program Fee plus 3rd Party Manager fee on $100,000

AMC Truist Invest

The Program Fee for the AMC Truist Invest Program is 0.85%. The Program Fee is not negotiable and investment

balances of multiple Client accounts are not aggregated for fee purposes.

Examples of the Fee Calculation:

An AMC Truist Invest relationship of $100,000 consisting of three accounts of $75,000 (individual taxable),

$20,000 (traditional IRA) and $5,000 (joint taxable) would have a Program Fee of 0.85% which equates to an

effective annual fee of $850 in aggregate and $638, $170 and $42 respectively.

Tax and Impact Overlay Services

Clients who elect the Tax and/or Impact Overlay management services provided by the Platform Manager related

to the AMC Pinnacle Program will be charged an additional fee based on the schedule below in addition to the

TAS base fee, manager or model fees. Clients should review the Platform Manager’s Brochure for more

information on fees related to Tax and/or Impact Overlay Services.

Clients who elect the Fidelity Investments® Charitable Gift Fund will be charged an additional fee paid

to Fidelity Charitable on the schedule below in addition to the TAS base fee and any model provider

or investment manager’s fees.

Giving Accounts Less than $5,000,000

Tiered Fee Schedule

Average Giving Account Balance Fee (Basis Points)

First $500,000 60 bps

Next $500,000 30 bps

Next $1,500,000 20 bps

Next $2,500,000 15 bps

Assets Under Management

Tax Overlay Service

$0 - $10,000,000

10 basis points

$10,000,001- $25,000,000

8 basis points

$25,000,001 and over

5 basis points

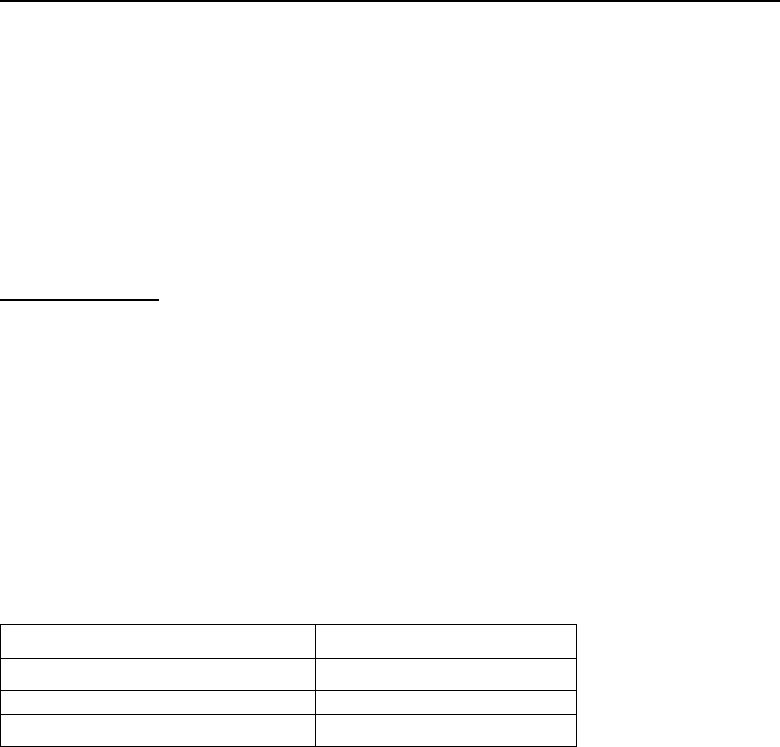

Giving Accounts with Balances of $5,000,000 or More: Flat Fee Schedule

Average Giving Account Balance Fee (Basis Points)

$ 5,000,000

- $ 9,999,999

19 bps

$10,000,000

- $19,999,999

17 bps

$20,000,000

- $34,999,999

15.5 bps

$35,000,000

- $47,999,999

13.5 bps

$48,000,000

- $74,999,999

12 bps

$75,000,000 and up

11.5 bps

Program Fees are pro-rated for accounts that are opened or closed during the quarter. Multiple Program accounts

held by the same Client or members of the Client’s immediate family (i.e., spouse, children, or parents) within the

same Program can be aggregated, at Client request and in the discretion of and upon approval of TAS, for

purposes of determining total amount of assets under management.

If Client invests or withdraws $10,000 or more in any AMC Program account after the inception of a calendar

quarter, the Program Fee for that quarter will be recalculated and pro-rated as of the day of the additional

investment or withdrawal.

Excluded and Unsupervised assets are not included in the Program Fee calculation; however, excluded assets

are included in account performance report calculations.

Additional areas Clients should consider when investing in an AMC Program where noted, where applicable:

• Asset Valuation. For purposes of the computation of the value of any securities or other investments in

an AMC Program account, securities listed on a national securities exchange will be valued, as of the

valuation date, at the closing price on the principal exchange on which they are traded. Shares of mutual

funds will be valued at their respective net asset values as calculated on the valuation date (or the most

recent net asset value if none is calculated on the valuation date) as determined by pricing sources

believed by TAS to be reliable. Any other securities or investments in an account will be valued by NFS

in a manner determined in good faith to reflect fair market value. Any such valuation should not be

considered a guarantee of any kind whatsoever with respect to the value of the assets in an account. NFS

typically uses a pricing service or other independent evaluator, as well as other independent sources, in

computing the value of securities. These values are believed to be reliable, but TAS will not verify the

accuracy of the information.

• Program Fee Valuation. The Program Fee is based on the value of the eligible Program Assets, including

cash and cash equivalents held in an AMC Program account. Excluded Assets (defined below) are certain

investments which may be included in the Account for reporting purposes. The Program Fee will not be

charged on Excluded Assets held in the account and the total market value of the Excluded Assets will

be deducted from the total market value of the account for determination of the billable value. Therefore,

the amount of Excluded Assets in an account could. result in the Client paying a higher fee percentage

due to the Program Fee Valuation decreasing below a schedule tier. As an example, a portfolio that

started with $500,000 at 2.15% where $300,000 was moved to an excluded position due to Client request

or for supervisory reasons, would incur a Program Fee of 2.20% at the next billing cycle after the assets

were transitioned to an excluded position.

• Privately Offered Securities. Valuations can lag a month or more and are received from the issuer’s third-

party administrator to the alternative investment vehicle, for directly offered investments or from iCapital

Network’s or CAIS’ fund administrator for those available on the iCapital Network and CAIS platforms.

The quarterly Program Fee calculation uses this data to calculate the Program Fee.

• Margin Use Increases Risk and the Program Fee. The Program Fee is based on the total amount of

assets in the Client’s account, including assets purchased using margin. If TAS uses margin in a Client’s

account, TAS and the Client’s Advisor each will receive additional compensation based on the increase

in the assets being managed. Although the Program Fee, as a percentage of assets under management,

will not change, the total assets on which this percentage is based will increase through the use of borrowed

funds, and, accordingly, the compensation paid to TAS, and the Client’s Advisor, will increase. In addition,

Clients who borrow funds will pay interest on the outstanding loan balance. TIS, the broker-dealer and

affiliate of TAS and Client’s TAS Advisor, who is dually registered with TIS, receive a portion of these fees

and interest. The use of margin borrowing creates conflicts of interest for TAS in connection with the

management of AMC Program accounts, See Conflicts of Interest – TIS Clearing Broker Credits

Section below for details.

There are risks associated with the use of borrowed funds for investment purposes. The decision to use

leverage from borrowed funds in a Client AMC Program account rests with the Client and should be made

only if the Client understands the risks of margin borrowing, the impact of the use of borrowed funds on

an account, and how the use of margin will affect the Client’s ability to achieve Client’s investment

objectives. Specifically, positive or negative performance of a margined account, net of interest charges

and other account fees, will be enhanced by virtue of using borrowed money. Thus, gains or losses in a

leveraged account will be greater than would be the case with an un-leveraged account. In addition,

Clients with margin accounts will need to deposit additional cash or collateral in their AMC Program

account if the value of the portfolio declines below the required loan- to-value ratio. If the Client cannot

provide the additional required collateral, NFS, the firm providing the margin loan, in its sole discretion, is

authorized to sell securities in the collateral account and other Client accounts to meet the margin

requirement. In these circumstances, the securities often will be sold into a market that is declining, so

the prices obtained for the liquidated securities are lower than in a stable or rising market. TAS and/or

Client’s TAS Advisor will not act as investment adviser to the Client with respect to the liquidation of

securities held in an account to meet a margin call and, as creditors, TAS and our affiliates, or NFS may

have interests that are averse to the Client. Clients electing to engage in margin borrowing will receive a

separate margin disclosure document from TIS. See Conflicts of Interest - TIS Clearing Broker Credits

Section below for details.

Householding for Program Fee Purposes. In all AMC Programs, except the AMC Truist Invest Program,

for purposes of determining the Program Fee charged to an account, the value of all accounts held by the

account owner and/or members of the same household (as determined by TAS) can be aggregated for

fee calculation purposes at the Client’s request and in the discretion and upon approval by TAS). AMC

Program Accounts accepted for householding will be treated as part of the same household on a case-

by-case basis as determined by TAS and will be combined for fee billing purposes. It is the Client’s

responsibility to request that AMC Program accounts be treated as part of the same household.

Householding of fees can provide fee breakpoint discounts if certain asset thresholds are met (see section

Fee Schedule above). Individual retirement accounts and other personal retirement accounts can be

aggregated for this purpose, but retirement plan accounts subject to the Employee Retirement Income

Security Act of 1974 (“ERISA”) cannot be aggregated.

• Accrued Interest. Accrued interest on fixed income securities will be included in the Program Fee

calculation.

• Excluded Assets. The billable value of your account does not include the value of excluded assets. The

impact of this lower billable value is that your account may be assigned a higher fee tier percentage.

• High Cash and Cash Equivalent Positions. Fees associated with portfolios invested in large positions of

cash and/or cash equivalents, including money markets, can be higher than the returns on these types of

investments.

The exact Program Fee each Client will pay is specified in the Client’s Statement of Investment Selection (“SIS”).

TAS is permitted to discount the Program Fee for employees of TAS and its affiliates in its sole discretion.

AMC Program accounts can, depending upon the investment products utilized, cost Clients more or less than

purchasing such services separately. Factors that can bear upon the cost of AMC Program accounts in relation

to the cost of the same services and/or investment products purchased separately can include, among other

things, the size and type of the account, the historical and expected size or number of trades for the account, the

mutual fund and other investment share classes made available to each type of account by the mutual fund

company or other investment provider and the number and range of supplemental services provided to the

account.

COMPENSATION

AMC Program Clients will not be charged a separate commission or other transaction charge for trades executed

through TIS and its clearing broker, NFS, instead such charges are included in the Program Fee and TAS will pay

TIS and NFS’ commissions and other transaction charges (as negotiated between TAS and TIS) for transactions

for made in connection with the management of AMC Program accounts. TAS or one or more of their affiliates

incurs additional expenses as the amount of trading in an AMC Program increase. As a result, TAS has a financial

interest in the number of trades recommended and has a financial incentive to seek to limit the extent of trading

activity of the AMC Programs. See Conflicts of Interest – Active Trading Section below.

AMC Program Clients will also incur other fees, expenses and costs associated with their account. See Other

Fees and Charges Section below.

A portion of the Program Fee compensates TIS for custody, clearance and settlement activities that are undertaken

by TIS even where an investment manager chooses to place the trade through a broker-dealer other than TIS.

When investment managers place trades through other broker-dealers, AMC Program accounts will be charged

additional fees, expenses and other costs by the applicable third-party broker-dealer. If a third-party broker-dealer

is utilized for trade execution services, the total net price paid for bonds or equities can be higher than the net

price which would have been paid if the transaction was undertaken through TIS. AMC Program investment

managers of fixed income portfolios have historically placed more trades through other broker-dealers than equity

investment managers. All Third Party Managers are responsible for best execution and control brokerage selection

on behalf of their Client accounts and Clients utilizing Third Party Managers should closely examine each Third

Party Manager tr’s Form ADV Part 2A brochure for information relating to each Manager’s best execution and

brokerage policies, including information relating to such investment manager’s receipt of “soft dollars” in

connection with its trading activities on behalf of customer accounts. For more information about the trading

practices of Third Party Managers, please refer to the “Important Information about the Trading Practices of

Independent Investment Managers and Envestnet in Certain Truist Advisory Services Managed Programs”

disclosure located on Truist Wealth’s website https://www.truist.com/wealth/tas-disclosure.

Where Client assets are held at another financial institution, custody, clearance, settlement and other charges

and fees imposed upon Client’s AMC Program account by such other financial institution are not included in the

Program Fee. As such, the costs and expenses will be more than if the Client assets were held at TIS, which

includes such costs and expenses in the Program Fee.

For the duration of each Client’s AMC Program investment advisory relationship with TAS, a portion of the

Program Fee received by TAS in connection with the management of each AMC Program account will be paid

the TAS Advisor associated with the Program account and other employees of TAS and its affiliates.

Depending upon trading volume and other services provided to Client accounts, TAS and the TAS Advisor

associated with each Client account can earn greater compensation if a Client invests in an AMC Program account

than if the Client were to instead open a brokerage account to buy individual securities. Therefore, if greater

compensation is expected to be received from an AMC Program account than from a brokerage relationship, TAS

and TAS Advisors have a financial incentive to recommend one of the AMC Programs rather than a brokerage

account relationship. See Conflicts of Interest – Advisory vs Brokerage Account Section below.

Depending upon applicable fee schedules, amounts invested in products offered and other services requested by

each Client, TAS and the TAS Advisor associated with each Client account can earn greater compensation if you

invest in an AMC Program than if a Client were to instead open a Truist Bank trust or investment management

account to manage your assets. Therefore, if greater compensation is expected to be received from an AMC

Program account than from a TB trust or investment management relationship, Advisors and TAS have a financial

incentive to recommend one of the AMC Programs rather than a TB trust or investment management relationship.

See Conflicts of Interest – Advisory vs Truist Bank Trust and Investment Management Accounts Section

below.

In addition, TB employees may refer qualified bank Clients to TAS Advisors for a one-time nominal fee of a fixed

dollar amount that is not contingent on whether the qualified Client referral results in any advisory activity or the

establishment of an investment advisory relationship. See Conflicts of Interest – Non-Deposit Retail Sales

(Networking) Agreement Section below.

Unsupervised Assets

Assets in certain Client AMC Program accounts can be classified as “unsupervised” for oversight reasons.

Unsupervised assets, although held in the same underlying brokerage account are not part of the managed

Program assets and therefore, no advice is given related to these assets, the assets are not subject to the Program

Fee and Unsupervised assets are not included in the performance calculations. Any unsupervised assets held in

an AMC Advise Program account are included in the Firm’s proxy voting process. See Section VOTING CLIENT

SECURITIES below for details.

New Client accounts enrolled in the AMC Programs (including existing TIS brokerage accounts) are required to

remove such “unsupervised” assets from their TAS advised TIS brokerage account and transfer such assets to a

separate TIS or other brokerage firm account. Any transfer of “unsupervised” assets to a separate brokerage

account will require affected Clients to execute applicable securities transfer documentation.

Excluded Assets

Assets in certain Client AMC Program accounts can be classified as “excluded” for a variety of reasons. Excluded

assets can be included in a model and will be included in Program performance calculations but will not be

included in the calculation of the Program Fee.

Other Fees and Charges

AMC Program Client accounts will incur separate fees or charges associated with odd-lot differentials, auction

fees, transfer taxes, electronic fund and wire transfer fees, SEC fees on NASDAQ trades, any other fees mandated

by law, certain fees in connection with the establishment or administration or termination of retirement or profit-

sharing plans or trust accounting, and any other charges for special services requested by Clients. Client accounts

holding shares of investment companies, including money market funds, closed-end funds, exchange-traded

funds, annuities and other investment products will incur additional fees, including, as applicable and disclosed in

each investment products prospectus, statement of information or other offering materials, certain advisory,

distribution, administration or other fees and expenses.

In addition to the Program Fees, Clients are subject to certain charges in connection with investments made

through the AMC Programs, including mutual fund/ETF advisory, distribution, early redemption or other fees.

Mutual funds (including money market mutual funds) and ETFs, or the advisers or principal underwriters of the

mutual funds or ETFs make payments to TIS, an affiliated company of TAS, from applicable share classes,

pursuant to a Rule 12b-1 distribution plan or other arrangement as compensation for distribution, shareholder

services, recordkeeping, or administrative services; these payments may be paid from the fund’s total assets or

may be paid by a fund’s adviser, distributor or their affiliates. TAS typically invests AMC Program Client accounts

in mutual fund and ETF share classes which do not pay 12b-1 fees to TIS. However, some mutual funds and

ETFs do not offer non-12b-1 share classes or do not contractually offer them to TAS Clients. TIS automatically

credits Client AMC Program accounts with an amount equal to any 12b-1 fees received by TIS as well as any other

fees for the distribution, shareholder services, recordkeeping or administrative services received during the period

an account is enrolled in an AMC Program. Each fund’s Rule 12b-1 distribution plan and other fee arrangements

will be disclosed to Client’s by TIS upon request and such fees are also disclosed in the applicable fund’s

Prospectus and Statement of Additional Information.

Client AMC Program accounts invested in these investment products will bear these fees and expenses. Each of

the fees discussed above is in addition to the Program Fee and will reduce Client investment returns by a like

amount.

TIS does not accept distribution, shareholder services, recordkeeping, or administrative services from mutual

funds, ETFs or similar products in connection with TAS accounts enrolled in the AMC Programs.

TIS receives and retains marketing support payments from investment product providers which can be

recommended and/or selected by TAS and TAS Advisors in connection with the management of the AMC

Programs. TAS evaluates all investment products offered to AMC Program Clients accounts using uniform criteria

and without regard to the receipt of marketing support payments by TIS. See Sections Conflicts of Interest -

Financial Service Vendor Continuing Education Sessions and Training and Educational Financial Support

below.

When selecting the share class for the mutual funds and ETFs, TAS does not, in all instances, select the share

class with the lowest fees that is available from the fund company due to the fund company not contractually

offering them to TIS for use by the AMC Program accounts. The Firm monitors fund families and holdings for

lower cost funds available on our platform on an ongoing basis. If a lower cost fund is available an exchange will

be made or the holdings will be excluded from billing.

TFC - Sterling Capital Management LLC Referral Agreement

Under the terms of TFC’s agreements with Guardian Capital Group Limited (“Guardian”) relating to TFC’s sale of

Sterling to Guardian, TFC may receive additional financial benefits if Sterling’s investment advisory, separate

account management, unified managed account model portfolio services, and other advisory services (“Sterling

Advisory Services”) are used in connection with TAS Program Accounts (other than Retirement Accounts

1

). See

Conflicts of Interest –__ TFC - Sterling Capital Management LLC Referral Agreement Section below.

Affiliated Multi-Manager Portfolios

GFO Advisory Services LLC (“GFO”), is a SEC registered investment adviser and an affiliate of TAS. GFO is the

general partner/managing member and/or investment adviser to a group of privately pooled investment vehicles.

Such vehicles are organized as domestic limited partnerships, limited liability companies, and offshore

corporations, (collectively, the “Affiliated Private Funds”). Affiliated Private Funds offered to AMC Advise and

AMC Allocation Plus Program Client accounts are evaluated by the Firm’s due diligence and research process by

the Investment Advisory Group (“IAG”) in the same manner as all other similar investments.

In addition, certain members of IAG serve as Portfolio Manager to GFO Advisory Services LLC’s Multi-Manager

Portfolios (“MMPs”). TAS and GFO share expenses related to the members of IAG who act as Portfolio Managers.

Offering Affiliated Private Funds to AMC Program Client Accounts creates conflicts of interest in connection with

TAS offering and management of the AMC Programs. See Conflict of Interest - GFO LLC, Section below for

details.

In the case of Retirement Account(s), TAS prohibits investment of Client accounts in Affiliated Private Funds. GFO

receives compensation for services provided to the Affiliated Private Funds that is separate, distinct and in addition

to, the Program Fee(s) earned by TAS. Clients can obtain additional information concerning Affiliated Private

Fund expense sharing by GFO, by contacting their TAS Advisor and/or consulting each Affiliated Private Fund(s)’

offering materials.

AMC Program Clients have the right to terminate their consent and authorization to the purchase or continued

retention of any Affiliated Fund(s) in Client’s AMC Program account any at any time (i) by terminating (or directing

TAS to terminate) the investment in the applicable Affiliated Fund(s), or (ii) by providing written notice to TAS of

Client’s intention that Client’s consent and authorization to invest Client’s AMC Program account in shares of

Affiliated Funds(s) set forth above has been terminated.

Mutual Funds and ETFs imposing Upfront Sales Charges Prohibited