Department of the Treasury

Internal Revenue Service (IRS)

FY 2025

Capital Investment Plan

Table of Contents

Major IT Investments .......................................................................................................... 3

Case Management ...................................................................................................................................... 3

Compliance ................................................................................................................................................ 7

Compute ..................................................................................................................................................... 9

Digital Services ........................................................................................................................................ 11

Engagement Channels ............................................................................................................................. 14

Filing and Intake ...................................................................................................................................... 16

Infrastructure Management ...................................................................................................................... 19

Internal Operations .................................................................................................................................. 20

Network Services ..................................................................................................................................... 23

Platforms & Applications ........................................................................................................................ 24

Storage ..................................................................................................................................................... 27

Tax Account Management ....................................................................................................................... 29

User Services ........................................................................................................................................... 31

Major Non-IT Investments ................................................................................................ 34

Criminal Investigation Owned Vehicles .................................................................................................. 34

Leasehold Improvements ......................................................................................................................... 34

Security Equipment ................................................................................................................................. 35

Appendix 1: Legacy Investment Crosswalk to New IT Investment Structure .................. 36

3

Note to Reviewers: IRS re-structured its legacy IT investments from an organizational stand-alone

investments model to a capabilities and platforms based model. FY 2024 and FY 2025 Estimated

Obligations are reported under the new IT infrastructure framework. FY 2023 Actual Obligations are

reported based on the legacy IT infrastructure model (see appendix 1).

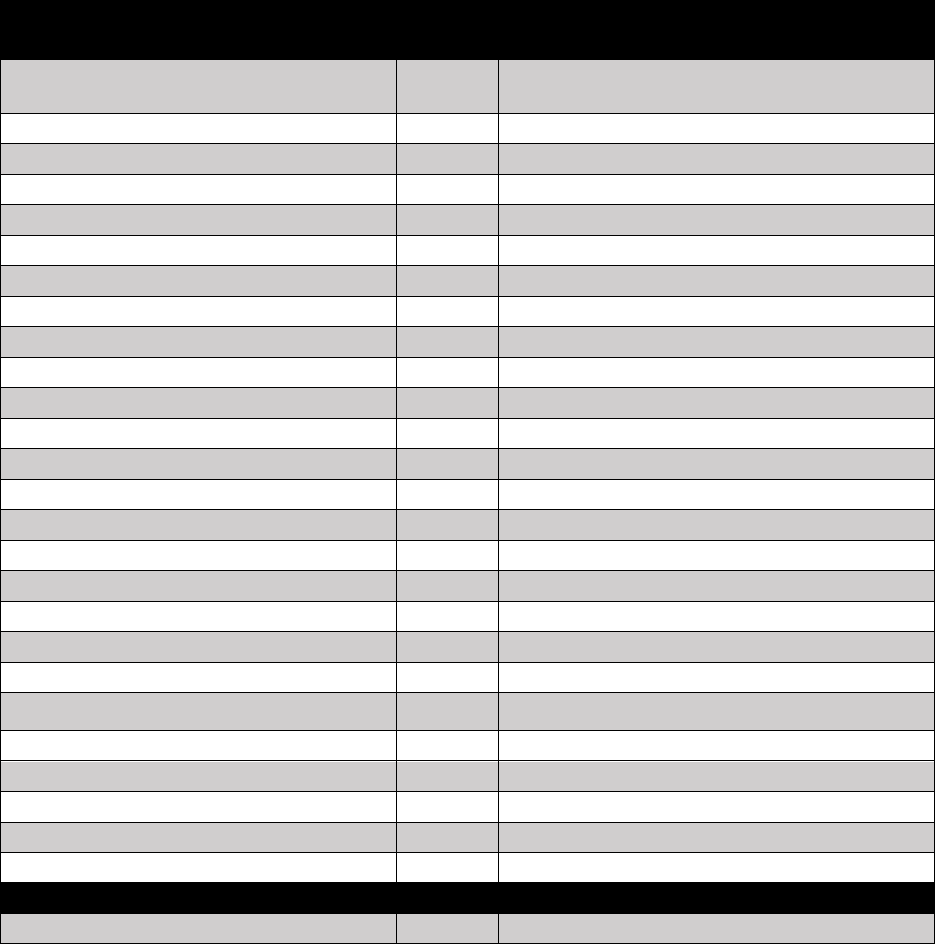

Consistent with the corresponding Summary of Capital Investments table, the columns included in the

investment tables below are defined as:

• FY 2023 Actuals – Total actual obligations.

• FY 2024 Estimated Obligations – Anticipated obligations from all budgetary resources (e.g.,

balances from prior years, user fees, and FY 2023 Operating levels).

• FY 2025 Estimated Obligations – Anticipated obligations from all budgetary resources (e.g.,

balances from prior years, user fees, and FY 2025 President’s budget).

Major IT Investments

Case Management

Description:

Case Management includes case initiation, case work (selection, assignment, administration, tracking, and

closure), and case reporting and analytics to resolve a broad range of cases that now require a

combination of IRS business personnel and electronic workflows. This investment covers a cross-cutting

business area comprised of policy, programmatic, and managerial support functions necessary to IRS

operations for cases that could originate in other business areas including data retrieval from systems such

as the Integrated Data Retrieval System.

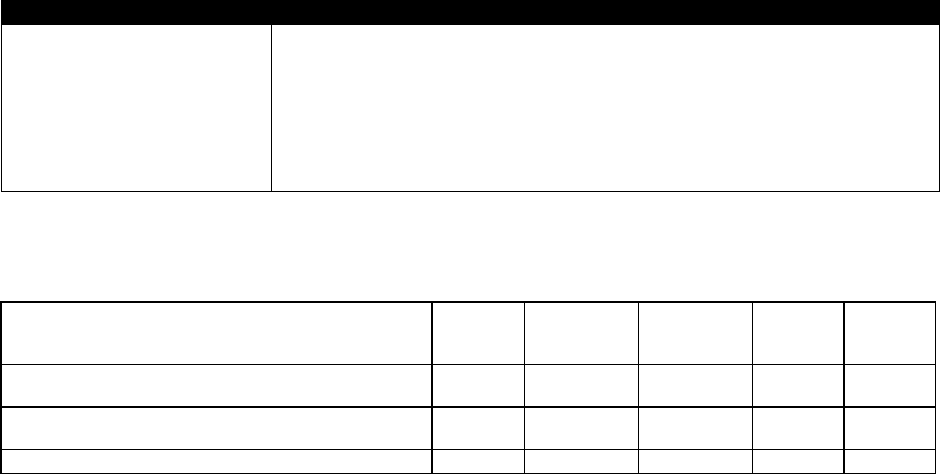

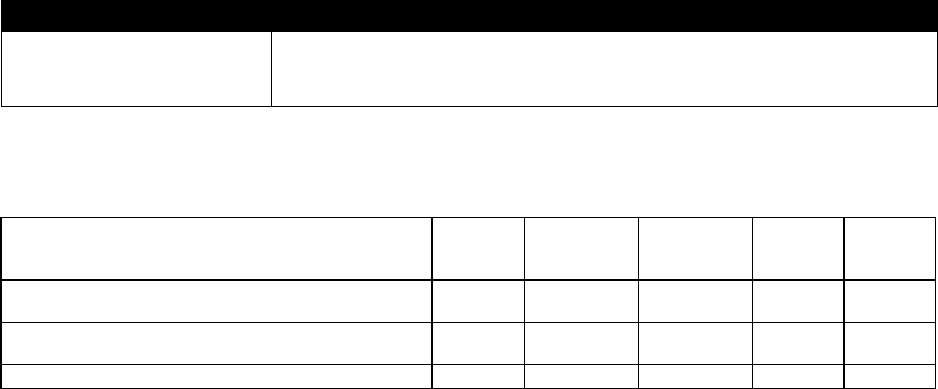

Consolidation of previous investments:

Major Investment

Sub-investments

Case Management

Account Management Services (AMS), Appeals Centralized Database System (ACDS), Audit

Information Management System (AIMS), Automated Insolvency System (AIS), Automated Trust

Fund Recovery (ATFR), Compliance Tools, Criminal Investigation Management Information

System (CIMIS), Enforcement Revenue Information System (ERIS), Enterprise Case Management

(ECM), EP/EO/GE Aims Report Processing Systems (EARP), Integrated Data Retrieval System

(IDRS), Issue and Knowledge Management System (LMSB IMS), LMSB Issue Based Management

Information System (IBMIS), Report Generation Software (RGS) Program, Tax Litigation Counsel

Automated Tracking System (TLCATS), Taxpayer Advocate Management Information System

(TAMIS), TEGE Support Systems (TEGE SS)

*Under the legacy structure, AMS, ECM and IDRS were categorized as Major IT Investments; some, or all their sub-investments are now aligned under Case

Management.

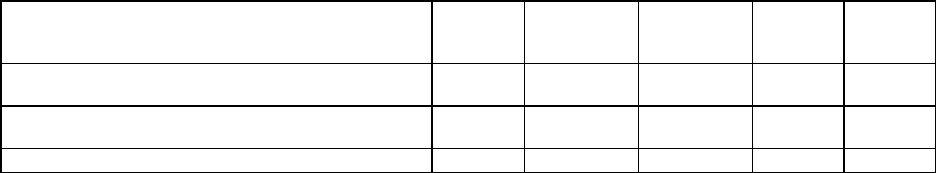

Investment Obligations: (In Millions of $):

Type

FY 2023

Actuals

FY 2024

Estimated

Obligations

FY 2025

Estimated

Obligations

Change

in $

%

Change

Sub- Total DME Obligations (Including Internal

labor (Govt. FTE))

0.00

310.51

400.52

90.01

28.99%

Sub- Total O&M Obligations (Including Internal

Labor (Govt. FTE))

0.00

75.96

85.78

9.81

12.92%

Total Obligations

0.00

386.48

486.30

99.82

25.83%

4

Purpose, Accomplishments, Future Objectives:

Enterprise Case Management (ECM):

ECM provides an enterprise solution for performing case management functions using a Commercial Off

the Shelf (COTS) platform and common services to improve customer service, automate manual

processes, increase efficiencies, and simplify case management systems operations. ECM helps drive

modernization efforts across the IRS, leading to increased business and IT efficiencies and improved

customer service while enabling the retirement of legacy case management systems/components.

The IRS envisions modernizing and standardizing enterprise-wide case management processes and

systems to provide top quality service to taxpayers. ECM will empower employees to rapidly resolve

cases in a simplified technical environment, designed to drive efficiency and collaboration. The ECM

Program's primary focus is on the Exam Line of Business, with a secondary focus on delivering additional

functionality for current ECM applications and on-boarding additional new users as capacity allows.

The target platform for ECM has been deployed into production and we continue to work with various

business process owners to prepare their individual applications to go live. Continued work to integrate

data and common services and develop applications on the platform will result in most major business

organizations transitioning off their legacy case management systems over time. These business process

deployments demonstrate how ECM will improve business units' case management and better serve their

customers. The adoption and evolution of ECM empowers employees to rapidly resolve cases in a

simplified technical environment, designed to drive efficiency and collaboration.

The anticipated benefits include significant cost reductions and a simplification of maintenance tasks. By

centralizing the enterprise-wide technology platform, case management is streamlined, redundancies are

minimized, and overall cost of ownership decreases. In addition, automation (to include the IDRS

modernization efforts) and readily accessible data (providing a 360-degree view of each taxpayer),

together with standardized business processes, notably reduce the time required to resolve cases. Lastly,

the technology platform enhances taxpayer interactions through the integration of digital services and

self-service options with case management. Thus, it allows for a more dynamic and flexible interaction

experience, making the resolution process more effective and efficient for all parties involved.

Account Management Services (AMS):

The AMS application provides a variety of research and case management tools for approximately

41,000 IRS employees. These entities include a multitude of organizations i.e. TIGTA, Tax Auditors and

all those enjoined with collectively ensuring that the IRS accomplishes its core mission and service to the

taxpayer. The AMS system also provides both large-scale inventory management at the enterprise level

and customized workflow management at the individual case level.

Integrated Data Retrieval System (IDRS):

IDRS is a secure, reliable, flexible, and mission-critical system consisting of databases and programs

supporting IRS employees who are working active tax cases. IDRS manages data retrieved from the Tax

Master Files allowing over 60,000 IRS employees who use it daily to take actions on specific taxpayer

account issues, track statuses and post updates back to the Master Files.

IDRS provides for systemic review of case status, reducing staffing needs and providing consistency in

case control. For example, each time a taxpayer phones IRS, the representative answering the phone uses

IDRS to log the call and answer any questions. Actions taken via IDRS include (but are not limited to):

notice issuance; taxpayer correspondence; installment agreement processing; offers in compromise;

adjustment processing; penalty and interest computations and explanations; credit and debit transfers

among accounts; and research of taxpayer accounts for problem resolution of taxpayer inquiries.

5

Using data analytics, IDRS enables IRS to efficiently evaluate taxpayer data to inform enforcement and

secure legal compliance, both domestically and internationally.

IDRS produces a variety of tax information that facilitates collaboration with various internal and external

partners, including Social Security Administration, Bureau of the Fiscal Service, state and local

governments, and tax practitioners. IDRS is continuously monitored for cost, schedule, and project

performance. IDRS's taxpayer-centered services ensures consistent, efficient service, and helps address

various performance gaps.

Accomplishments and Future Objectives: ECM

FY 2023 Accomplishments:

• Delivered four new features to Privacy, Governmental Liaison and Disclosure (PGLD) including

form updates, notifications and improved search to support efficient separation processing.

• External Referrals Go-Live enabled the public to electronically submit digital referrals. ECM

External Referrals capability provides the workflow for business operating divisions to review

and route referrals to the appropriate business treatment streams.

• Installed and configured Adobe Experience Manager to support Exam Taxpayer correspondence

via standard Media & Pubs templates.

• Deployed Exam functionality to the Training Environment for Tax Compliance Officers to test

the Exam workflow.

FY 2024/2025 Future Objectives:

• Digitalize case information and establish virtual case folders to improve access to case data

through digital channels.

• Encourage service-wide solutions for streamlined case and workload management processes to

consolidate systems with similar functionality.

• Automate workload allocation to assign the next best case to the next available case worker with

the appropriate permissions and skills.

• Build, configure, and update workflows based on case characteristics throughout the case life

cycle with continuous feedback.

• Support IRA SOP Objective 4.1: Transform core account data and processing, by modernizing

ECM to host all compliance workflows, enabling the decommissioning of legacy applications.

• Host all compliance workflows within ECM, thereby enabling the decommissioning of legacy

applications.

• Subsequent ECM releases in FY 2024 and FY 2025 will focus on delivering additional

capabilities for the exam solution while looking for opportunities to migrate additional business

processes to ECM.

6

Accomplishments and Future Objectives: AMS

FY 2023 Accomplishments:

• Completed User Interface upgrades and migration to remediate security findings and allows all

AMS to run in native Edge mode especially the Correspondence Imaging Inventories (CII)

component.

• Implement a new Graphical User Interface (GUI) tool that will allow certain business contacts to

make updates to AMS Worksheets and Checklists to free severely limited AMS Application and

Development (AD) resources for other work.

• Migrate AMS from existing in-house Continuous Integration and Continuous Development

(CICD) tools and processes to Enterprise offerings (Jenkins Software Tool, Incident Management

of Record (IMR), Central Software Staging Repository (CSSR).

• Migrated AMS ClearQuest to Engineering Workload Management (EWM), Rational Team

Concert (RTC), and Collaborative Lifecycle Management (CLM).

• Reviewed the possibility of adding CII for business units other than W&I to allow for flexibility

in working taxpayer correspondence digitally.

FY 2024/2025 Future Objectives:

• AMS will continue to deliver UI upgrades and migration.

• Upgrade current IT Architecture to JAVA 11.

• Upgrade current IT Architecture to Windows 11.

• Implement GUI checklist for tool creation.

• Upgrade COTS products Brava & Documentum if DME funding is approved.

• Modify AMS to allow certain SBSE users to have access to both CSCO and Automated

Collection System Support (ACSS) inventories at the same time if funding is approved.

• Upgrade of AMS servers to RHEL8 to review the possibility of adding Correspondence Imaging

Inventories for business units other than W&I to allow for greater flexibility in managing

taxpayer correspondence digitally.

Accomplishments and Future Objectives: IDRS

FY 2023 Accomplishments:

• Supported a successful filing season.

• Data at Rest Encryption (DARE) implemented on MSQL CDP Web - All Environments.

• Delivered functionality to Only Allow Alpha or Numeric Characters in SEID Field.

• Clean Energy Act, Update TC971 with AC830 to allow entry of qualifying VIN automobile

purchase. The VIN supplied by dealer and must match VIN on taxpayer’s return.

• Successfully delivered all IDRS IRA program UWR’s.

• All programs for Filing Season 2024 successfully deployed for production on schedule.

• Populated Penalty and Interest Tables for Taxpayer Delinquent Accounts (TDA), Automated

Collections (ACS), and Automated Lien (ALP) notices.

• Interest rate changes requiring an update to program code.

• Adjustment Command Code (ADJ54) implemented changes related to several Unified Work

Requests (UWR's), including those related to the future Legislative Initiatives.

FY 2024/2025 Future Objectives:

7

• Planning in progress for transformational initiatives IRS will perform in 2024/2025.

• Planning for defining what IDRS modernization means and defining an IDRS roadmap and spend

plan.

• Populate Penalty and Interest Tables for TDA, Automated Collections (ACS), and Automated

Lien (ALP) notices.

• Deliver all adjustments with respect to command code changes related to UWR's, including

Legislative Initiatives.

• Successfully deliver all IRA program UWRs that require IDRS updates.

• Deliver programs, for Filing Season 2025, for production on schedule.

• Interest rate changes requiring an update to program code.

Compliance

Description:

Compliance includes the collection, examination, appeals, and criminal enforcement functions, with key

activities that include forecasting potential non-compliance issues, performing pre-filing preventive

treatment, case prioritization models and algorithms, performing filing, payment and reporting

compliance actions, and investigating criminal violations of the tax law.

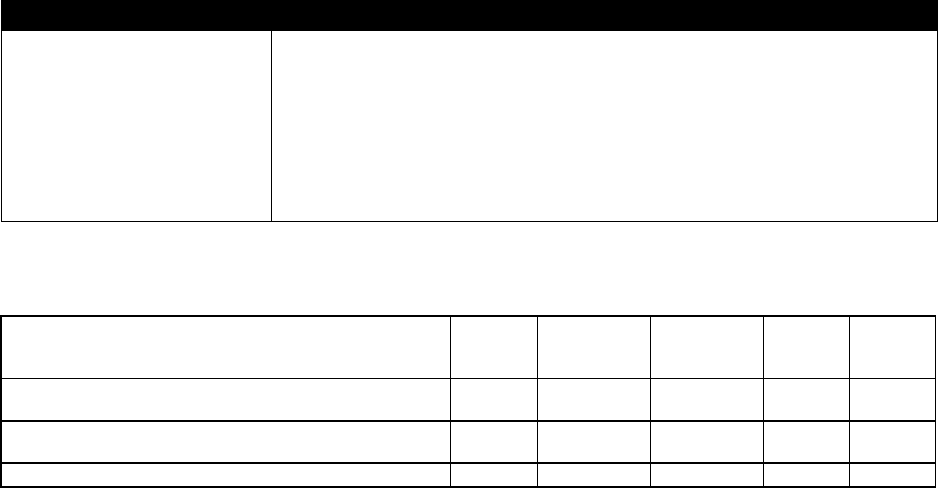

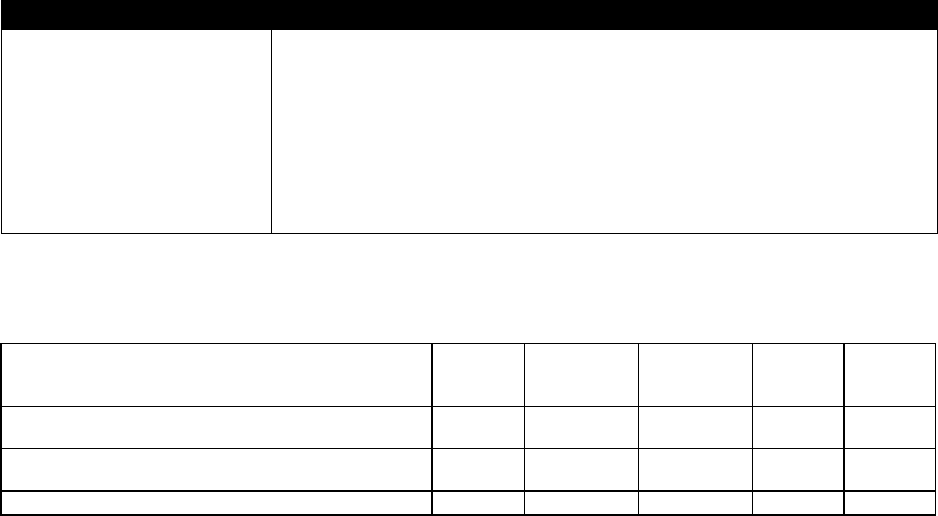

Consolidation of previous investments:

Major Investment

Sub-investments

Compliance

Automated Collection System (ACS), Automated Offer in Compromise (AOIC), Automated

Underreporter Program (AUR), Business Masterfile Case Creation Nonfiler Identification Process

(BMF CCNIP), Collection Activity Reports (Statutory Reports) (CARSR), Combined Annual Wage

Reporting Federal Unemployment Tax Act (CAWR FUTA), Compliance Tools, Correspondence

Examination Automation System CPE Unix (CEAS CU), Dependent Data Base (DDB),

Examination Returns Control System (ERCS), Excise Files Information Retrieval Systems

(ExFIRS), Federal Payment Levy Program (FPLP), Information Reporting and Document Matching

(IRDM), Integrated Collection System (ICS), Integrated Production Model (IPM), LMSB Selection

and Workload Classification - Component 2 (SWC C2) - B, Return Review Program (RRP)

*Under the legacy structure, RRP was categorized as Major IT Investment; some, or all sub-investments of RRP are now aligned under Compliance.

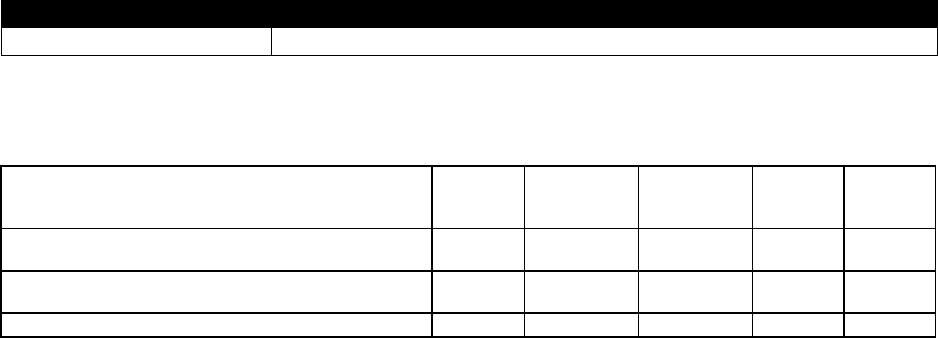

Investment Obligations: (In Millions of $):

Type

FY 2023

Actuals

FY 2024

Estimated

Obligations

FY 2025

Estimated

Obligations

Change

in $

%

Change

Sub- Total DME Obligations (Including Internal

labor (Govt. FTE))

0.00

184.85

230.82

45.97

24.87%

Sub- Total O&M Obligations (Including Internal

Labor (Govt. FTE))

0.00

126.71

143.54

16.83

13.29%

Total Obligations

0.00

311.56

374.36

62.81

20.16%

Purpose, Accomplishments, Future Objectives:

The purpose of Compliance includes planning and modeling, anomaly detection, case selection, and

compliance common services that enable taxpayers to realize and meet their tax obligations.

8

The goal is to foster taxpayer compliance by providing tools and resources to promote voluntary

compliance and quick, accurate issue resolutions. Modernization of key compliance

systems expedite detection and resolution of non-compliance, shrinking the tax gap. The IRS

will significantly leverage the Enterprise Data Platform and Advanced Analytics, improving data access,

modeling, and analytics, enabling precise compliance measures, and streamlining the taxpayer

experience.

The benefits include a reduced tax gap through improved identification of non-compliance and

fraud. An integrated anomaly detection system will provide real-time detection, leading to

prompt resolution and an enhanced taxpayer experience. Furthermore, voluntary compliance

will be boosted through strategies like pre-filing nudges, self-service opportunities, and

proactive early interactions with taxpayers. These combined initiatives will improve revenue protection,

recovery, deliver superior outcomes for the IRS, and will improve the overall

taxpayer experience.

FY 2023 Accomplishments:

• Documented and socialized the current state and future vision of compliance systems

and applications through the Examination Case Selection (ECS) and Enterprise Automated

Deployment (EAD) Architecture Transition Strategy and Roadmap

in April-July 2023.

• Completed stakeholder analysis of existing anomaly detection and case selection

application owners to expand the Revenue Production Advisory Board for an

enterprise-wide view across the Business Operating Divisions (BODs) in July 2023

• Engaged with the Transformation & Strategy Office for the Business Capability

Prioritization process initiated in August 2023. The goal is to re-align IT

Modernization Roadmaps and IRA Program planning to the outcomes through

November 2023.

• Confirmed support for EAD/ECS from Procurement and the Enterprise Architecture

and Design Office for acquisitions planning activities through strategy and planning.

• Designed Framework for Compliance System Workshops to be conducted with

technical SMEs starting in June 2023 to validate baseline view and document system

pain points.

• Delivered initial data analysis of IT Workforce Tool (ITWT) 2021 Assessment results

to AD leadership in April 2023.

• Completed draft of Unified Compliance Organization (UCO) Decommissioning Activities Desk

Guide and enhanced

template for Project Decommissioning on June 30, 2023.

• RRP delivered 1040X which implements new requirements to evaluate and associate a

return with up to four types of treatment (both IDT and NIDT).

• Completed Solution Concept for Partnership Compliance Evaluation (PCS

modernization) in coordination with Enterprise Architecture Implemented separate resource

queues for rules processing and extracts so that performance issues when reviewing current day

returns for fraud and IDT do not impact sending prior-day selections of returns for potential fraud

and IDT to downstream systems (i.e., Selection and Analysis Platform (SNAP)/Criminal

Investigation (CI)/ Research, Applied Analytics & Statistics (RAAS)).

• Initiated processing of IMF balance due returns.

• Completed fundamental infrastructure improvements for RRP to rebuild overaged

servers to enable Red Hat Enterprise Linux (RHEL) 8 upgrade and cutover to the new Greenplum

Version 6 platform.

9

FY 2024/2025 Future Objectives:

• Mobilize resources to focus on high-risk and emerging issues that have not received appropriate

enforcement attention, including enforcement pertaining to digital assets.

• Implement data and research approach to inform and continuously refine compliance coverage

levels needed to promote voluntary compliance.

• Establish centralized compliance planning and strategy function to identify potential high-risk

compliance cases using existing systems and analytics.

• Refine approaches and treatments piloted for large corporate enforcement, high-income and high

wealth enforcement, and in key segments.

• Pilot new approaches and treatments for detection and enforcement of key emerging issues.

• Hire and onboard workforce to achieve compliance coverage rate, including specialists and

experienced hires.

• Train and re-skill workforce with specialized capabilities to address complex and

emerging issues.

• Complete IT Future State Technical Competencies Summary Report for AD:

Compliance Domain workforce.

• Build and execute a corresponding workforce re-skilling action plan leveraging IT Academy and

other training resources.

• Deliver completed Decommissioning Project Plans for Automated Campus Exam

(ACE), Correspondence Examination Automation Support (CEAS) and other legacy Compliance

systems.

• Continue foundational infrastructure updates for RRP RHEL 8 new server migration and RRP

Legacy Component (RRPLC) implementation of 2-factor authentication and SNAP Palantir Data

Connection Agent (PDCA) server upgrade.

• Establish the comprehensive long-term ECS/EAD Modernization Roadmap to establish

timeframes for the disposition of legacy systems as part of Government Accounting Office

(GAO)104719 corrective action activities.

Compute

Description:

Compute Services contains spending for all IRS compute resources, whether physical or cloud-based.

Any serverless/containerized/virtualized compute processes will be included to go along with physical

compute resources. All spending on operating systems will also be reported with this investment.

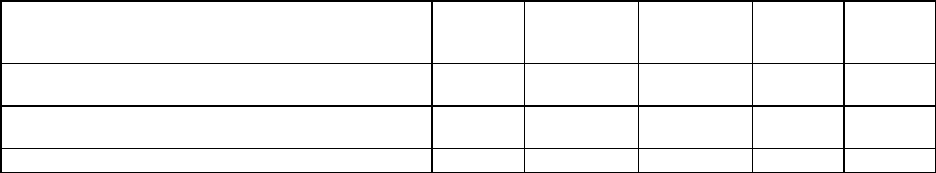

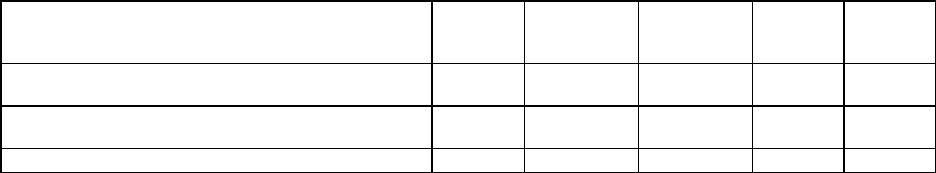

Consolidation of previous investments:

Major Investment

Sub-investments

Compute IRS Main Frames and Servers Services and Support (MSSS)

*Under the legacy structure MSSS was categorized as Major IT Investment; some, or all sub-investments of MSSS are now aligned under Storage, Compute, and

Infrastructure Management.

10

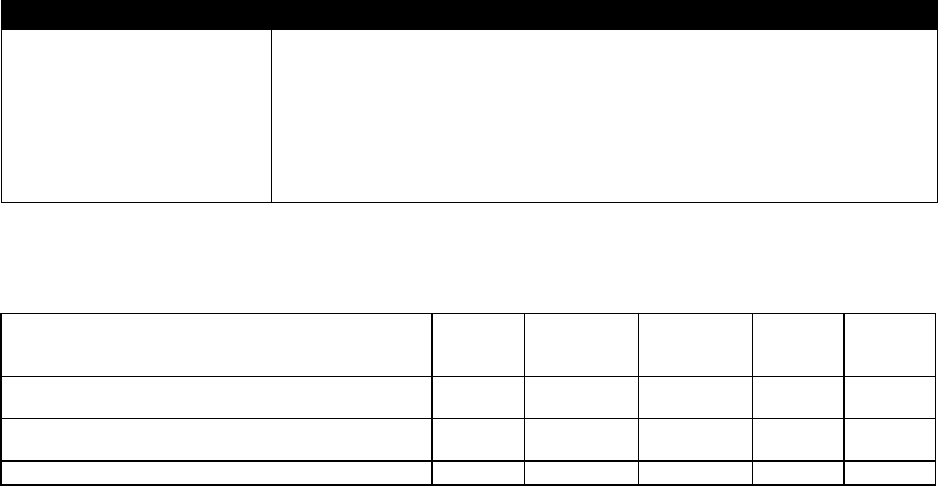

Investment Obligations: (In Millions of $):

Type

FY 2023

Actuals

FY 2024

Estimated

Obligations

FY 2025

Estimated

Obligations

Change

in $

%

Change

Sub- Total DME Obligations (Including Internal

labor (Govt. FTE))

0.00

6.75

6.75

0.00

0.00%

Sub- Total O&M Obligations (Including Internal

Labor (Govt. FTE))

0.00

383.96

422.40

38.44

10.01%

Total Obligations

0.00

390.71

429.15

38.44

9.84%

Purpose, Accomplishments, Future Objectives:

The purpose of this investment focuses on managing all IRS compute resources. These resources span

from physical servers to cloud-based solutions, and include serverless, containerized, and virtualized

computing systems. This investment also oversees the management of operating systems, essential for the

smooth execution of applications and functionality.

The goal of this investment includes maximizing the efficiency and efficacy of the agency's

computational capabilities. It aims to optimize the usage of compute resources, effectively manage

computing virtualization, and ensure smooth operation of all operating systems. This is aimed towards

empowering the agency's business operations and facilitating efficient data processing and application

functionality.

The benefit of this investment includes bringing about improved efficiency and flexibility by allowing for

a streamlined management of compute resources. It enhances scalability and elasticity with virtualization,

enabling the agency to respond to fluctuating computational demands effectively. Also, the meticulous

management of operating systems ensures a robust and reliable environment for application

functionalities, reducing downtime and maintaining service reliability.

FY 2023 Accomplishments:

• Successfully refreshed the International Business Machine (IBM) mainframe Tax Processing

infrastructure to z/16, which is the latest modern version. The IBM mainframe is the primary host

for critical Tax programs such as CADE2, IMF, and BMF processing. The upgrade increased the

processing performance over the previous system and supports critical application code

transitions from legacy Assembly\Cobol to Java (ITPE).

• Successfully refreshed the Unisys mainframe Tax Processing infrastructure to Unisys Dorado

8590, which is the latest modern version. The Unisys mainframe is the primary host for critical

Tax programs such as IDRS, Generalized Mainline Framework (GMF) and Error Resolution

System (ERS) processing. The upgrade increased the processing performance over the previous

system, which reduced the weekend processing times and will allow the IRS more real time

processing windows.

FY 2024/2025 Future Objectives:

• Transition to cloud and managed service providers where possible.

• Perform continuous monitoring and patching of aged hardware and software assets to mitigate

security risks.

• Upgrade critical infrastructure to maintain filing season systems resiliency, leveraging cloud-

based infrastructure where practical.

11

Digital Services

Description:

Digital Services includes the self-service and online options which allow taxpayers and external

stakeholders to interact on the web via IRS websites and web applications.

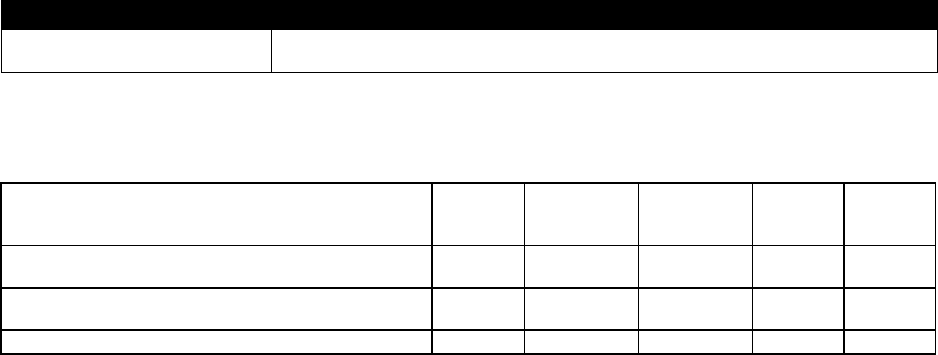

Consolidation of previous investments:

Major Investment

Sub-investments

Digital Services

Integrated Customer Communications Environment (ICCE), e-Services (e-SVS), IRS.GOV - Portal

Environment, Web Applications

*Under the legacy structure, ICCE, eSVS, IRS.GOV and Web Applications were categorized as Major IT Investments; some, or all their sub-investments are now

aligned under Digital Services.

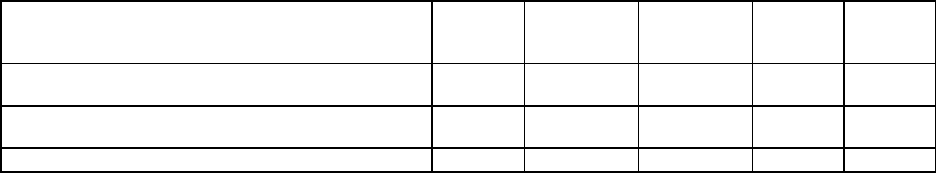

Investment Obligations: (In Millions of $):

Type

FY 2023

Actuals

FY 2024

Estimated

Obligations

FY 2025

Estimated

Obligations

Change

in $

%

Change

Sub- Total DME Obligations (Including Internal

labor (Govt. FTE))

0.00

445.19

211.61

- 233.58

-

52.47%

Sub- Total O&M Obligations (Including Internal

Labor (Govt. FTE))

0.00

143.32

163.61

20.30

14.16%

Total Obligations

0.00

588.51

375.23

- 213.28

- 36.24%

Purpose, Accomplishments, Future Objectives:

The purpose of Digital Services is to revolutionize the taxpayer experience through enhancing service

offerings. The IRS plans to create a state-of-the-art digital environment for taxpayers, simplifying their

interactions with the agency. Digital Services strives to ensure services are accessible through all

channels, facilitating a seamless and enriched taxpayer experience via six projects focused on improving

digital services to taxpayers: e-Services, IRS.gov, Individual Online Account (IOLA), Business Online

Account (BOLA), TaxPro and Integrated Customer Communication Environment (ICCE). Digital

Services modernizes the way individual taxpayers interact with the IRS by providing a seamless, one-stop

digital solution to support filing, data, and communication needs. The investment transforms the way

business taxpayers interact with the IRS by providing a modern, secure, one-stop digital suite of self-

service that provides tax record information, digital correspondence, and payment capabilities to support

tax compliance. Digital Services provides a unified architecture to allow Tax Professionals to serve IRS

taxpayers across omni-digital channels and provides an improved user experience, utilizing data to drive

results and developing an intelligent enterprise where tax professionals and technology collaborate to

produce value.

The primary goals of the Digital Services investment include the realization of a comprehensive, on-

demand data view system and implementing self-service capabilities to enable business users to interact

with the IRS online efficiently and effectively, and reduce the burden of less efficient taxpayer and phone

interactions.

Through the integration of customer account, interaction, case, and compliance data, the IRS can provide

a 360-degree perspective for both IRS employees and taxpayers. Furthermore, the IRS plans to enhance

its technology to ensure equal access to information, services, and documents for all taxpayers. This will

12

be achieved through adopting multilingual standards, refactoring, and developing multilingual systems,

providing multilingual forms and notices, and integrating software-enabled translation support.

The benefits of the investment include empowering taxpayers and tax professionals with expanded digital

options for increased self-service and streamlined tax transactions. It will provide a seamless tax

experience via omni-channel, enhanced interactions for efficient customer service and increase the

availability of digital channels of contact between tax professionals and the IRS, enhancing the customer

experience. In addition, it will also improve compliance through plain language and multilingual

communications, enhance IRS.gov search, tailor outreach and simplify adherence to IRS requirements.

Additional benefits include; new IRS-hosted applications scaled to include additional value-added and

secure business taxpayer products and features that comply with the latest National Institute of Standards

and Technology (NIST).

The IRS.gov portal provides seamless one-stop web-based services to internal and external users, such as

taxpayers, business partners and IRS employees. The mission at the IRS is to provide America's taxpayers

top-quality services by helping them understand and meet their tax responsibilities, and enforce US tax

law, with integrity and fairness to all. The IRS.gov portal supports the IRS mission by providing a virtual

tax assistance center for internal and external users. In an environment of constrained resources, IRS.gov

remains a cost-efficient platform to rapidly deploy standardized customer facing solutions. During the

COVID-19 pandemic, the IRS.gov portal's ability to provide remote access to taxpayers, business

partners, and employees continued to be invaluable to the continuity of U.S. tax administration in times

when standard face to face methods increased risk to taxpayers and IRS employees. During the 2020 and

2021 filing seasons, the IRS.gov portal was instrumental in the administration of the Economic Impact

Payments to American taxpayers providing remote access to applications like Get My Payment (GMP),

the COVID-19 screening application, and Modernized Electronic filing (Mef). The IRS.gov portals

continue to support rapid application deployments that are secure and fully capable to meet taxpayer

needs. New evolving applications like Document Upload Tool (DUT) and ECM aligns the IRS with the

changing needs of taxpayers by providing them with an accessible, faster, and secure digital presence.

IRS.gov continues to improve its ability to provide better tools by supporting rapid deployment solutions,

utilizing Cloud technologies to quickly acquire secure storage, and application platforms

FY 2023 Accomplishments:

• eServices deployed functionality to automate the validation of new electronic tax and information

return submitters and implemented a programmatic input channel for Income Verification

Express Service (IVES) transcript requests.

• eServices digitized the process to initiate FBI background checks to authorize electronic filers.

• Deployed “Link a CAF” to production, providing tax professionals with the ability to link their

Centralized Authorization File (CAF) number(s) to their Tax ID Number to validate authority and

enable access to expanded capabilities.

• IRS.gov Portal deployed the Document Upload Tool (DUT) and the Taxpayer Employee Facing

(TPEF) tool.

• IRS.gov Portal completed RHEL 8 upgrade in three preproduction environments: System

Integration Testing (SIT), Enterprise Integration & Test Environment (EITE), and Final

Integration Testing (FIT) environments.

• IRS.gov Portal completed the MarkLogic database build out for production.

• Completed all annual filing season prep activities for all IRS Internet portals; Public User Portal

(IRS.gov), Registered User Portal, Employee User Portal, and Transactional Processing

Environment.

13

• Released one deployment of the Business Online Account (BOLA) application, which enables

representatives of Sole Proprietorship businesses to login, gain authorization, view their business

profile, manage authorized users, and view balance due information.

• IOLA Secure Two-Way Messaging went live in Online Account in April 2023. This feature

allows taxpayers who have set up a secure messaging account through Taxpayer Digital

Communications (TDC) to securely view and reply to messages in their Online Account. This

deployment enables the IRS to reduce paper correspondence and further empowers Online

Accounts to be a “one-stop shop" for individuals to address their tax needs.

• IOLA Chat Bot – Virtual Assistant and Live Chat was deployed, allowing individual taxpayers to

interact virtually with IRS support. The Virtual Assistant is made available to eligible taxpayers

for payment-related questions which are answered through automated text interaction with the

Chat Bot. This Virtual Assistant serves as first line of defense for guided help to taxpayer

inquiries. These tools now provide handy self-service solutions for taxpayers.

• Tax Pro deployed capabilities for Link a CAF, View and Manage Authorizations, adding an

additional level of assurance, allowing tax professionals to have access to all of their active

authorizations and enabling future self-service capabilities.

• Tax Pro deployed capabilities for Individual Taxpayers: Payment Activity (Scheduled / Pending

Payment), Payment Activity (Posted Payment), and Payment Activity. (Canceled / Returned

Payment), and View Balance Due for individuals and businesses, expanding self service

capabilities so that tax professionals are able to better serve taxpayers.

• ICCE implemented OMB Audit logging for all ICCE web and telephone applications.

• ICCE expanded text chat capabilities to Online Payment Agreement (OPA) application.

• ICCE Implemented FUTURE Act – Direct Data Exchange (FA-DDX) IDR in a joint effort with

the Department of Education.

• Integrated ICCE phone applications with VoiceBot/ ACS Conversational IVR (ACI).

• Digitized fingerprint capture for efile applicant background checks.

• Deployed electronic submission of IVES individual and business transcript requests.

• Deployed electronic submission and management of Certified Acceptance Agent application.

• All Field Applications infrastructure were updated to be more current and more secure.

• Incorporated the authorization and management of all IRS Information Returns electronic filers.

• Delivered Transcript Delivery System (TDS) Application Programming Interface (API) that

delivers business transcripts through BOLA.

• Optimized transcript processing and vastly increased capacity of current infrastructure.

• .

• Updated eServices API Infrastructure to increase security and capacity.

• Incorporated a very large number of legislative changes to successfully deploy Filing Season

releases.

FY 2024/2025 Future Objectives:

• Incorporate Taxpayer First Act information return users within e-Services and modernize the

transcript delivery system to create a more robust web experience for the taxpayer.

• Expand Digital Service offerings across multiple service channels to meet the needs of taxpayers

and tax professionals.

• BOLA will be available to all business entity types, and will add capabilities like online business

filing, new digital communications capabilities, and account profile customizations.

• Drive IRA’s vision of transformation by delivering additional self-service options and expanding

access to Business tax professionals in BOLA programs.

14

• Expand access to Tax Pro Accounts by providing capabilities to support business tax

professionals and taxpayers.

Engagement Channels

Description:

Engagement Channels encompasses the interactions between the IRS and taxpayers or other external

stakeholders, to include; over the phone (live assistance or voice bots), via chat services (chat and live

chat), and through physical or digital notices. The Engagement Channels investment includes operating

one of the largest Contact Centers in the Federal Government, serving taxpayers though live assistance

and self-service options, meeting the taxpayer on their channel of choice. The Contact Center is one of

the most mission critical areas within IRS due to its role managing call routing for the enterprise.

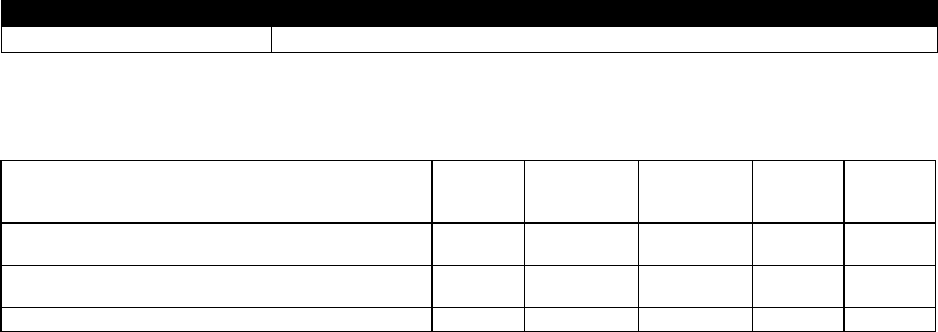

Consolidation of previous investments:

Major Investment

Sub-investments

Engagement Channels

Computer Assisted Publishing System (CAPS), Mail Labels and Media Support (MLMS), Notice

Conversion (NOTCON), Notice Print Processing (NPP), On Line Notice Review (OLNR),

Integrated Customer Communications Environment (ICCE), IRS Telecommunications Systems and

Support (TSS)

*Under the legacy structure, TSS was categorized as a Major IT Investment; some, or all sub-investments of TSS are now aligned under Engagement Channels and

Network.

Investment Obligations: (In Millions of $):

Type

FY 2023

Actuals

FY 2024

Estimated

Obligations

FY 2025

Estimated

Obligations

Change

in $

%

Change

Sub- Total DME Obligations (Including Internal

labor (Govt. FTE))

0.00

95.40

65.00

- 30.40

-

31.87%

Sub- Total O&M Obligations (Including Internal

Labor (Govt. FTE))

0.00

69.54

74.20

4.66

6.70%

Total Obligations

0.00

164.94

139.20

- 25.74

- 15.61%

Purpose, Accomplishments, Future Objectives:

The purpose of this IT investment is to improve taxpayer engagement, utilizing advanced technology for a

seamless user experience. This investment aims to integrate voicebots and chatbots, expanding

accessibility across all available channels. With the enhancement of English/Spanish standards, system

development, and translation support, the objective is to offer equal access to information, services, and

documents for every taxpayer. The Contact Center is to deliver mission critical functionality for self-

service and assistor-based taxpayer services. Live Assistance is to enable real-time communication via a

taxpayer’s preferred channel and improve the taxpayer experience through expanded self-service and

Natural Language Processing-enabled capabilities.

The goal of this investment includes implementing industry standards and innovative technology to put

the IRS into the forefront of engagement, focusing on adaptability and inclusivity. The IRS aims to

implement advanced voice and communication tools, enabling customer service representatives to resolve

issues more swiftly. The goal is to make every interaction between taxpayers and the IRS seamless,

fostering a modern, efficient, and inclusive taxpayer experience.

15

The benefits of this investment include expanding services which ensure customer access through all

channels and modernizing the way taxpayers engage with the agency. The implementation of advanced

voice and communication tools (like Chatbot, Conversational Voice Service, Customer Call Back, and

Agent Desk Top Modernization), enables customer service representatives to resolve issues swiftly. The

integration of advanced technology will ensure a streamlined, customer-centric approach, underpinning

an exceptional taxpayer experience.

FY 2023 Accomplishments include deployment of:

• Online Account (OLA) Phase 2 Chatbot.

• The addition of Offer in Compromise Small Business/Self Employed (SBSE) New Chat Topic.

• SBSE CORR Exam chatbot.

• The deployment of the Agent Desktop Modernization (ADM) full release.

• Voice Bot Notification for System Down Time update.

• The deployment of Where's My Refund? (WMR) Voice Bot.

• The deployment of Where's My Amended Return? (WMAR) Voice Bot.

• Providing callback to additional 17 Small Business/Small Engagement (SBSE) Applications.

• Enhancements to Agent Desktop Modernization (Finesse desktop) to have Live Agents for

chatbot.

• Information Technology Service Desk (IT SD) Main Menu Natural Language Understanding

(NLU).

• 1040 Menu Conversion.

FY 2024/2025 objectives include deployment/addition of:

• W&I Customer Service Unauthenticated FAQ New Topics chat service.

• Automated under reporter (AUR) Voicebot.

• Insolvency Voicebot service.

• Specialty Collection Offers in Compromise (SCOIC) Voicebot.

• Financial Relief Conversational Voice service.

• Estate and Gift – Status of Form 706 – Authenticated Voicebot.

• Excise – Form 2290 Inquiries – Unauthenticated Voicebot.

• Electronic Performance Support Systems (PSS) e-Business Master File Automated underreported

- Voicebot: PSS Voicebot.

• Business Underreporter (BUR) – Disagree with Proposed / Actual Assessment – Unauthenticated.

• Innocent Spouse Status of Case – Authenticated Voicebot.

• Electronic Performance Support Systems (EPSS) Transmitter Codes (TCC) – Authenticated

Voicebot.

• Direct File chat request and Toll-Free Phone Line.

• Addition of Self-Service Authenticated Capabilities to the Automated Under reporter (AUR)

Chatbot.

• Government Task Manager (GTM) Integration with eGain & FDR365.

• EPSS Unauthenticated chatbot with Authenticated Live Chat.

• Innocent Spouse – Status of Case – Authenticated Chatbot and Authenticated Live Chat.

• Central Lien Operations – Unauthenticated Live Chat.

• Automated Substitute for Return (ASFR) – Authenticated Live Chat.

• Taxpayer Assistance Center Contact Modernization Phase 1.

• Taxpayer Assistance Center Contact Modernization Phase 2.

16

Filing and Intake

Description:

Filing and Intake includes the registration, ingestion, validation and perfection, error resolution, and

payment processing of all inbound electronic and paper submissions, IRS correspondence and other

inbound taxpayer information. This investment provides ingestion mechanisms for institutions to send

data for IRS and provides up-front issue detection and resolution.

Consolidation of previous investments:

Major Investment

Sub-investments

Filing and Intake

Base Erosion and Profit Shifting (BEPS), Batch/Block Tracking System (BBTS), Chapter Three

Withholding Systems (CTW), Customer Service International Applications (CSIA), Electronic

Federal Payment Posting System (EFPPS), Electronic Management System (EMS), Error

Resolution System (ERS), Filing Information Returns Electronically (FIRE), Generalized Mainline

Framework/Generalized Unpostable Framework (GMF/GUF), Health Coverage Tax Credit

(HCTC), Information Returns Processing (IRP), National Account Profile (NAP) (Formerly

NAP/OLE), Remittance Processing System (RPS), Remittance Strategy for Paper Check

Conversion v2. (RSPCC), Remittance Transaction Research (RTR), Submission Processing

Measure Analysis & Reporting Tool (SMART) - A, Tax Return Data Base (TRDB), TEGE Support

Systems (TEGE SS), Modernized e-File (MeF), Information Returns Modernization (IR Mod)

formerly Business Services

*Under the legacy structure, Modernized e-file and IR Mod were categorized as Major IT Investments; their sub-investments are now aligned under Engagement

Channels.

Investment Obligations: (In Millions of $):

Type

FY 2023

Actuals

FY 2024

Estimated

Obligations

FY 2025

Estimated

Obligations

Change

in $

%

Change

Sub- Total DME Obligations (Including Internal

labor (Govt. FTE))

0.00

410.81

319.48

- 91.33

-

22.23%

Sub- Total O&M Obligations (Including Internal

Labor (Govt. FTE))

0.00

229.01

274.51

45.50

19.87%

Total Obligations

0.00

639.82

593.99

- 45.83

- 7.16%

Purpose, Accomplishments, Future Objectives:

The purpose of this investment is to deploy a versatile intake platform for all tax forms and incoming

data, enhancing IRS’s adaptability to changing requirements and flexibility in customer submissions. A

modern payments platform will offer a unified account experience, accepting all government-approved

payment methods and channels.

The primary goals include achieving “digitalization at the door,” converting non-digital submissions (i.e.,

paper, fax, and image files) into machine-readable formats for efficient use and processing. Through these

improvements, the IRS aims to reduce manual processing and significantly decrease its IT footprint. This

collective effort will result in a more streamlined, user-friendly, and efficient tax processing system.

Achieving “digitalization at the door” will enable the IRS to streamline our current intake methods.

Incoming non-digital submissions (e.g., paper tax returns) will be efficiently digitalized and ready for

downstream processing. This will ultimately reduce the IT footprint by allowing us to retire legacy

systems in favor of more modernized applications.

17

The primary benefit of this investment includes the modernization of IRS intake systems which will

notably reduce taxpayer burden by promoting electronic submissions. This streamlining process will

increase efficiency and ease for taxpayers. Enhanced data integrity and integration will be achieved

through standardizing intake of tax and information returns, and digitalizing paper-based submissions,

ensuring uniform digital data for downstream processing. A significant cost reduction is another key

benefit, as the digitalization of paper-based ingestion and implementation of a modern intake platform

will significantly reduce labor-intensive manual processes and drastically decrease the IRS IT footprint.

FY 2023 Accomplishments:

• The expanded use of the Document Upload Tool (DUT) is now available for more high-volume

notices. This potentially can help more than 500,000 taxpayers each year who receive these

notices, which include military personnel serving in combat zones and recipients of widely-

claimed credits like the Earned Income Tax Credit and Child Tax Credit.

• Further expanded the DUT solution with the DUT for All release in September 2023, which

allows taxpayers to digitally respond to nearly all correspondence types released for digital

submission via DUT. As of December 31st, the IRS has received more than 45,000 responses to

notices via the online tool.

• As part of the Digital and Mobile Adaptive Forms (DMAF) solution, the IRS will deploy four

non-signature web-based forms using the DUT for form completion and submission in September

2023. This initial release applies to more than 380,000 annual submissions.

• Launched the Digital Enablement Platform (DEP) with scanning, extraction, and downstream

routing capabilities for initial customers in Correspondence Examination (Corr Exam) and

Automated Underreporter (AUR).

• Expanded scanning solutions for Digital Intake to Modernized e-File (DIME) for F940s, F941s,

and F1040s.

• Integrated the DUT with the DEP for automated downstream routing of applicable notices

responses (e.g., CP2000 for AUR).

• Integrated Enterprise Electronic Fax (EEFax) with Electronic File Transfer Unit (EFTU) to

automatically route faxes to the DEP for extraction and processing.

• Delivered Digitalized Content Retrieval (DCR) to provide enhanced search and reporting

capabilities of As Received.

FY 2024 Accomplishments:

• Deployed onboarding of Compliance Services Collections Operations (CSCO) to the Digital

Enablement Platform, enabling scanning, extraction, and downstream routing capabilities for the

Form 9465.

• Expanded the DUT through the release of DUT for Certifying Acceptance Agency (CAA and

multiple rounds of enhancements for DUT for Notices, enabling the digital upload of CAA

applications, supporting documents, and additional repository letters.

• Delivered 1099 Paper Processing enabling the Business to process paper Forms 1099 via the new

modernized information returns (IR) intake system as opposed to the legacy General Mainline

Framework.

• Delivered the new, modernized Information Returns Review Portal (IRRP) for paper analysts and

tax examiners to resolve errors in information returns, replacing the Error Legacy System (ERS).

• Delivered Extensions (Balance and Control) enabling downstream processing of automatic

extensions received through the IR intake system.

18

• Delivered Customer Service Representative (CSR) Partial Search Function allowing customer

service representatives to perform partial searches for information returns in the CSR portal

against various data elements.

• Delivered additional functionality in the Information Returns Intake System (IRIS) for taxpayers,

including enhanced system performance and the refactoring of existing forms to support intake

and processing time for Filing Season 24 (FS24) and multi-year submissions at the speed of 2,500

forms/second. They aim to reduce the need for future refactoring and lay the foundation to handle

future capacity needed to support broader modernization efforts (e.g., legacy system retirement,

intake of Cryptocurrency returns).

• Delivered the migration of the Information Returns Processing System (IRPS) to OpenShift

containers, accelerating technology delivery and laying the foundation for full move to cloud in

2024 and help IRS IT move forward with “Cloud First” vision and goals.

FY 2024/2025 Future Objectives:

• Complete Modernized e-File (MeF) schema development for 20+ prioritized forms.

• Deliver multiple extraction engines.

• Developed solution for Paper Payment Processing.

• Deliver Enterprise File Storage (EFS) and E-Fax Modernization.

• Deploy Digital Inventory Management (DIM).

• Complete Onboarding of remaining eligible DUT Notices and Letters.

• Expand onboarding of additional customers to the DEP.

• Deliver and expand Service Center Recognition/Image Processing System (SCRIPS)

modernization for incoming paper tax and information returns, ultimately scanning at point of

entry and digitally processing virtually all paper-filed tax and information returns.

• Clear 100% of Form 709s at the Independence, Missouri c-site prior to its closure in October

2026.

• Expand historical document digitalization to clear up to 1 billion priority documents at IRS

Campuses.

• Convert Historical Media Archives into stored digital formats.

• Complete installation of new Service Center Automated Mail Processing System (SCAMPS)

machines, IBML scanners, and high-end scanners to accelerate digital processing.

• Scan for digital processing up to 50% of paper-submitted correspondence, non-tax forms, and

notice responses.

• Update current transcripts to be user-friendly and available in Spanish and other languages.

• Develop mechanism to push data into return preparation software to help taxpayers prepare

current-year tax returns.

• Upgrade Online accounts to incorporate user-friendly views of account and return information

(e.g., notices, letters, account history, payment history, balances due, etc.).

• Make high-priority forms, returns, and certifications available for electronic filing and

digitalization.

• Launch payment capabilities over the phone and through IRS employees.

• Enable payments through online accounts, allowing taxpayers and third parties to make payments

through online accounts, with options to pay by bank account, credit or debit card, or digital

wallet.

• Deliver 25+ Robotic Process Automations (RPA).

• .

19

Infrastructure Management

Description:

Infrastructure Management describes IRS IT infrastructure, both in the Cloud and on-premises. This

investment includes the configurations, monitoring, and physical or Cloud-based construction of IRS IT

Infrastructure.

Consolidation of previous investments:

Major Investment

Sub-investments

Infrastructure Management IRS Main Frames and Servers Services and Support (MSSS), Modernized IRS Operations

*Under the legacy structure MSSS and Modernized IRS Operations were categorized as Major IT Investments; some, or all their sub-investments are now aligned

under Storage, Compute, and Infrastructure Management.

Investment Obligations: (In Millions of $):

Type

FY 2023

Actuals

FY 2024

Estimated

Obligations

FY 2025

Estimated

Obligations

Change

in $

%

Change

Sub- Total DME Obligations (Including Internal

labor (Govt. FTE))

0.00

112.31

110.46

- 1.85

-

1.65%

Sub- Total O&M Obligations (Including Internal

Labor (Govt. FTE))

0.00

331.96

374.65

42.69

12.86%

Total Obligations

0.00

444.27

485.11

40.84

9.19%

Purpose, Accomplishments, Future Objectives:

The purpose of this investment is to ensure the IRS’s IT infrastructure is robust, flexible, and adaptable to

changing needs. The focus lies in scaling and optimizing infrastructure, promoting a shift to cloud-based

solutions, and implementing managed service infrastructures on-premises. This investment aims to

automate the process of provisioning, monitoring, and managing resources, thus enhancing service

reliability, efficiency, and agility.

The primary goals of this investment include reducing operating costs and delivery timelines through

automation; standardizing infrastructure configurations for improved operational consistency;

transitioning to a scalable, cloud-based infrastructure for greater flexibility; and enhancing on-premises

infrastructure with managed services for optimized resource allocation. Achieving these goals will enable

the agency to better adapt to evolving technological requirements.

The benefit of this investment includes substantial cost savings through the reduced need for manual

resource management, improved operational efficiency due to standardized configurations, and enhanced

adaptability with the shift towards flexible, scalable cloud infrastructure. Moreover, on-premises

infrastructure will become more efficient with managed services, leading to further resource optimization.

Overall, this investment can drive a significant improvement in the IRS’s operational efficiency and

agility.

20

FY 2023 Accomplishments:

• Information Returns Intake System controlled launch conducted January 25, 2023, allowed

businesses to file Form 1099 series returns using a new online portal, available for free from the

IRS as required by Taxpayer First Act (TFA) legislation.

• Improved IRS employee experience by implementing M365 Mobile Device and Application

Management & migrated all Blackberry Unified Endpoint Management (UEM) users to Intune by

June 12, 2023.

• One hundred percent of on-premises mailboxes migrated to Exchange Online (EXO) & all legacy

Information Technology (IT) SharePoint sites modernized.

• Implemented Enterprise Business Intelligence Platform (EBIP) consists of Business Objects

Enterprise (BOE) and Tableau Enterprise Visualization (TEV) platforms. BOE is the IRS wide

shared services reporting infrastructure platform.

• Deployed Document Upload Tool – Taxpayer Facing Employees (DUT – TPFE) interface into

Integrated Enterprise Portal (IEP) production in December 2022, allowing taxpayers to respond to

IRS inquiries by uploading documents instead of mailing.

FY 2024/2025 Future Objectives:

• Continue the mission of the former MSSS investment by continuing to deliver a successful filing

season through the efficient management & maintenance of infrastructure operations.

• Leverage automation to transform operations by increasing efficiency and removing redundancies

to accelerating modernization.

• Improve the IRS infrastructure to support taxpayer facing applications as they transform to meet

customer expectations.

• Transition to cloud and managed service providers where possible.

• Perform continuous monitoring and patching of aged hardware and software assets to mitigate

security risks.

• Upgrade critical infrastructure to maintain filing season systems resiliency, leveraging cloud-

based infrastructure where practical.

Internal Operations

Description:

Internal Operations includes enterprise-wide administrative systems related to workforce support, human

capital management, accounting, financial management, procurement, facilities, and travel.

Consolidation of previous investments:

Major Investment

Sub-investments

Internal Operations

Automated Labor and Employee Relations Tracking System (ALERTS), Business Performance

Management System (BPMS), Counsel Automated Legal Systems (CALS), Embedded Quality

(EQ), Employee Connection (ECON), E-Travel (IRS migration), Financial Management

Information Systems (FMIS), Integrated Planning and Information System (OPIS), OP500 Series

Programs for Returns Processing (OP500), PIV Background Investigation Process (PBIP) - B,

Reimbursable Accounts System (REACS), Redesign Revenue Accounting Control System

(RRACS), Service-wide Electronic Research Project (SERP), Totally Automated Personnel System

(TAPS)/Single Entry Time Reporting (SETR), Web Integration Collaboration and Development

(WICD), Work Request Management System (WRMS) - A, Integrated Financial System/CORE

Financial System (IFS)

*Under the legacy structure, IFS was categorized as a Major IT Investment; sub-investments of IFS are now aligned under Internal Operations.

21

Investment Obligations: (In Millions of $):

Type

FY 2023

Actuals

FY 2024

Estimated

Obligations

FY 2025

Estimated

Obligations

Change

in $

%

Change

Sub- Total DME Obligations (Including Internal

labor (Govt. FTE))

0.00

75.91

41.91

- 34.00

-

44.79%

Sub- Total O&M Obligations (Including Internal

Labor (Govt. FTE))

0.00

217.77

247.66

29.89

13.73%

Total Obligations

0.00

293.67

289.56

- 4.11

- 1.40%

Purpose, Accomplishments, Future Objectives:

The purpose of this IT investment is to help the IRS transition to more efficient and advanced operational

systems. By utilizing government-wide shared services and commercial off-the-shelf solutions, the

agency seeks to enhance its operations, improve the employee experience, and equip the workforce with

the tools they need for data-driven decision making. This investment supports critical initiatives in HR,

finance, IT service management, and eRecords management.

The goals of this IT investment include the modernization of specific systems like HR, accounting,

financial systems, IT service management platform, and an eRecords management platform. Additionally,

it aims to support the IRS’s vision of the "workforce of the future" by providing advanced collaboration

tools and an e-learning platform.

The benefits of this IT investment include empowering the IRS’s workforce with expanded self-service

options and collaboration tools that meet the modern workplace demands, fostering a knowledgeable,

diverse, flexible, and engaged team. These innovations will also enhance operational efficiency and

productivity, provides a reliable, standardized, and auditable platform for administrative accounting,

budget formulation/labor forecasting and execution (funds management) of the IRS annual budget,

contributing significantly to the agency’s resilience. By migrating platforms and systems to the cloud, the

IRS is positioned to achieve significant cost reductions, driving towards operational excellence.

FY 2023 Accomplishments:

• Completed changes to support ongoing Federal Financial System mandates.

• Began the migration of the current IFS SAP applications to a Software Application and Products

(SAP) High Performance Analytical Appliance (HANA) Infrastructure in a Cloud Environment.

The overall migration effort will take two (2) years to complete.

• Completed the automated accrual for asset forfeiture fund.

• Completed Vendor advance payment functionality.

• Completed upgrades to components financial systems.

• Increased IT workforce enrollment in IT Academy by 168% as of May 2023 by providing IT

Academy overviews and demos during ACIO roadshows, townhalls, and IT Workforce Strategy

(ITWS) communications.

• Developed and socialized Leadership Development Current State Assessment with IT leadership

that included recommendations for evolving leadership development across IT.

• Hosted several “Journey to Leadership” Series events, to promote leadership paths and

development programs for all IT employees to drive new IRA modernization programs and

projects.

• Achieved 95 percent Knowledge Management Desk Guide completion from IT managers and

executives to meet the FY23 ACIO succession planning commitment by September 30, 2023.

22

• Exceeded ACIO Employee Engagement Commitment during second quarter by completing 183

percent of targeted chats and third quarter by completing 170 percent of targeted chats.

• Delivered legislatively mandated Inflation Reduction Act and other form changes to keep Service

Center Recognition/Image Processing System (SCRIPS) up to date.

• Transformed manual, disconnected processes that used email and spreadsheets with no visibility

into streamlined, automated, interconnected workflows.

• Coordinated workflows across Human Resource, Facilities, and IT business units, thus ensuring

all components of a request are efficiently fulfilled in a timely manner.

• Successfully expanded the legacy OS Get Services for IT Issues and requests to IRS Service

Central – the one-stop shop for IRS employees to request a wide range of services and support.

• Provided more robust functionality beyond the spreadsheet documentation previously used.

• Established a streamlined approach to resource planning.

• Bridged the IT security gap of asset alignment and reconciliation with official inventory sources

within the IRS.

FY 2024/2025 Future Objectives:

• Create operating model for enterprise data-analytics development and deployment spanning

research, operations, and IT.

• Develop new capacity for using aggregated and anonymized information derived from tax data to

inform policy and program decisions beyond the IRS.

• Enhance capabilities of the centralized learning platform.

• Build an accessible and multi-modal set of best-practice training programs that emphasize core

competencies and launch the platform enterprise-wide as IRS University.

• 40 percent increase in capacity to process a final investigation determination from an average of

70 per day to 100 per day by December 31, 2025.

• 20 percent increase in velocity to pre-screen an IRS employee or contractor from 70 percent of

pre-screened determinations completed within three days or less of fingerprints received to 90

percent of pre-screened determinations completed within two days or less by December 31, 2025.

• Complete the Legislative mandated interface with Treasury's G-Invoicing system for seller side

transactions.

• Complete the functionality for Clean Vehicle credit.

• Identify technical training needs to support modernization and future skills needs.

• Intentionally develop leaders and conduct succession planning to lead IT to the future.

• Enhance employee experience and inclusion through self-directed learning culture and

engagement.

• Deploy security patches, maintenance, and firmware updates.

• Deliver legislatively mandated Tax Changes to keep SCRIPS up to date.

• Continue to support and improve the digitalization SCRIPS efforts.

• Continue to support both Individual Master File (IMF) and Business Master File (BMF).

• Continue the effort to keep the SCRIPS infrastructure current.

• Consolidate existing disparate solutions and provide a path to Cloud SaaS and a more resilient

experience for employees and reduction in legacy systems footprint.

• IFS will complete the Legislative mandated interface with Treasury's G-Invoicing system for

seller side transactions.

• Complete the effort to migrate the application to the next level of SAP architecture from the

current version Enterprise Resource Planning (ERP) Central Component (ECC) to S/4 High

Performance Analytical Appliance (HANA).

23

• IFS will continue the effort to move to the next level of Software Application and Products (SAP)

architecture from the current version ECC to HANA on the cloud.

Network Services

Description:

Network Services includes IRS network spending, for onsite, remote, and cloud networks. This

investment describes all necessary spending to create and maintain these networks (including any

hardware or network-related software), as well as any telecommunications spending.

Consolidation of previous investments:

Major Investment

Sub-investments

Network Services

IRS Telecommunications Systems and Support (TSS), Modernized IRS Operations

*Under the legacy structure, TSS and Modernized IRS Operations were categorized as Major IT Investments; some, or all their sub-investments are now aligned under

Network Services.

Investment Obligations: (In Millions of $):

Type

FY 2023

Actuals

FY 2024

Estimated

Obligations

FY 2025

Estimated

Obligations

Change

in $

%

Change

Sub- Total DME Obligations (Including Internal

labor (Govt. FTE))

0.00

113.42

126.88

13.46

11.87%

Sub- Total O&M Obligations (Including Internal

Labor (Govt. FTE))

0.00

421.94

479.96

58.02

13.75%

Total Obligations

0.00

535.35

606.83

71.48

13.35%

Purpose, Accomplishments, Future Objectives:

The purpose of this investment includes enhancing network services for storage, computing, and users

through cloud, internet, and remote access. It is designed to modernize network infrastructure, adopting

technologies like PCI-express network fabrics and 5G, reducing IT footprint, and transitioning from wired

to mobile devices for seamless, always-connected service.

The goal of this investment includes network enhancements by embracing advanced network fabrics and

implementation of intent-based networking, designed to simplify operations, increase agility, and fortify

security through advanced automation.

The benefits of this investment include an increase to network security via geo-fencing for mobile devices

and automated network tuning for edge-content delivery. The investment also supports distributed

workflows, remote and mobile users, effectively aligning with contemporary work patterns. This leads to

a more resilient, efficient, and adaptable network system, ensuring optimal performance and user

experience.

FY 2024 Accomplishments:

• Obtained Authority to Operate (ATO) for Cloud Security Boundary - External Partner Zone.

• Performed Microsoft O365 Express Routes Upgrade from 5G to 10G.

• Completed 107 of 107 Post of Duty (POD) network bandwidth expansions.

• Completed 316 of 400 planned POD bandwidth expansions.

• Completed Engineering designs to support network expansion efforts and hybrid environments.

24

• Refreshed and decommissioned 200+ network switches.

• Refreshed voice over IP (VoIP) network attached storage infrastructure.

• Modernized provision and operation of VoIP with enhanced automation.

• Enabled Teams Direct Routing initial operating capability.

• Enabled IPv4/v6 dual stack operation across VoIP infrastructure.

FY 2025 Future Objectives:

• Transition to cloud and managed service providers where possible.

• Perform continuous monitoring and patching of aged hardware and software assets to mitigate

security risks.

• Upgrade critical infrastructure to maintain filing season systems resiliency, leveraging cloud-

based infrastructure where practical.

• Upgrade and expand network to accommodate the anticipated increase in size of the IRS

workforce and increased consumption patterns with the introduction of new digital services for

taxpayers.

• Enhance the end user experience by implementing automation, integration, and a proactive

environment.

• Upgrade and refresh VoIP Call Manager infrastructure.

• Enable IPv6-only (Internet Protocol) operation across VoIP infrastructure.

• Refresh and upgrade critical infrastructure to maintain filing season systems resiliency,

leveraging cloud-based infrastructure where practical.

Platforms & Applications

Description:

Platforms and Applications addresses the architectures, technologies, and platforms that the IRS uses to

create, deliver and deploy new enterprise applications – including API/Microservices, web and mobile

platforms, event-driven architecture, messaging and streaming middleware, application frameworks and

environments, machine learning/Artificial Intelligence, data analytics, and continuous integration /

continuous deployment tools.

Consolidation of previous investments:

Major Investment

Sub-investments

Platforms & Applications

Financial Management Information Systems (FMIS), Integrated Planning and Information System

(OPIS), OP500 Series Programs for Returns Processing (OP500), PIV Background Investigation

Process (PBIP) - B, Reimbursable Accounts System (REACS), Redesign Revenue Accounting

Control System (RRACS), Service-wide Electronic Research Project (SERP), Totally Automated

Personnel System (TAPS)/Single Entry Time Reporting (SETR), Web Integration Collaboration and

Development (WICD), Work Request Management System (WRMS) - A, Integrated Financial

System/CORE Financial System (IFS)

*Under the legacy structure, SCRIPS, Web Applications, Affordable Care Act Administration, MSSS and Modernized IRS Operations were categorized as Major IT

Investments. Some, or all sub-investments are now aligned under Platforms and Applications.

25

Investment Obligations: (In Millions of $):

Type

FY 2023

Actuals

FY 2024

Estimated

Obligations

FY 2025

Estimated

Obligations

Change

in $

%

Change

Sub- Total DME Obligations (Including Internal

labor (Govt. FTE))

0.00

86.53

72.11

- 14.42

-

16.66%

Sub- Total O&M Obligations (Including Internal

Labor (Govt. FTE))

0.00

95.38

119.72

24.33

25.51%

Total Obligations

0.00

181.92

191.83

9.92

5.45%

Purpose, Accomplishments, Future Objectives:

The purpose of this investment is to ensure that the IRS possesses a cutting-edge, robust, and resilient IT

infrastructure that can deliver high-quality services and solutions. This is achieved by focusing on the

enhancement and modernization of architectures, technologies, and platforms that are utilized in the

creation, delivery, and deployment of new enterprise applications. The IRS aims to transition from aging

systems to more modern business solutions that leverage API/Microservices, Event-Driven Architecture

(EDA), enterprise web portals, and cloud-based delivery platforms. The shift towards cloud-native

applications, container platforms, and microservices aims to provide superior workload profitability and

scalability.

The goal of this investment is to reconstruct and replace outdated applications with advanced business

solutions that are future-proof and can adapt to technological changes. By employing API/Microservices,

EDA, enterprise web portals, and cloud-based delivery platforms that feature low/no-code, Platform as a

Service (PaaS), and Software as a Service (SaaS), the IRS aims to expedite application delivery. Further,

the IRS is focused on the deployment of new cloud-native applications and microservices to container

platforms, thereby optimizing workload portability and scalability across on premise and cloud providers.

The benefits of this investment include accelerated application delivery due to automation in governance,

security scans, and functional testing. It ensures future-proof applications by enabling them to evolve with

changing technologies and requirements, thanks to their modular, loosely coupled components. The

adoption of container-based application deployment greatly increases the portability of applications

between on premise infrastructure and cloud platforms. Additionally, the simplification and

standardization of the agency's IT portfolio significantly reduces cost, legacy code risk, and technical debt