4-1

Section 4 - Document Locator Number

1 Nature of Changes

Description Page No.

Campus Location Codes 4-2

IDRS Campus and File Location Codes 4-10

Adjustment Blocking Series 4-21

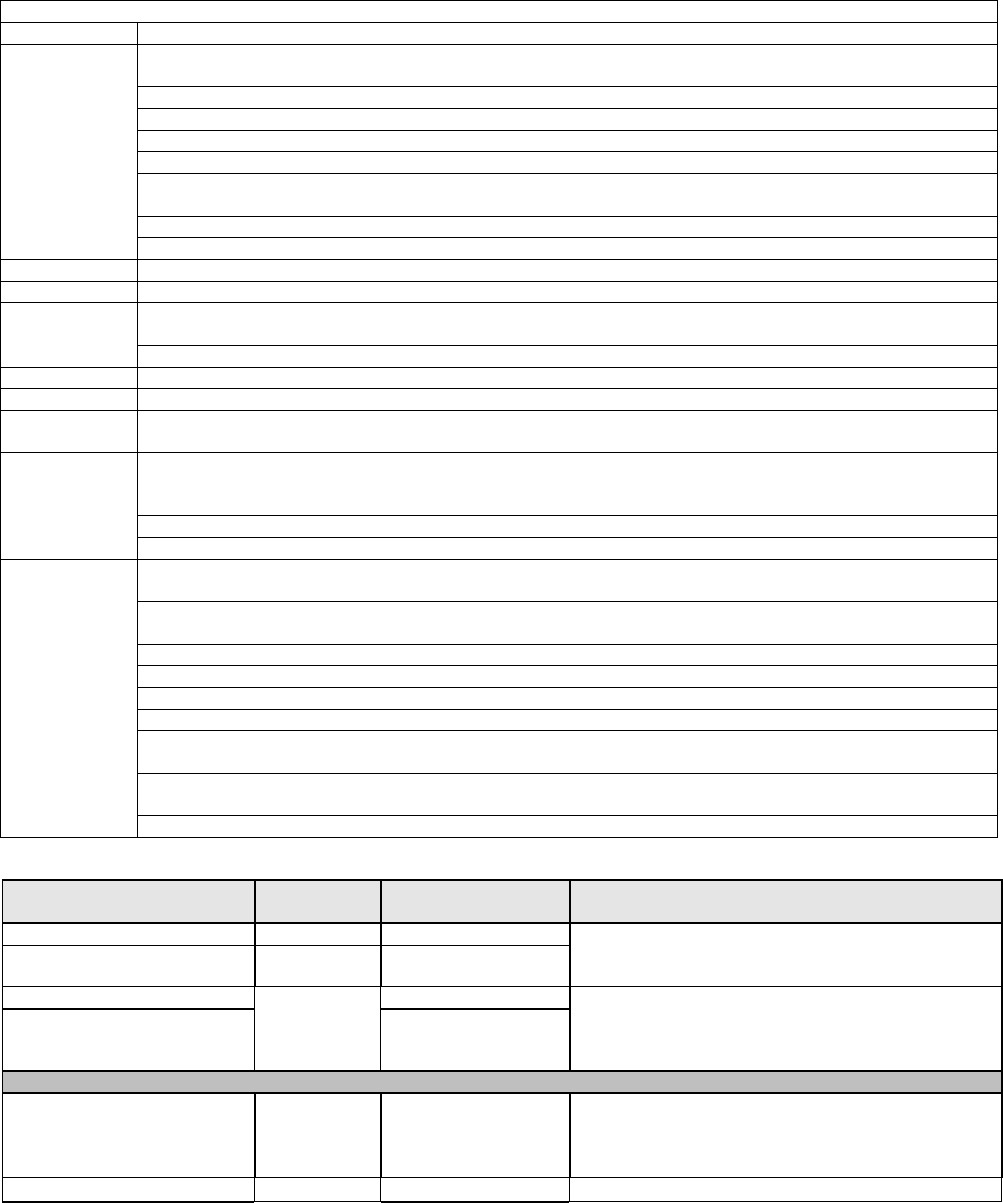

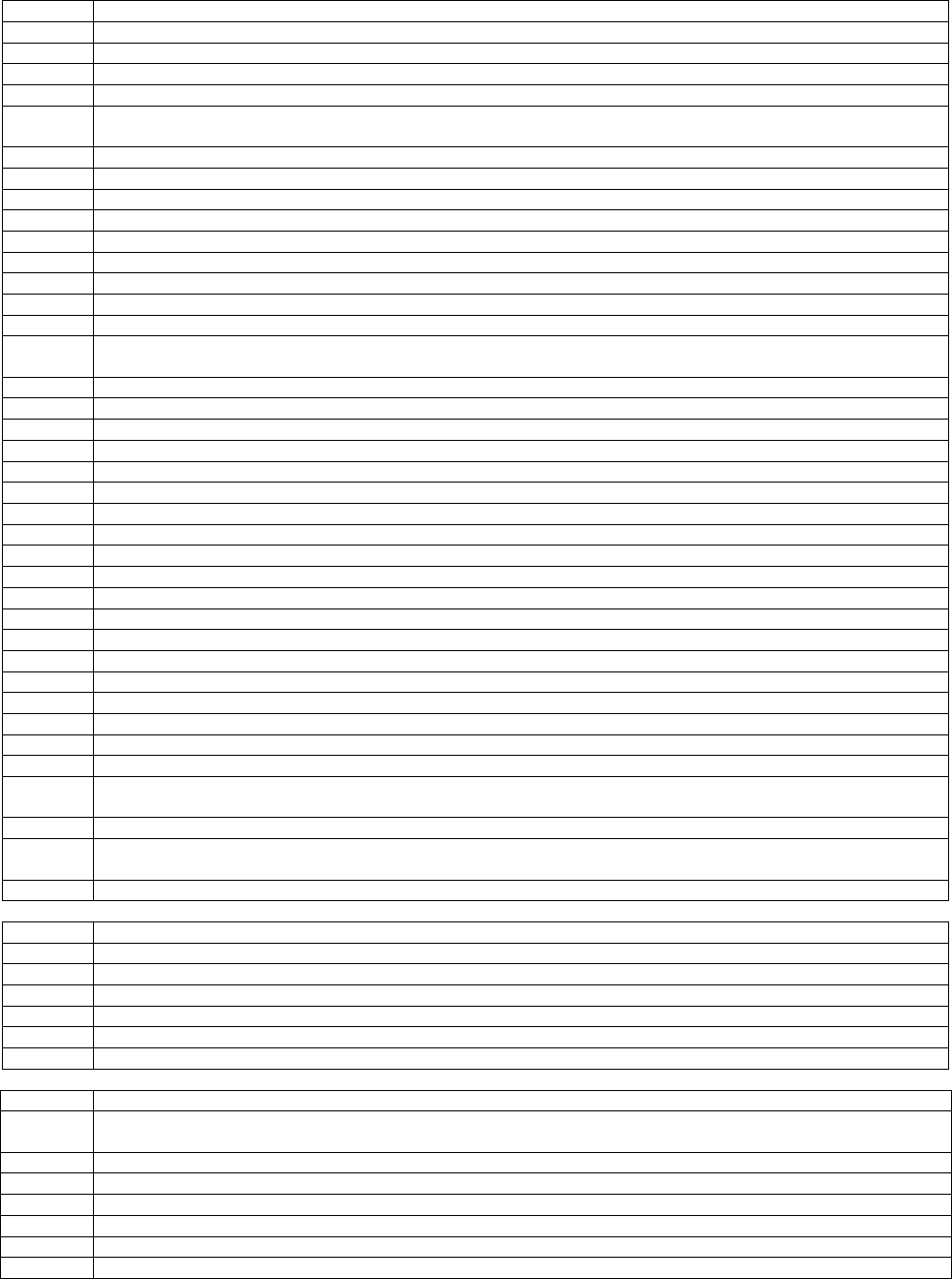

2 DLN Composition

(1) The document locator number (DLN) is a controlled number assigned to every return or document input through

the ADP system. The fourteenth (last) digit is the year of processing and is assigned by the Campus computer at

the time of the original input.

(2) The DLN is used to control, identify, and locate documents processed in the ADP system.

(3) The DLN should not be confused with the Taxpayer Identification Number (TIN), which consists of nine digits, for

example: (Xs identify a numeric field in the following example)

o Social Security Number XXX-XX-XXXX (IMF)

o IRS Individual Taxpayer Identification Number 9XX-(70-88)-XXXX (IMF)

o Employer Identification Number XX-XXXXXXX (BMF, EPMF)

o IRS Adoption Taxpayer Identification Number 9XX-93-XXXX (IMF)

Note: A temporary SSN is sometimes assigned by the Campus. The first three digits (900-999) indicate the

number is temporary. The 4th and 5th digits are the code of the Campus assigning the number. The

last four digits are numbers assigned consecutively beginning with 0001. The printed format is

TXXXXXXXXX* (The “T” Indicates a temporary SSN, and the asterisk (*) indicates the number is

invalid.)

(4) Returns and documents are blocked and filed by DLN.

(5) The format for a DLN is as follows:

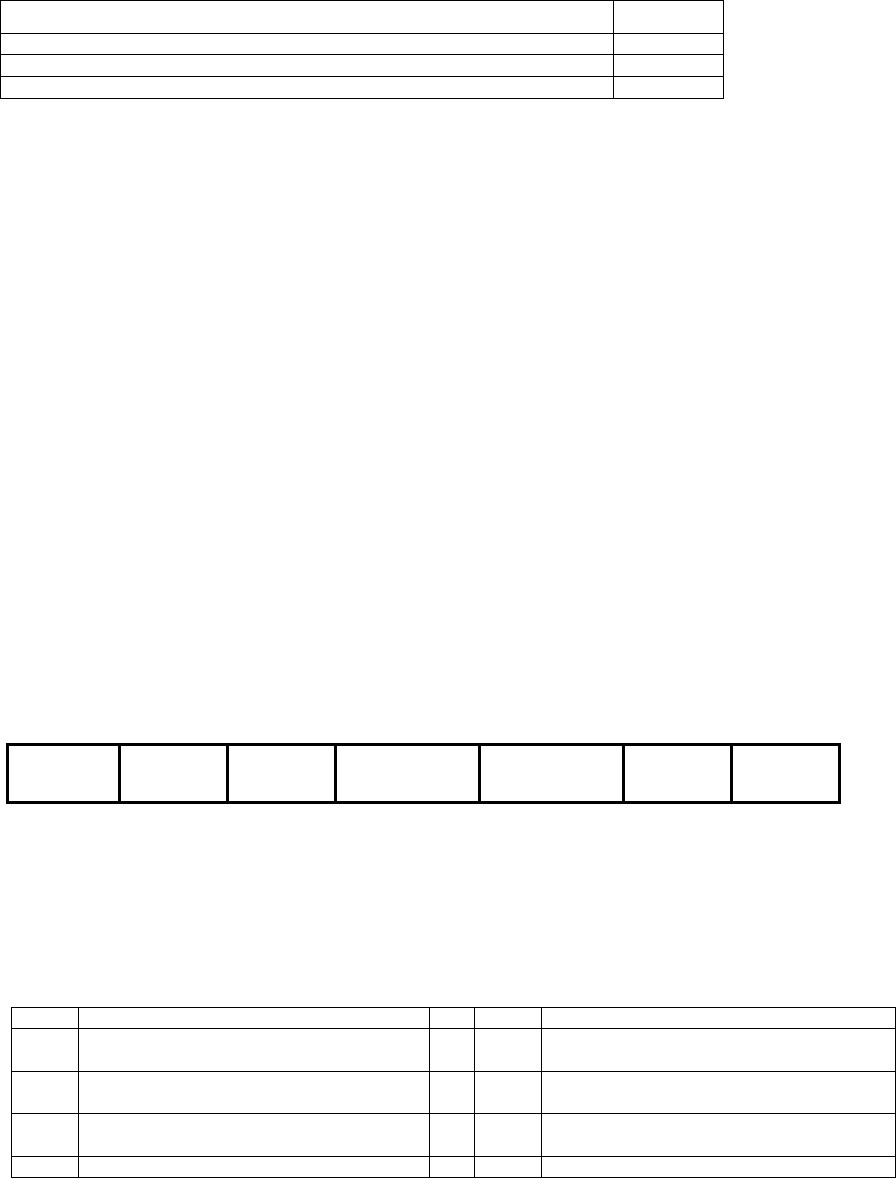

28 2 10 105 600 25 4

FLC Tax Class Doc Code Julian Date Block Series Serial # List Yr

(a) The first two digits of the DLN represent the File Location Code (or Campus Code). Generally, the primary

FLC codes are used in the DLN; however, during heavy filing periods, overflow File Location Codes will be

used to handle overflow conditions and will not correspond to the actual filing location. For Payer Master File

(PMF) W3 Payer DLNs, the first two digits will be the first two positions of the Payer TIN (if non-numeric, a

value of 69 is assigned).

(b) The third digit is the tax class. This identifies the type of tax each transaction involves.

Code Definition Code Definition

0 Employee Plans Master file (EPMF), EO

and EP Determination

5 Information Return Processing (IRP),

Estate and Gift Tax

1 Withholding and Social Security – Form

941

6 NMF

2 Individual Income Tax, Fiduciary Income

Tax, Partnership return

7 CT-1

3 Corporate Income Tax, 990T,8038 8 FUTA

Any line marked with # is for official use only

4-2

3 Campus and File Location Codes

Series, 8609, 8610

Code Definition Code Definition

4 Excise Tax 9 Mixed - Segregation by tax class not

required.

(c) The fourth and fifth digits are the document codes. These are shown in this book in Section 2 by form number.

Certain document codes can be applicable to more than one type form or tax class. The most frequently

encountered are:

Code Definition Code Definition

07 EP Determination Application 52 Account Transfer In

17 Subsequent payment input by the

Campus

53 EO Determination Application

18 Subsequent payment input by the Area

Office

54 DP Adjustment

47 Examination Adjustment 63 Entity changes

51 Prompt/Manual/Quick Assessment 77 Form 3177

(d) The sixth, seventh and eighth digits represent the control (Julian) date. This date could be the deposit date of

remittance received with a return or payment documents. A Sunday date when numbering NR returns that

week, a transfer date-transfer of credits, or the current date when not otherwise specified. The control date for

IDRS, Remittance Processing System (RPS), and Lockbox input transactions is incremented by 400 to avoid

duplicate DLNs. Subtract 400 to determine control date.

NOTE: The Julian Date does not always correspond with the Received Date or Processing Date.

(e) The ninth, tenth and eleventh digits represents the Blocking Series. Complete information can be found in

IRM 3.10.73 for Non-remittance Documents. Revenue Receipt documents are 000-999 Blocking Series,

except for Extensions. See section 4.13 for Adjustment Blocking Series. For Payer Master File (PMF) W3

Payer DLNs, the ninth through thirteenth digits are used as a single five position sequence number ranging

from 00000 through 99999 within unique FLC, Doc. Code (37, 38) and Julian day.

(f) The twelfth and thirteenth digits are the serial numbers. The maximum number of records within a block is

100 and they are serially numbered from 00 thru 99.

(g) The fourteenth digit is the last year digit of the year the DLN was assigned. This digit is computer generated.

(h) The original DLN of the return is associated with Transaction Code 150. If there has been an Examina

tion/Adjustment which created a refile DLN, a letter X following the DLN will denote that the return is now filed

under the refile DLN.

-

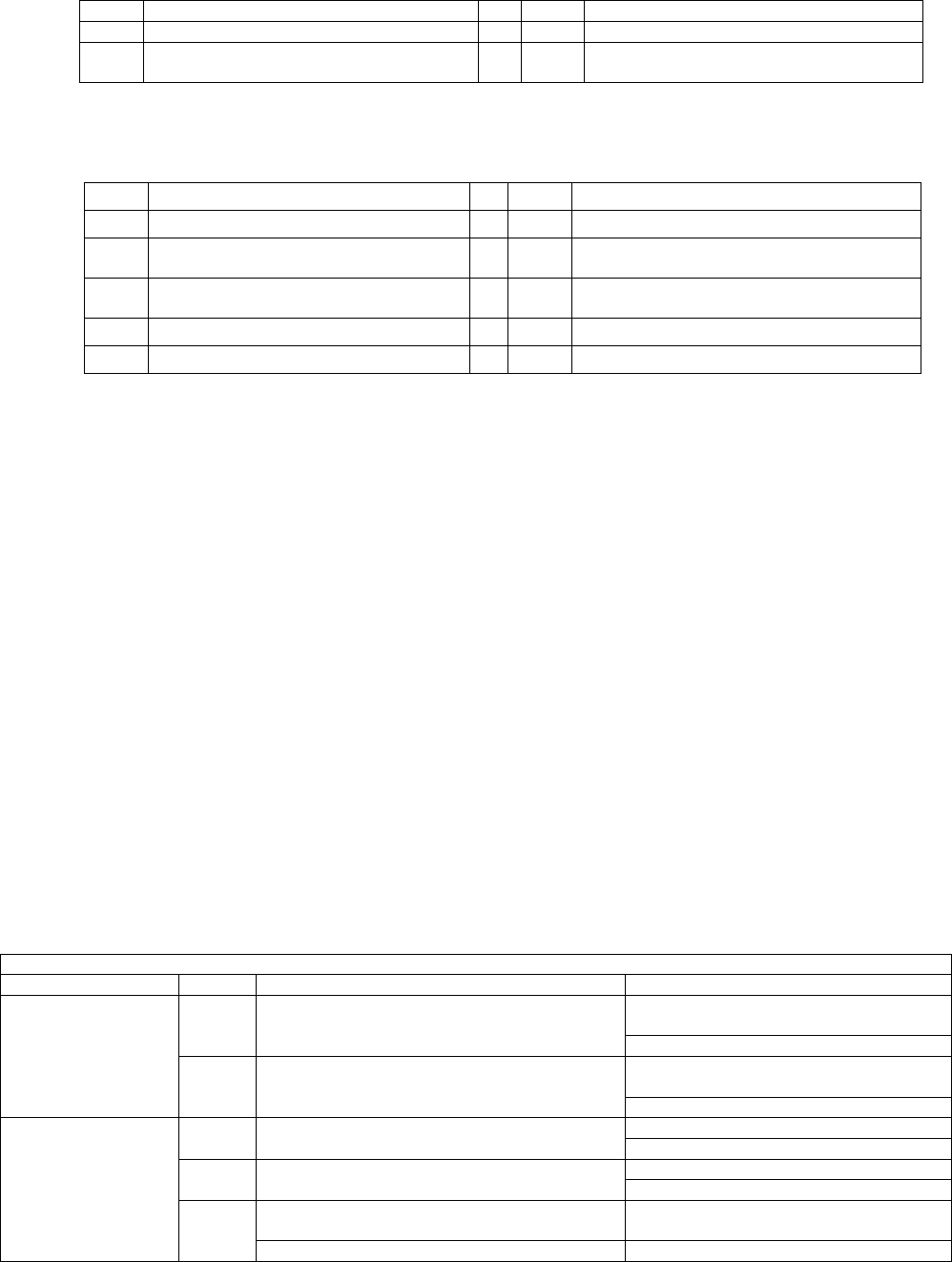

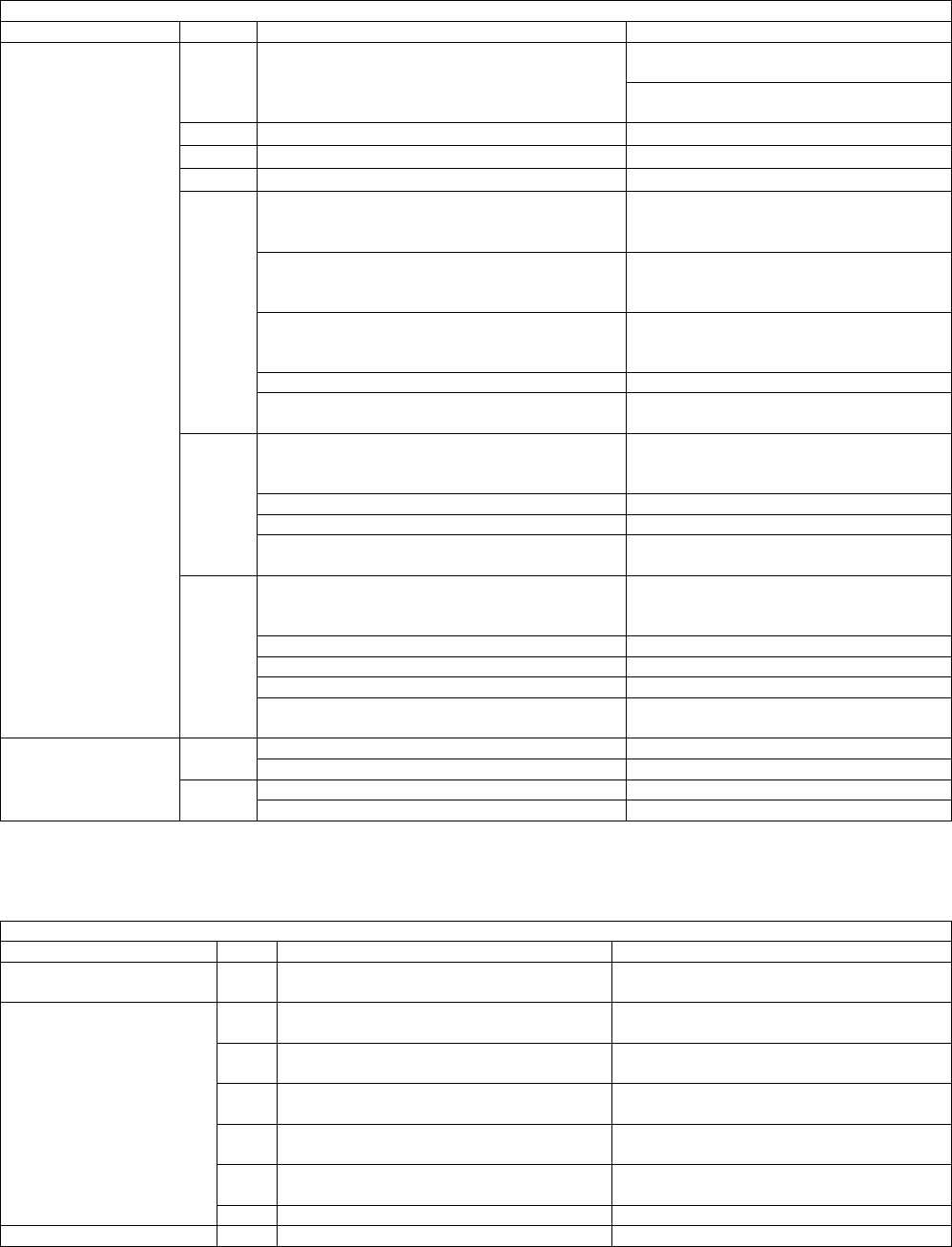

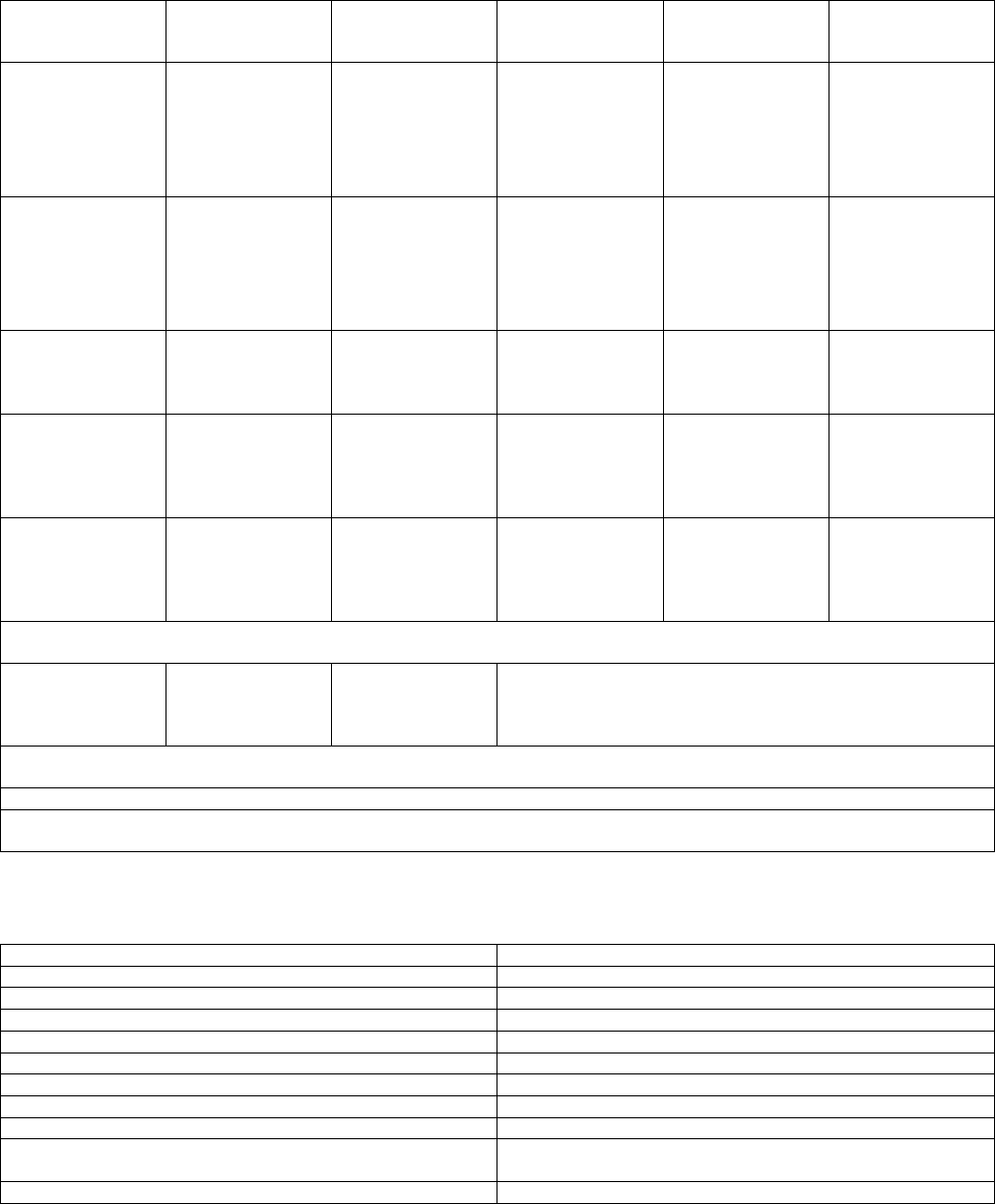

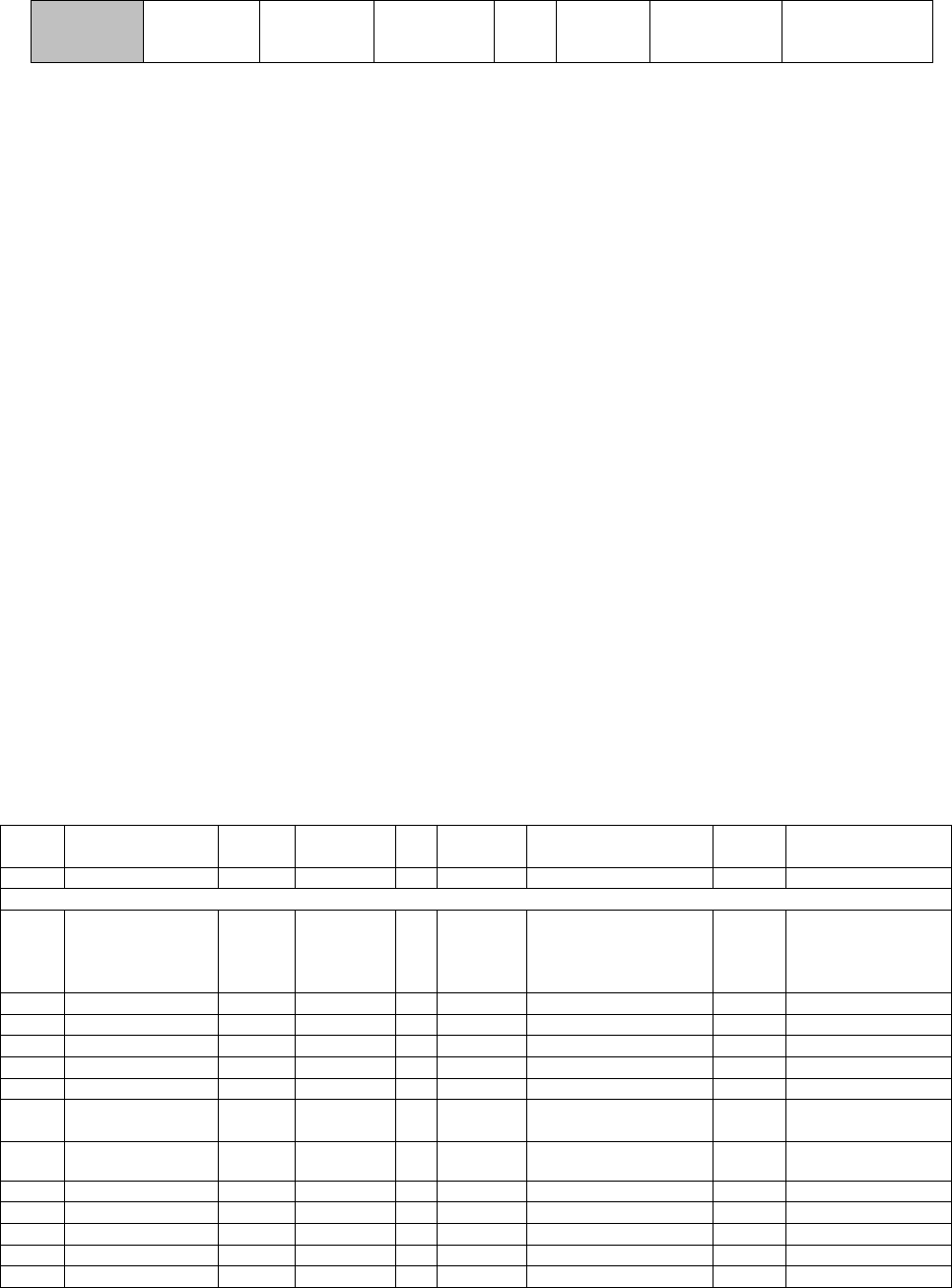

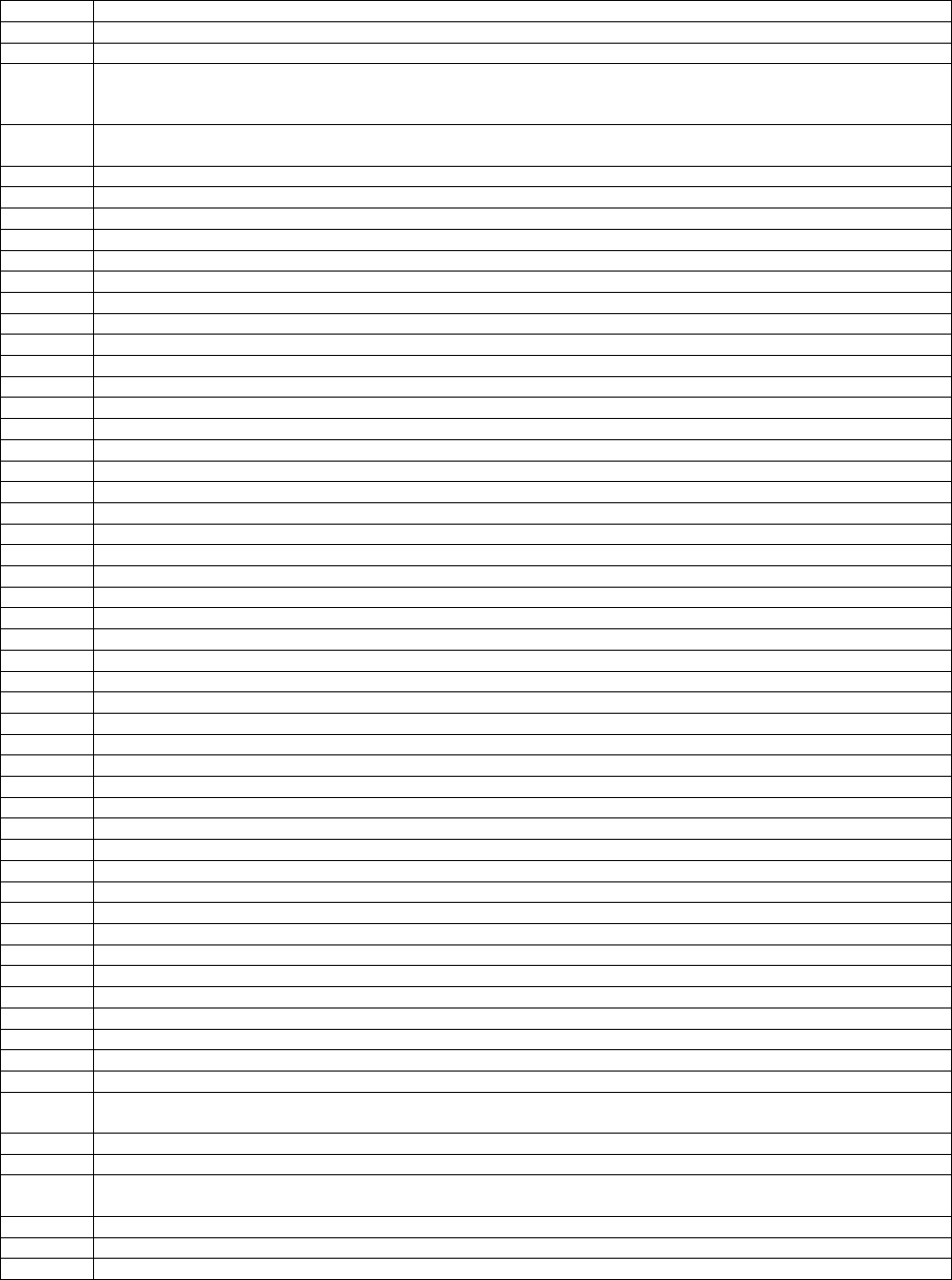

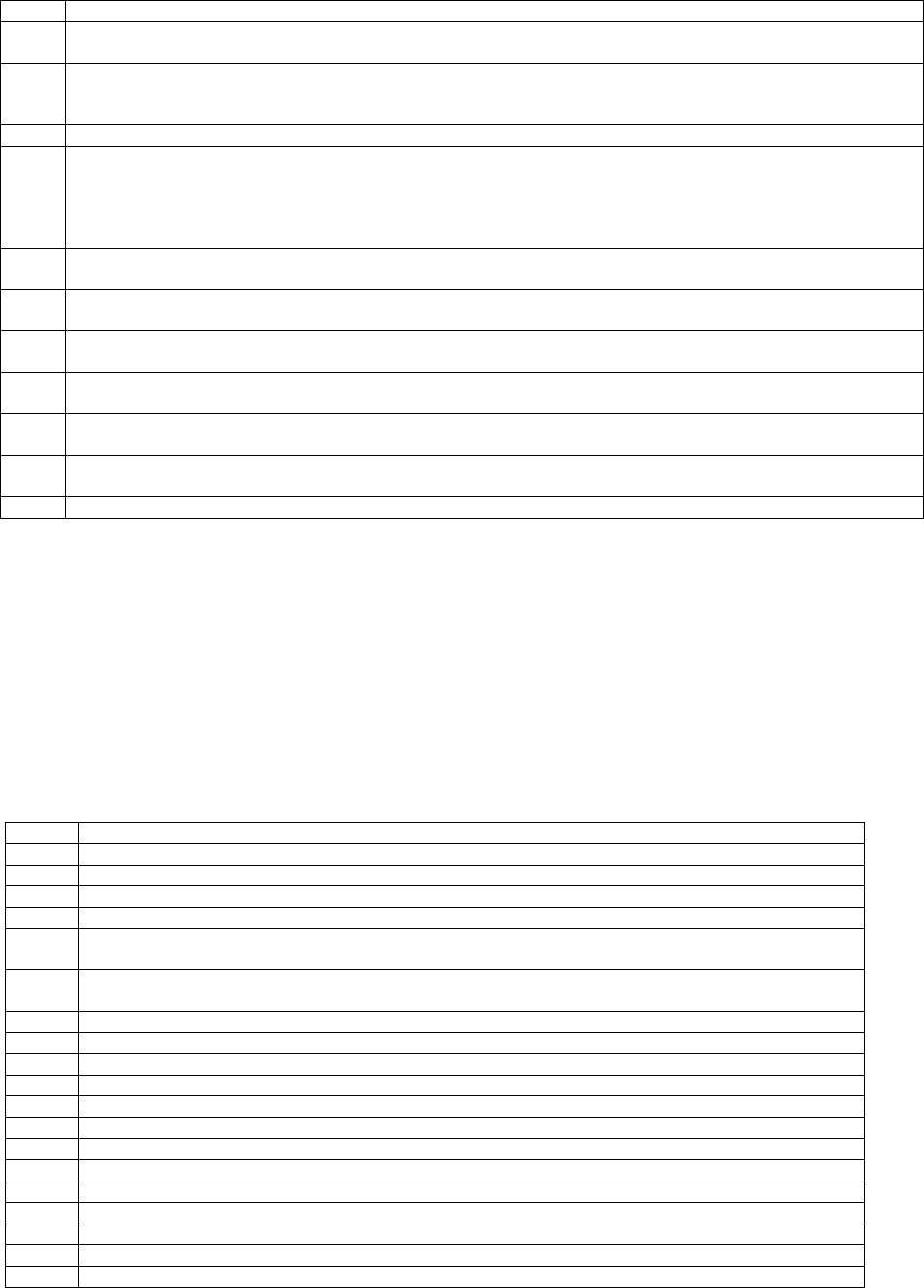

A. 2013 Electronic File Location Code

Note: File Location Codes are the first and second digits of the DLN.

2013 Electronic FLC

CAMPUS FLC Description DLN Composition Specifics

Andover

14

Primary IMF Legacy and MeF Tax Returns Legacy = Normal Julians

MeF = Inflated Julians

16

Overflow IMF Legacy and MeF Tax Returns Legacy = Normal Julians

MeF = Inflated Julians

Austin

76

Primary IMF Legacy and MeF Tax Returns

Legacy = Normal Julians

MeF = Inflated Julians

75

Overflow IMF Legacy and MeF Tax Returns

Legacy = Normal Julians

MeF = Inflated Julians

20

20 (IMF) 1040, 1040A, 1040EZ International

IMF Legacy and MeF Tax Returns

Legacy = Normal Julians; blocking

range 950-999

or F2555, F2555EZ, F8833, F8854, F8891 MeF = Inflated Julians; blocking range

Any line marked with # is for official use only

4-3

2013 Electronic FLC

CAMPUS FLC Description DLN Composition Specifics

attached 950-999

Shared with Paper

Refer to Other Than Electronic FLC

Chart

21

21 (IMF) US Possession IMF Legacy and

MeF Tax Returns

Legacy = Normal Julians; blocking

range 950-999

F1040PR, F1040SS or F4563, F5074, F8689,

FW2GU attached

MeF = Inflated Julians; blocking range

950-999

Shared with Paper

Refer to Other Than Electronic FLC

Chart

Cincinnati

26

Primary BMF

MeF BMF Forms

720,940,941,943,944,945, 2290 and

8849

27

Overflow BMF

MeF BMF Forms 720, 940, 941, 943,

944, 945, 2290 and 8849

35

Primary BMF F940 and F941 (Domestic)

F940 = T/C 8, D/C 39, Blocking Series

000 - 999

F941 = T/C 1, D/C 35, Blocking Series

000 - 999

38

Overflow BMF F940 and F941 (Domestic)

F940 = T/C 8, D/C 39, Blocking Series

000 - 999

F941 = T/C 1, D/C 35, Blocking Series

000 - 999

Fresno

80

Primary IMF Legacy and MeF Tax Returns

Legacy = Normal Julians

MeF = Inflated Julians

90

Overflow IMF Legacy and MeF Tax Returns

Legacy = Normal Julians

MeF = Inflated Julians

Kansas City

70

Primary IMF Legacy and MeF Tax Returns

Legacy = Normal Julians

MeF = Inflated Julians

79

Overflow IMF Legacy and MeF Tax Returns

Legacy = Normal Julians

MeF = Inflated Julians

Ogden

60 BMF International

Legacy = F941SS - Normal Julians;

blocking range 000-999

MeF =

940,941,943,944,945,1041,1065,

1065B, 1120 Family, 7004 Julian dates

and, blocking ranges shown below:

MeF 940 = T/C 8, D/C 39, Inflated

Julians, Blocking Series 000-499.

MeF 941 = T/C 1, D/C 35, Inflated

Julians, Blocking Series 000-399.

MeF 943 = T/C 1, D/C 43, Inflated

Julians, Blocking Series 000-499.

MeF 944 = T/C 1, D/C 49, Normal

Julians, Blocking Series 500-999.

MeF 945 = T/C 1, D/C 44, Inflated

Julians, Blocking Series 000-999.

MeF 1041= T/C 2, D/C 36, Inflated

Julians, Blocking Series 000-999.

MeF 1065 = T/C 2, D/C 69, Blocking

Series 500 - 599

MeF 1065B = T/C 2, D/C 68, Blocking

Series 500 - 599

MeF 1120 = T/C 3, D/C 11, Blocking

Series 500 - 599

MeF 1120 = T/C 3, D/C 10, Blocking

Series 500 - 978

MeF 1120F = T/C 3, D/C 66, Blocking

Series 600 - 999

MeF 1120F = T/C 3, D/C 67, Blocking

Series 600 - 999

Any line marked with # is for official use only

4-4

2013 Electronic FLC

CAMPUS FLC Description DLN Composition Specifics

MeF 1120S = T/C 3, D/C 16, Blocking

Series 500 - 599

MeF 7004 = T/C 3, D/C 04, Blocking

Series 500 - 999

MeF 7004 = T/C 3, D/C 04, Blocking

Series 100 - 399

MeF 7004 = T/C 2, D/C 04, Blocking

Series 500 - 999

MeF 7004 = T/C 1, D/C 04, Blocking

Series 500 - 999

MeF 7004 = T/C 5, D/C 04, Blocking

Series 500 - 999

Refer to Other Than Electronic FLC

Chart

78 BMF US Possession

Legacy = F940PR - Normal Julians;

blocking range 000-999

Legacy = F941PR - Normal Julians;

blocking range 000-999

MeF =940, 940pr, 941, 941pr, 941ss,

943, 943pr, 944, 945, 1041, 1065,

1065B, 1120 Family, 700. Julian dates

and blocking ranges shown below:

MeF 940 = T/C 8, D/C 39, Inflated

Julians, Blocking Series 000-499.

MeF 940PR = T/C 8, D/C 39, Inflated

Julians, Blocking Series 500-999.

MeF 941 = T/C 1, D/C 35, Inflated

Julians, Blocking Series 000-399.

MeF 941PR = T/C 1, D/C 35, Inflated

Julians, Blocking Series 400-699.

MeF 941SS = T/C 1, D/C 35, Inflated

Julians, Blocking Series 700-999.

MeF 943 = T/C 1, D/C 43, Inflated

Julians, Blocking Series 000-499.

MeF 943PR = T/C 1, D/C 43, Inflated

Julians, Blocking Series 500-949.

MeF 944 = T/C 1, D/C 49, Normal

Julians, Blocking Series 500-999.

MeF 945 = T/C 1, D/C 44, Inflated

Julians, Blocking Series 000-999.

MeF 1041= T/C 2, D/C 36, Inflated

Julians, Blocking Series 000-999.

MeF 1065 = T/C 2, D/C 69, Blocking

Series 500 - 599

MeF 1065B = T/C 2, D/C 68, Blocking

Series 500 - 599

MeF 1120 = T/C 3, D/C 11, Blocking

Series 500 - 599

MeF 1120 = T/C 3, D/C 10, Blocking

Series 500 - 978

MeF 1120F = T/C 3, D/C 66, Blocking

Series 600 - 999

MeF 1120F = T/C 3, D/C 67, Blocking

Series 600 - 999

MeF 1120S = T/C 3, D/C 16, Blocking

Series 500 - 599

MeF 7004 = T/C 3, D/C 04, Blocking

Series 500 - 999

MeF 7004 = T/C 3, D/C 04, Blocking

Series 100 - 399

Any line marked with # is for official use only

4-5

2013 Electronic FLC

CAMPUS FLC Description DLN Composition Specifics

MeF 7004 = T/C 2, D/C 04, Blocking

Series 500 - 999

MeF 7004 = T/C 1, D/C 04, Blocking

Series 500 - 999

81

Primary EFTPS Payment doc code 19 only

82

Overflow 1 EFTPS Payment doc code 19 only

83

Overflow 2 EFTPS Payment doc code 19 only

88

Primary MeF 1041

MeF 1041= T/C 2, D/C 36, Normal and

Inflated Julians, Blocking Series 000

999.

-

-

Primary MeF Sch K-1 (F1041)

MeF 1041= T/C 5, D/C 66, Normal and

Inflated Julians, Blocking Series 000

999.

Overflow 2 MeF BMF Domestic Forms other

than 1065B

MeF BMF Forms - (Forms 1065, 1120

family, 7004, 990 family, 8868, and Sch

K-1s for F1065, F1065B, F1120S)

Overflow 1 MeF BMF 1065B

Overflow 2 MeF EO

F990, F990EZ, F990N, F990PF,

F1120-POL and F8868

92

Overflow 1 MeF BMF Domestic Forms

(except for MeF Form 1065B)

MeF BMF Forms - (Forms 1065, 1120

family, 7004, 990 family, 8868, and Sch

K-1s for F1065, F1065B, F1120S)

Overflow Legacy BMF F1041

Overflow Sch K-1 (Form 1041) Legacy

Overflow 1 MeF EO

F990, F990EZ, F990N, F990PF,

F1120-POL and F8868

93

Primary MeF BMF Domestic Forms

MeF BMF Forms - (Forms 1065, 1120

family, 7004, 990 family, 8868, and Sch

K-1s for F1065, F1065B, F1120S)

Primary Legacy BMF F1041

Primary Sch K-1 (Form 1041) Legacy

Primary MeF BMF F1065B

Primary MeF EO

F990, F990EZ, F990N, F990PF,

F1120-POL and F8868

Philadelphia

30

Primary IMF Legacy and MeF Tax Returns Legacy = Normal Julians

MeF = Inflated Julians

32

Overflow IMF Legacy and MeF Tax Returns Legacy = Normal Julians

MeF = Inflated Julians

Note: BMF MeF - When all DLNs have been assigned using the current Julian date and File Location Codes, BMF forms

may begin using Inflated Julian dates or forward date up to 10 days for overflow.

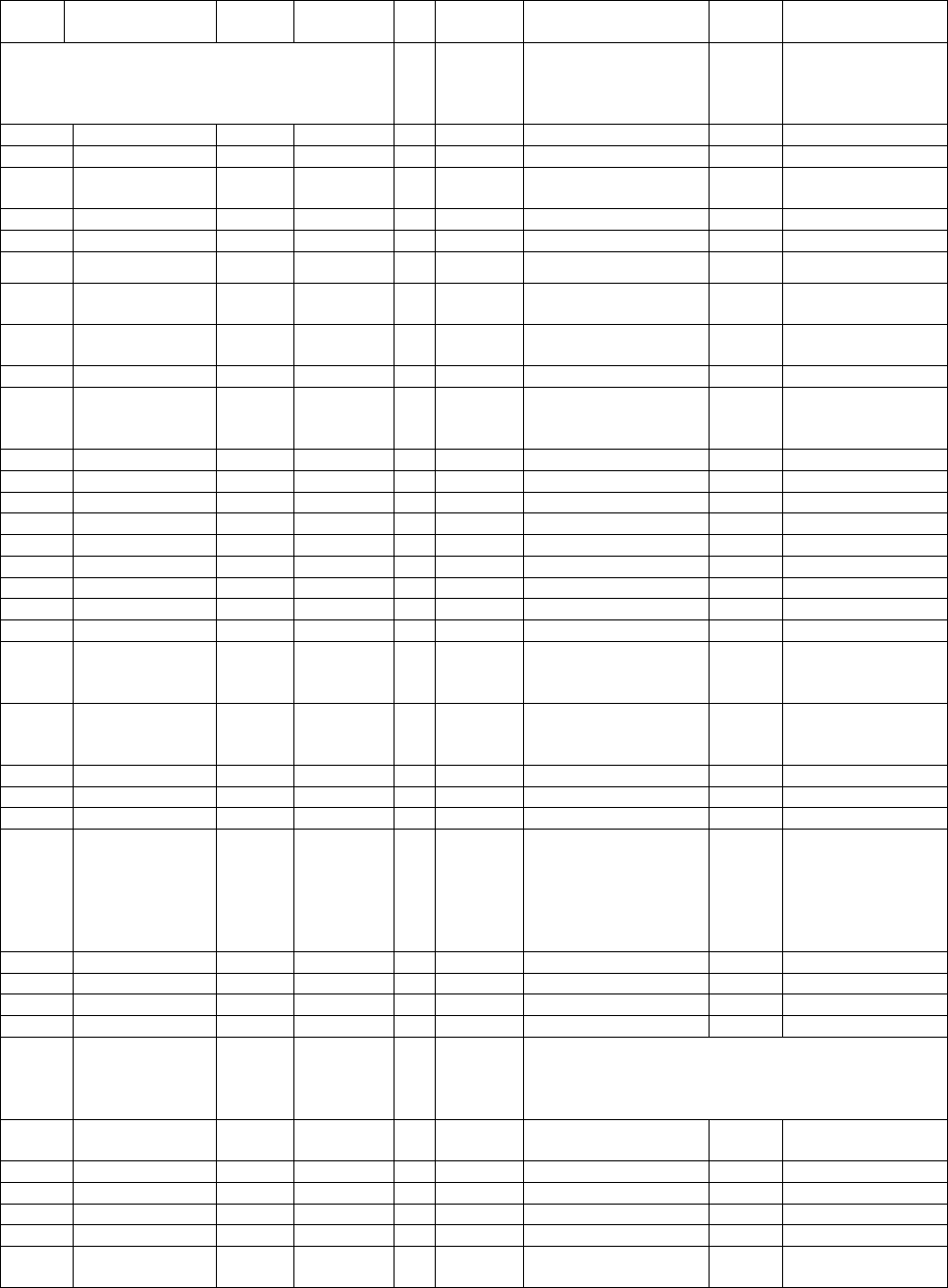

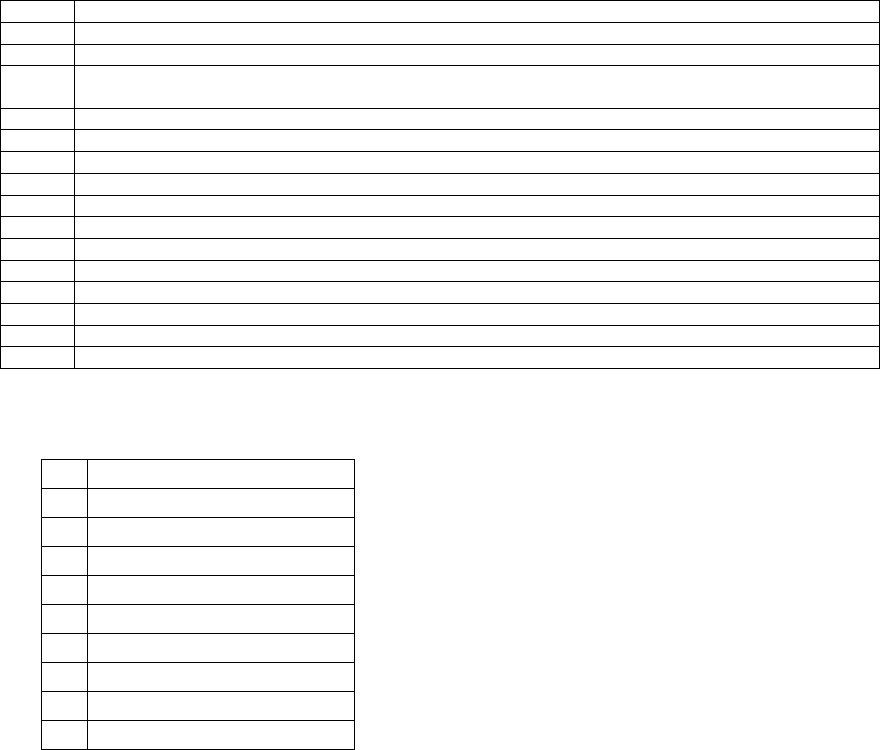

Other than electronic FLC

2013 “Other than Electronic” FLC

Campus FLC Description DLN Composition Specifics

Andover 01 Overflow 1

BBTS FLC Report for ANSC, Overflow

Sequence # 1

SP Rampdown

02 Overflow 2

BBTS FLC Report for ANSC, Overflow

Sequence # 2

03 Overflow 3

BBTS FLC Report for ANSC, Overflow

Sequence # 3

04 Overflow 4

BBTS FLC Report for ANSC, Overflow

Sequence # 4

05 Overflow 5

BBTS FLC Report for ANSC, Overflow

Sequence # 5

06 Overflow 6

BBTS FLC Report for ANSC, Overflow

Sequence # 6

08 Primary BBTS FLC Report for ANSC, Primary

Atlanta 07 Primary BBTS FLC Report for ATSC, Primary

Any line marked with # is for official use only

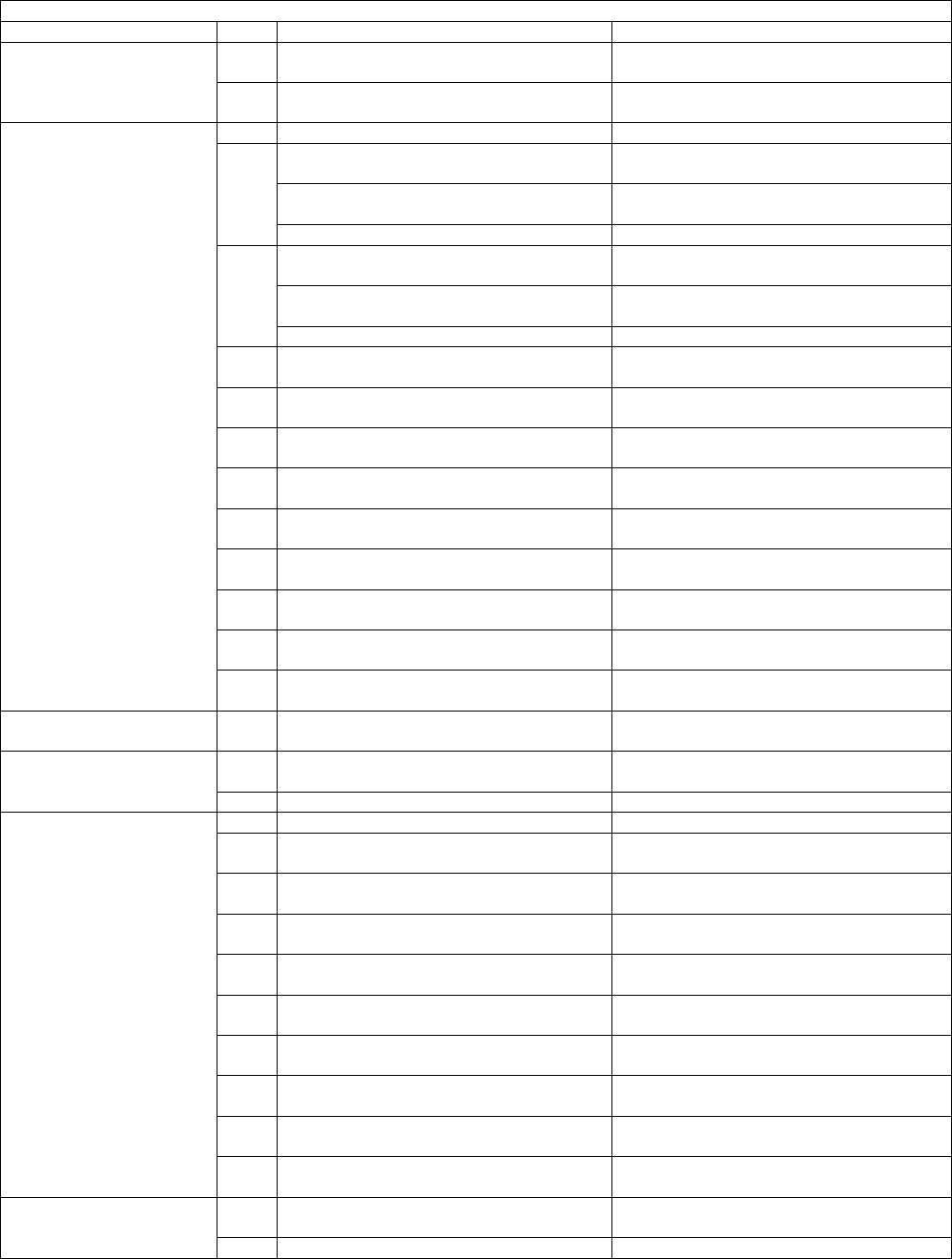

4-6

2013 “Other than Electronic” FLC

Campus FLC Description DLN Composition Specifics

SP Rampdown

58 Overflow 1

BBTS FLC Report for ATSC, Overflow

Sequence # 1

59 Overflow 2

BBTS FLC Report for ATSC, Overflow

Sequence # 2

Austin

18 Primary BBTS FLC Report for AUSC, Primary

20

20 (IMF) 1040, 1040A, 1040EZ

International - Foreign Address

BBTS FLC Report for AUSC, Overflow

Sequence # 6

or F2555, F2555EZ, F8833, F8854,

F8891 attached

Paper = Normal Julians; blocking range

000-949

Shared with Electronic Refer to Electronic FLC Chart

21

US Possession

BBTS FLC Report for AUSC, Overflow

Sequence # 7

F1040PR, F1040SS or F4563, F5074,

F8689, FW2GU attached

Paper = Normal Julians; blocking range

000-949

Shared with Electronic Refer to Electronic FLC Chart

50 Overflow 3

BBTS FLC Report for AUSC, Overflow

Sequence # 3

50 Lockbox SCAN Overflow*

Bank assignment per FLC; refer to IRM

3.10.73

53 Overflow 4

BBTS FLC Report for AUSC, Overflow

Sequence # 4

53 Lockbox NON-SCAN Overflow*

Bank assignment per FLC; refer to IRM

3.10.73

71 Overflow 5

BBTS FLC Report for AUSC, Overflow

Sequence # 5

73 Overflow 1

BBTS FLC Report for AUSC, Overflow

Sequence # 1

73 Lockbox SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

74 Overflow 2

BBTS FLC Report for AUSC, Overflow

Sequence # 2

75 Lockbox NON-SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

Brookhaven 11 Overflow 1

BBTS FLC Report for CSC, Overflow

Sequence # 1

SP Rampdown

13 Overflow 2

BBTS FLC Report for CSC, Overflow

Sequence # 2

19 Primary BBTS FLC Report for CSC, Primary

Cincinnati

17 Primary BBTS FLC Report for CSC, Primary

26 Lockbox SCAN Overflow*

Bank assignment per FLC; refer to IRM

3.10.73

27 Lockbox NON-SCAN Overflow*

Bank assignment per FLC; refer to IRM

3.10.73

31 Overflow 1

BBTS FLC Report for CSC, Overflow

Sequence # 1

31 Lockbox NON-SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

34 Overflow 2

BBTS FLC Report for CSC, Overflow

Sequence # 2

35

Overflow 5 - Shared with electronic

Legacy XML ELF 94X

BBTS FLC Report for CSC, Overflow

Sequence # 99

35 Lockbox SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

38

Overflow 4 - Shared with electronic

Legacy XML ELF 94X

BBTS FLC Report for CSC, Overflow

Sequence # 98

96 Overflow 3

BBTS FLC Report for CSC, Overflow

Sequence # 3

Fresno

15 Lockbox SCAN Overflow*

Bank assignment per FLC; refer to IRM

3.10.73

24 Lockbox NON-SCAN Overflow* Bank assignment per FLC; refer to IRM

Any line marked with # is for official use only

4-7

2013 “Other than Electronic” FLC

Campus FLC Description DLN Composition Specifics

3.10.73

33 Overflow 1

BBTS FLC Report for FSC, Overflow

Sequence # 1

33 Lockbox SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

68 Overflow 2

BBTS FLC Report for FSC, Overflow

Sequence # 2

68 Lockbox SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

77 Overflow 3

BBTS FLC Report for FSC, Overflow

Sequence # 3

77 Lockbox NON-SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

80 Lockbox SCAN Overflow*

Bank assignment per FLC; refer to IRM

3.10.73

89 Primary BBTS FLC Report for FSC, Primary

90 Lockbox NON-SCAN Overflow*

Bank assignment per FLC; refer to IRM

3.10.73

94 Overflow 4

BBTS FLC Report for FSC, Overflow

Sequence # 4

94 Lockbox NON-SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

95 Overflow 5

BBTS FLC Report for FSC, Overflow

Sequence # 5

Kansas City

09 Primary BBTS FLC Report for MSC, Primary

36 Overflow 1

BBTS FLC Report for MSC, Overflow

Sequence # 1

36 Lockbox SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

37 Lockbox SCAN Overflow*

Bank assignment per FLC; refer to IRM

3.10.73

39 Overflow 2

BBTS FLC Report for MSC, Overflow

Sequence # 2

39 Lockbox NON-SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

40 Lockbox SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

41 Overflow 3

BBTS FLC Report for MSC, Overflow

Sequence # 3

42 Lockbox NON-SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

43 Overflow 4

BBTS FLC Report for MSC, Overflow

Sequence # 4

44 Lockbox NON-SCAN Overflow*

Bank assignment per FLC; refer to IRM

3.10.73

47 Lockbox SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

48 Lockbox NON-SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

Memphis 49 Primary BBTS FLC Report for MSC, Primary

SP Rampdown

56 Overflow 1

BBTS FLC Report for MSC, Overflow

Sequence # 1

57 Overflow 2

BBTS FLC Report for MSC, Overflow

Sequence # 2

61 Overflow 3

BBTS FLC Report for MSC, Overflow

Sequence # 3

62 Overflow 4

BBTS FLC Report for MSC, Overflow

Sequence # 4

63 Overflow 5

BBTS FLC Report for MSC, Overflow

Sequence # 5

Any line marked with # is for official use only

4-8

2013 “Other than Electronic” FLC

Campus FLC Description DLN Composition Specifics

Ogden

29 Primary BBTS FLC Report for OSC, Primary

60

Overflow 12 - Shared with electronic -

Foreign Address BMF

BBTS FLC Report for OSC, Overflow

Sequence # 12

78

Overflow 13 - Shared with electronic -

US Possession BMF

BBTS FLC Report for OSC, Overflow

Sequence # 13

81 Overflow 1

BBTS FLC Report for OSC, Overflow

Sequence # 1

82 Overflow 2

BBTS FLC Report for OSC, Overflow

Sequence # 2

83 Overflow 4

BBTS FLC Report for OSC, Overflow

Sequence # 4

84 Overflow 5

BBTS FLC Report for OSC, Overflow

Sequence # 5

85 Overflow 6

BBTS FLC Report for OSC, Overflow

Sequence # 6

86 Overflow 7

BBTS FLC Report for OSC, Overflow

Sequence # 7

87 Overflow 8

BBTS FLC Report for OSC, Overflow

Sequence # 3

88 Overflow 8 - Shared with electronic

BBTS FLC Report for OSC, Overflow

Sequence # 8

91 Overflow 9

BBTS FLC Report for OSC, Overflow

Sequence # 9

91 Lockbox SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

92 Overflow 10 - Shared with electronic

BBTS FLC Report for OSC, Overflow

Sequence # 10

92 Lockbox NON-SCAN Primary*

Bank assignment per FLC; refer to IRM

3.10.73

93 Overflow 11 - Shared with electronic

BBTS FLC Report for OSC, Overflow

Sequence # 11`

99

BBTS FLC Report for OSC, Overflow

Sequence # 99

Philadelphia 23 Overflow 1

BBTS FLC Report for PSC, Overflow

Sequence # 1

SP Rampdown

25 Overflow 2

BBTS FLC Report for PSC, Overflow

Sequence # 2

28 Primary BBTS FLC Report for PSC, Primary

51 Overflow 3

BBTS FLC Report for PSC, Overflow

Sequence # 3

52 Overflow 8

BBTS FLC Report for PSC, Overflow

Sequence # 8

54 Overflow 4

BBTS FLC Report for PSC, Overflow

Sequence # 4

55 Overflow 5

BBTS FLC Report for PSC, Overflow

Sequence # 5

* Lockbox File Location Codes are used for Payment Processing only

Note: Campuses will not use Electronic Filing Location Codes for numbering paper returns.

Note: Effective January 1, 2010, the U.S. Department of Labor’s Pension and Welfare Benefits Administration (PWBA)

began processing 5500 series filings electronically using the ERISA Filing Acceptance System (EFAST2) using FLC 92 &

93. From July 2000 to January 2010, the following File Location Codes identify filings processed by EFAST: 56, 62, 72,

84, 86, and 91.

Any line marked with # is for official use only

4-9

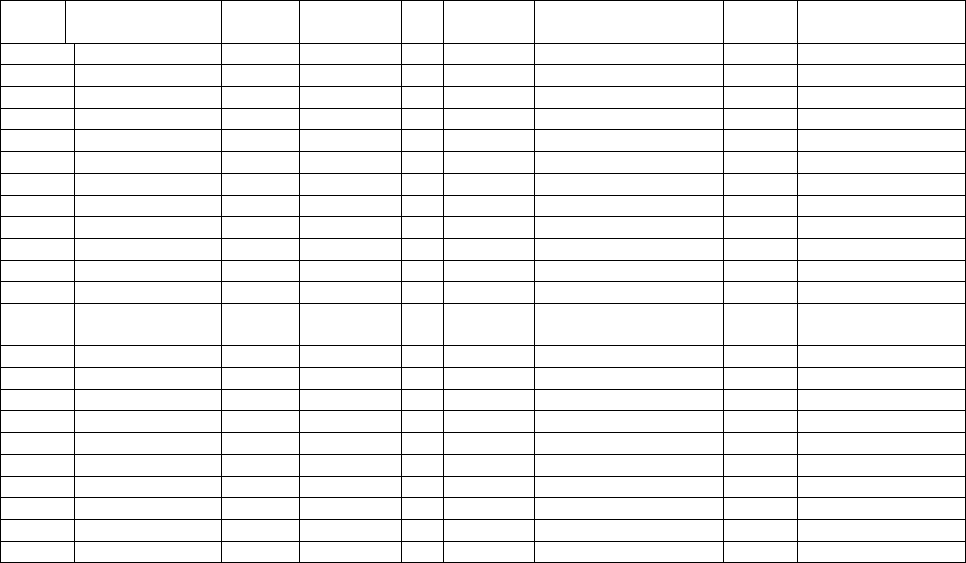

Historical Information

FLC Historical Information

Atlanta

Atlanta Submission Processing ceased paper processing operations in July 2011

Andover

Andover Submission Processing ceased paper processing operations in September 2009; continue to

process electronic IMF

14 (BMF) (beginning in 1991, Form 1065 Paper Parent Option only)

14 (IMF) (beginning in 1999)

16 (beginning in 1989, IMF and BMF Doc codes 19 and 35)

Andover Submission Processing ceased operation on 09/26/2009

Electronic returns (FLC 14 and 16) continue to process through the Andover ALN; accountability is

managed by Fresno.

FLC 02 was used by Lockbox, obsolete effective September 2009 per FSP

FLC 05 was used by Lockbox, obsolete effective September 2009 per FSP

Austin

FLC 75 removed from Austin paper processing; removed from Austin BBTS DLN Reference File

Brookhaven

Brookhaven Submission Processing ceased paper processing operations in October 2003

Cincinnati

35 & 38 (IMF) Note: CSC stopped processing IMF electronic returns in 2002; FLC 35 and 38 reassigned

to BMF 940 and 941 processing in filing season 2013 (UWR 64758)

The 2003 filing season was the last year Cincinnati processed IMF electronic returns.

Fresno

FLC 10 removed from Fresno processing; removed from BBTS DLN Reference File (paper)

Kansas City

Memphis

Memphis Submission Processing ceased paper processing operations in 2005; electronic IMF

processing was rerouted to Kansas City under KC FLCs.

Ogden

Effective January 1, 2010, the U.S. Department of Labor’s Pension and Welfare Benefits Administration

(PWBA) began processing 5500 series filings electronically using the ERISA Filing Acceptance System

(EFAST2) using FLC 92 & 93. From July 2000 to January

The 2002 filing season was the last year Ogden processed IMF paper returns

The 2003 filing season was the last year Ogden processed IMF electronic returns

Philadelphia

Philadelphia Submission Processing ceased paper processing operations in July 2007; continue to

process electronic IMF

Electronic returns (FLC 30 and 32) continue to process through the Philadelphia ALN; accountability is

managed by Ogden.

52 (BMF) (beginning in 1990, Form 1041 only) *

52 (IMF) (beginning in 1992, Form 9282 only) *

66 (BMF) (beginning in 1991, Form 1041 Puerto Rico) *

98 (BMF) (beginning in 1991, Form 1041 Other Foreign) *

66 Overflow 6 - Obsolete - US Possession until Philadelphia Service Center was ramped down; BBTS

FLC Report for PSC, Overflow Sequence # 6

98 Overflow 7 - Obsolete - Foreign Country until Philadelphia Service Center was ramped down; BBTS

FLC Report for PSC, Overflow Sequence # 7

*Doc code 36 Magnetic Media Only

Paper SCRIPS

Campus

Forms

FILE LOCATION

CODES

Paper (SCRIPS)

CSC

940/941

17,31,96

Normal/Inflated Julian, Blocking Series– 000-799,

F940=T/C8, D/C 40,

F941=T/C 1, D/C 41

OSC

940/941

29,81,82,83,84

CSC

Sch. K1s

1041 K-1,

1065 K-1,

1120S K1

06, 11, 13, 22 AND 31

Normal/Inflated Julian, Blocking Series – 000-799

T/C 5,

D/C 1041 K-1=66, 1065 K-1=65, 1120S K1= 67

OSC

84, 86, 91, AND 94

B - File Location Codes Tax Class 5 - Document Normally for IRP (Information Return Processing)

AUSC

1094-B,

1095-B,

1094-C, 1095-

C

18, 73,74,75,76

Normal/Inflated Julian, Blocking Series – 000-799

T/C 5,

D/C 1094-B=11, 1095-B=56, 1094-C=12, 1095-C=60

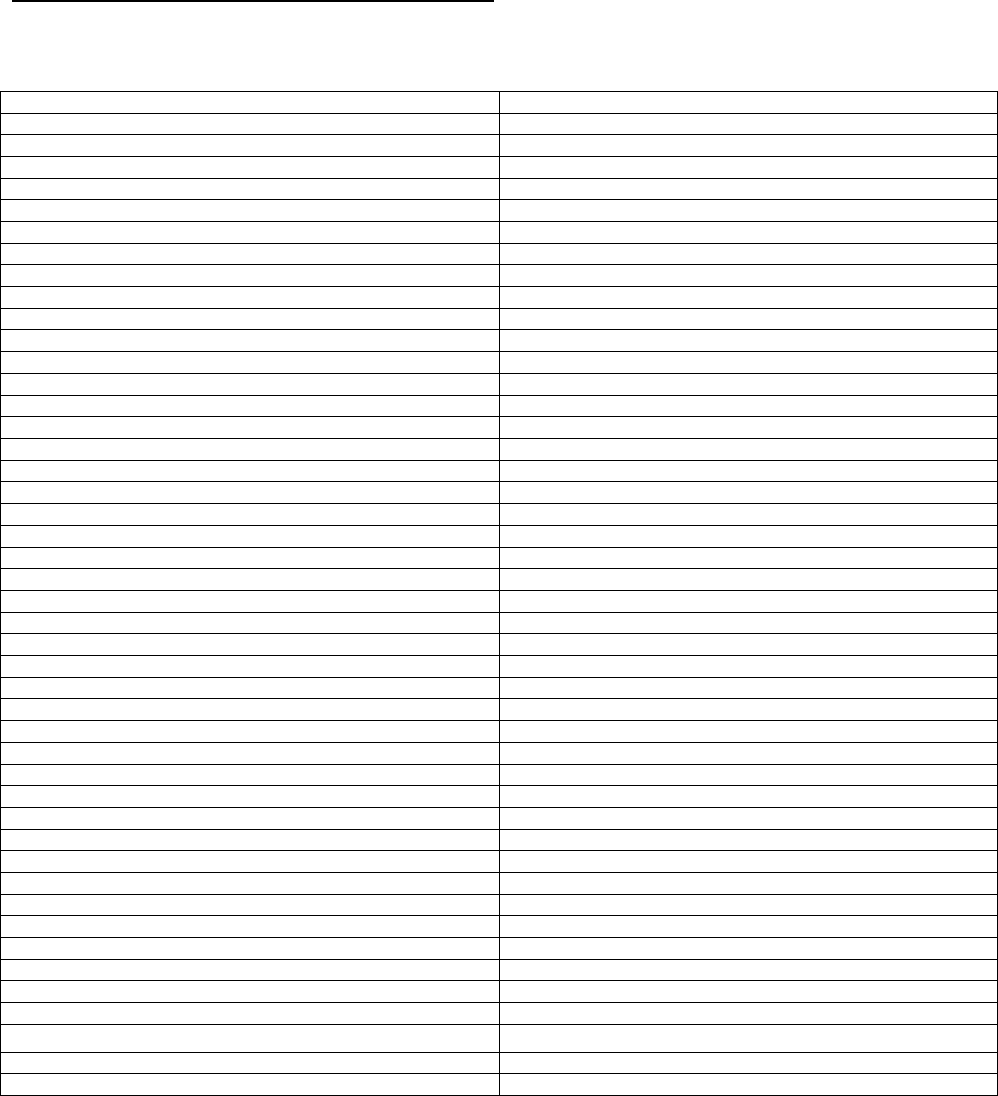

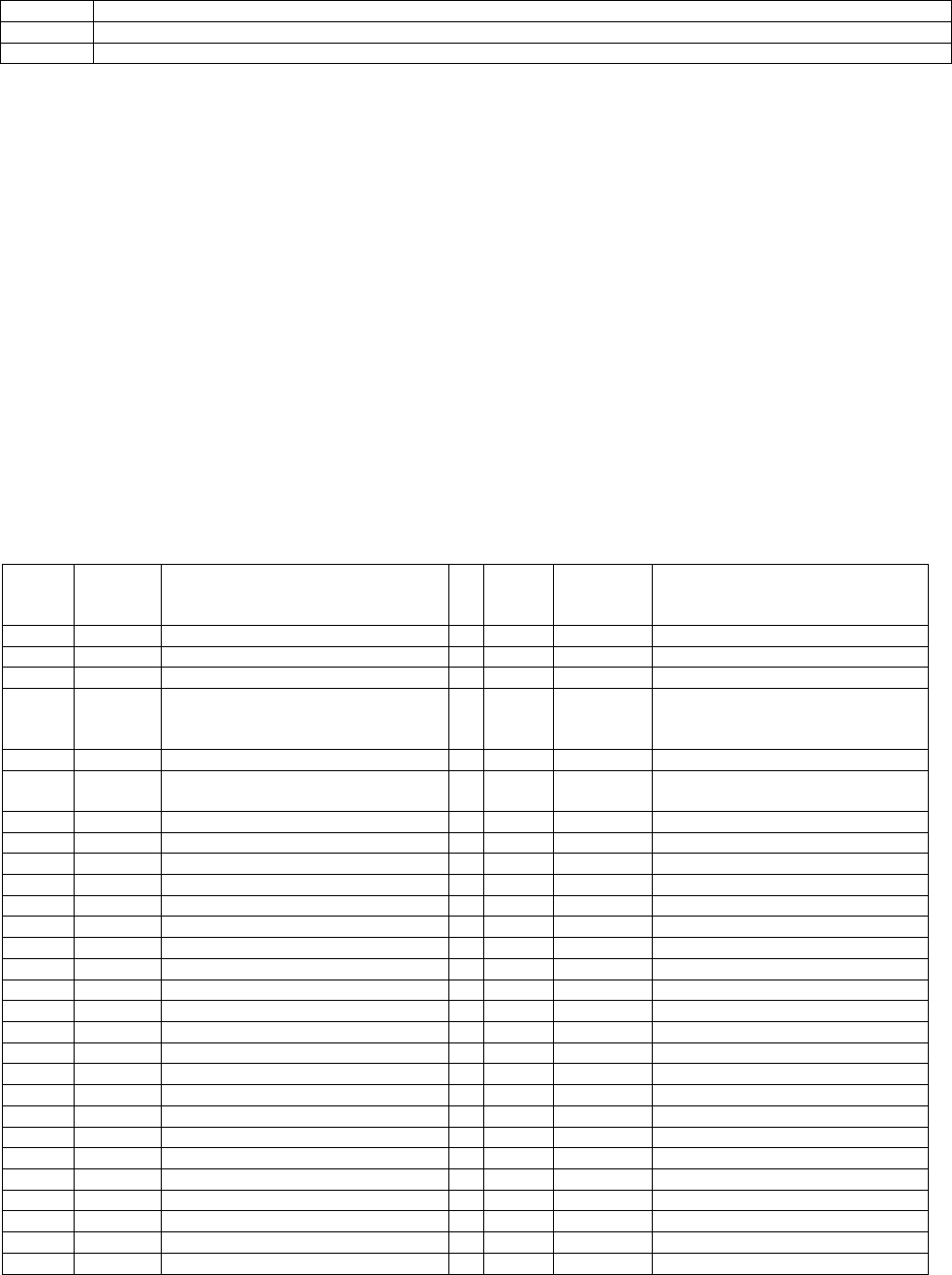

B. File Location Codes Tax Class 5 –document normally for IRP (Information Return Processing)

Any line marked with # is for official use only

4-10

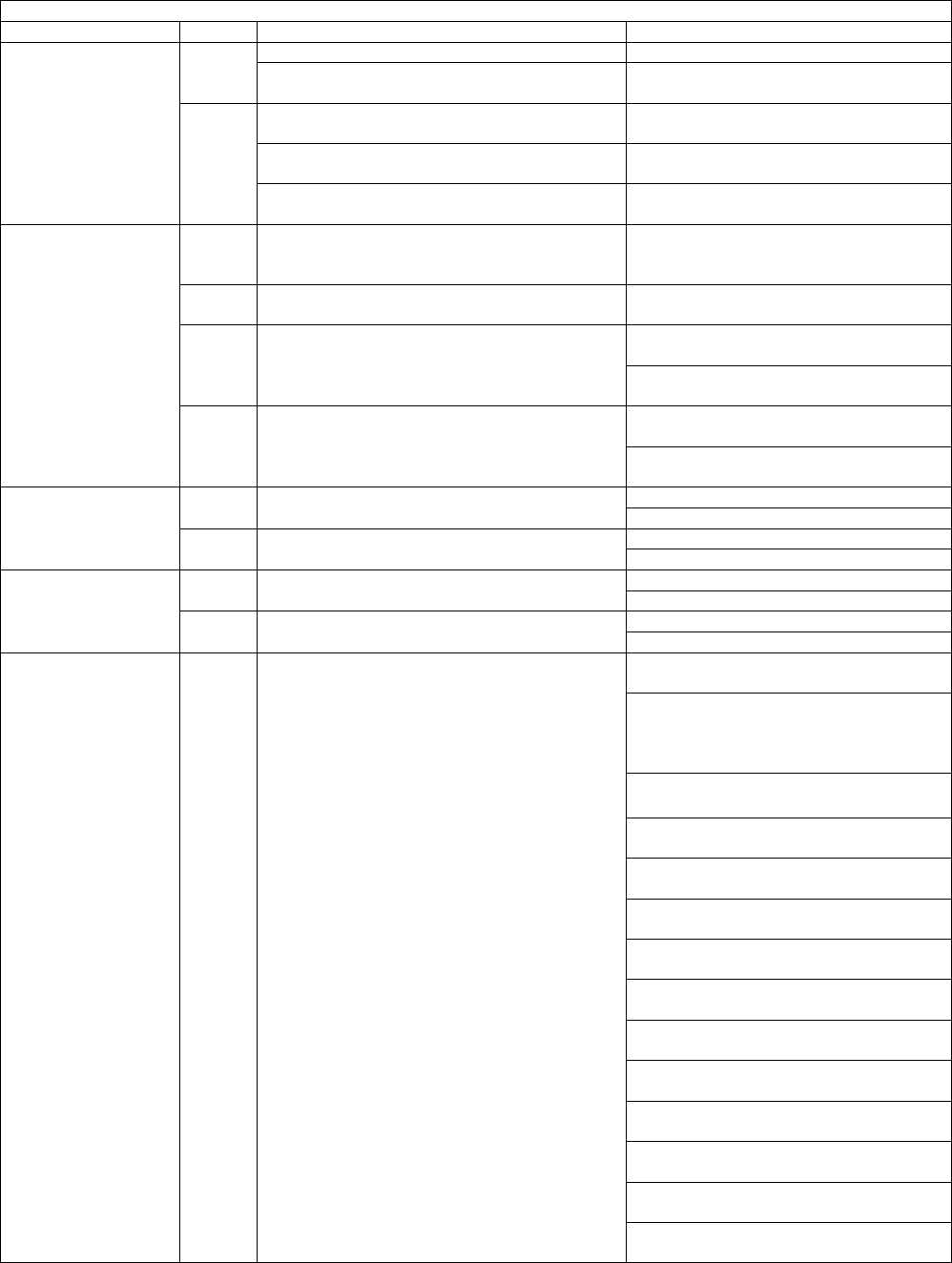

Campus

Paper File

Location Codes

Electronic Filing

Location Codes

Campus

Paper File

Location Codes

Electronic Filing

Location Codes

Atlanta Campus

Note: ATSC is no

longer a

processing site

07, 58, 59, 65

Brookhaven

Campus

Note: BSC is no

longer a

processing site

19, 11, 13, 22

Andover Campus

Note: ANSC is no

longer a

processing site

04, 06, 08, 16

Philadelphia

Campus

Note: PSC is no

longer a

processing site

23, 28, 52, 54

29, 81, 82, 87,

Kansas City

83, 84, 85, 86,

09, 36, 39, 41, 43

09, 36, 39, 41

Ogden Campus

Campus

88, 91, 92, 93,

29, 84, 86, 91

60, 78, 99

Cincinnati

Campus

06, 17, 11, 13,

22, 31

17, 31, 35, 38

Memphis

Campus Note:

MSC is no longer

a processing site

49, 56, 57, 62

Austin Campus

18, 73,74,75,76

18, 73, 74, 75

Fresno Campus

Note: FSC does

not process paper

IRP

89, 33, 77, 94

B - File Location Codes Tax Class 5 - Document Normally for IRP (Information Return Processing)

1094-B,

Normal/Inflated Julian, Blocking Series – 000-799

AUSC

18, 73,74,75,76

1095-B,

T/C 5,

KCSC

09, 36, 39, 41, 43

1094-C, 1095-C

D/C 1094-B=11, 1095-B=56, 1094-C=12, 1095-C=60

Electronically filed documents received in FIRE (Filing Information Returns

Electronically) will always have a Julian date and blocking series of “000”.

MeF Schedule K-1 for Form 1065 20, 60, 88, 92, 93, 98

Lockbox payments for Tax Class 5 73, 75, 50, 53, 35, 31, 26, 27, 68, 94, 15, 24, 33, 77, 80, 90, 40, 42, 47, 48, 37, 42, 36,

39, 40, 44, 91, 92

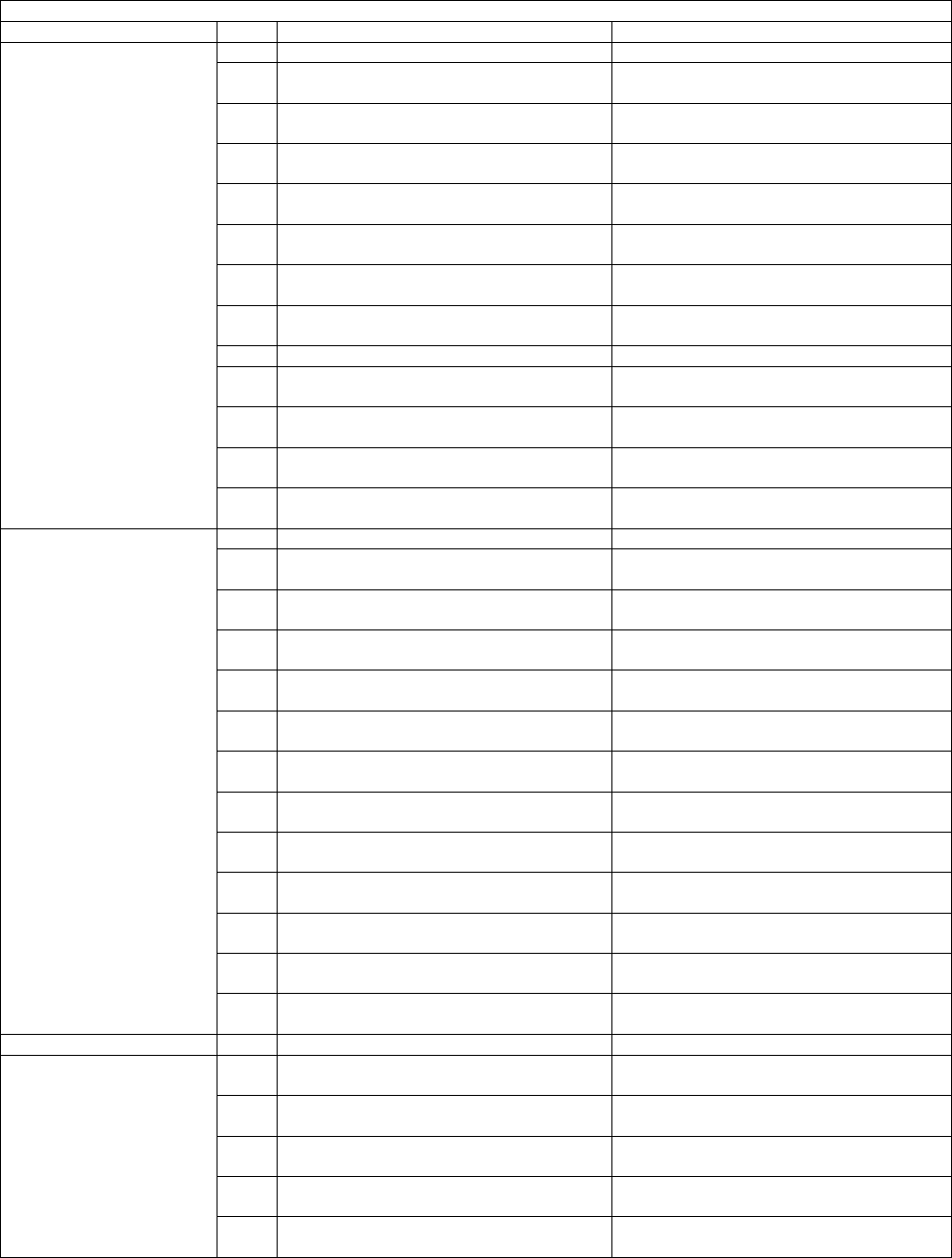

4 IDRS Campus and File Location Codes:

Campus

FLC

ANSC

01, 02, 03, 04, 05, 06, 08, 14, 16

ATSC

07, 58, 59, 65

AUSC

18, 71, 73, 74, 75, 76, 20, 21 (20 and 21 international)

BSC

11, 13, 19, 22

CSC

17, 31, 34, 35, 38, 96, 97 (96 and 97 are international)

FSC

33, 68, 77. 89, 94, 95

KCSC

09, 36, 37, 39, 41, 42, 43, 45, 46, 47, 48

MSC

49, 56, 57, 61, 62, 63, 64, 72

OSC

29, 81, 82, 83, 84, 85, 86, 87, 88, 91, 92, 93, 99, 60, 78

(60 and 78 international)

PSC

23, 25, 28, 51, 52, 54, 55, 66, 98 (66 and 98 international)

Any line marked with # is for official use only

4-11

Note: IDRS Campus and Doc Cd 77 File Location Codes:

High volume sources of Doc Cd 77 transactions are assigned alternate File Location codes.

Otherwise, most FRM77 inputs default to the campus or office code corresponding to the IDRS employee number.

Campus / Input Source FLC

ANSC 01, 02, 03, 04, 05, 06, 08, 14, 16

TDA/BAL DUE15 14

ATSC 07, 58, 59, 65

TDA/BAL DUE15 59

AUSC 18, 71, 73, 74, 75, 76, 20, 21

TDA/BAL DUE15 76

IAT (internal batch runs) 75

IAT (customer tools 74

GII 71

CIS 73

BSC 11, 13, 19, 22

TDA/BAL DUE15 22

CSC 17, 31, 34, 35, 38, 96, 97

TDA/BAL DUE15 34

IAT 35

GII 31

CIS 38

FSC 33, 68, 77. 89, 94, 95

TDA/BAL DUE15 68

IAT (internal batch runs) 95

IAT (customer tools) 94

GII 77

CIS 33

KCSC 09, 36, 37, 39, 41, 42, 43, 45, 46, 47, 48

TDA/BAL DUE15 48

IAT (internal batch runs) 45

IAT (customer tools)

GII 41

CIS 43

MSC 49, 56, 57, 61, 62, 63, 64, 72

TDA/BAL DUE15 63

CAF 64

OCS 29, 81, 82, 83,84, 85,86, 87, 88, 91, 92, 93, 99, 60, 78

TDA/BAL DUE15 92

IAT (internal batch runs) 85

IAT (customer tools) 86

GII 81

CIS 83

CAF 88, 93

RAF 87

FRM77, TC971/AC3xx 91

PSC 23, 25, 28, 51, 52, 54, 55, 66, 98

TDA/BAL DUE15 51

PDTC 52

CAF 55

5 Individual Master File (IMF) Electronically Filed R eturns General

A. Electronic Returns

(1) Electronic returns can be identified by the unique Document Locator Number (DLN) assigned to each Campus as

follows (the number in parentheses will be used when the maximum is reached for that processing day):

Any line marked with # is for official use only

4-12

Campus

DLN

Andover Campus Note: ANSC is no longer a processing site, but the

FLCs are still used for IMF electronic returns.

16(14)

Austin Campus

76(75)

Austin (U.S. Possessions)

21

Austin (International)

20

Fresno Campus

80

(90)

Kansas City Campus

70(79)

Philadelphia Campus - Note: PSC is no longer a processing site, but

the FLCs are still used for IMF electronic returns

30(32)

Tennessee Computing Center

72(64)

Example: DLN 16211-110-036XX-4 would indicate an electronic return was filed at the Andover Campus.

Document Code 21 will be used before going to the second FLC for the Form 1040. Blocking Series for

document Code 21 has been expanded to 000 through 999, document code 11 has been expanded to 000

through 919 and 930 through 999.

(2) When an electronic return is printed, it is the original return unless it is stamped photocopy.

(3) An electronic return can be displayed in two different formats using two different prints. The graphic print is in the

official 1040 format. The GEL print displays all the data contained on the electronic return, but are not in the

official Form 1040 format. Both types of original returns are charged out to the requester and will remain so until it

is renumbered or refiled. DO NOT DESTROY ORIGINAL ELECTRONIC RETURNS. NOTE: A photocopy of the

return is not charged out.

(4) IMF electronic return prints can be identified by the words “ELECTRONIC RETURN–DO NOT PROCESS” in the

bottom margin of a graphics print and in the top margin of a GEL print. If a correction was made to the return, the

word “shadow” will appear at the top right corner of the printed return.

B. Form 8453, U.S. Individual Income Tax Declaration for an IRS e-file Return

(1) Form 8453 is the signature document for an electronically filed Form 1040/A/EZ return. It also serves as a

transmittal for required attachments, (i.e. Form 3115, Form 8332, etc.). Form W-2, Form W-2G and Form 1099-R

are not required to be submitted with Form 8453. If the IRS does not receive a signed Form 8453, or taxpayer’s

electronic signature(s), the return is not considered filed and the taxpayer could face a failure to file penalty.

Taxpayers should not file Form 8453 if they signed their electronic return using a Personal Identification Number

(PIN) signature method. The Electronic Return Originator (ERO) sends the completed Form 8453 and required

attachments to the appropriate Campus.

(2) Form 8453/8453-OL and the electronic return will not have the same DLN.

(3) Forms 8453/8453-OL are processed using a Form 8453 DLN. The two-digit File Location Code (FLC) will be the

same as that for the Campus paper documents. The tax class will be “2” and the document code will be “59”.

(4) Forms 8453/8453-OL can be identified as follows:

Tax Class /

DOC Code

Blocking

Series

Processing Center

Form

259

000-949

ANSPC, AUSPC, CSPC, KCSPC, MSPC, OSPC, PSPC

1040

C. Form 8453-OL, U.S. Individual Income Tax Declaration for On-Line Filing

(1) Form 8453-OL is the signature document for an electronically filed Form 1040/A/EZ return filed through the Online

Filing Program, and also serves as a transmittal for required attachments, (i.e. Form 3115, Form 8332, etc.). Form

W-2, Form W-2G and Form 1099-R are not required to be submitted with Form 8453-OL. The Form 8453-OL

authorizes direct deposits of refunds, direct debits of payments and identifies what information the Service is

permitted to disclose to the on-line filing company (internet service provider or transmitter). If the IRS does not

receive a signed Form 8453-OL, or taxpayer’s electronic signature(s), the return is not considered filed and the

Any line marked with # is for official use only

4-13

taxpayer can face a failure to file penalty. Taxpayers should not file Form 8453-OL if they signed their electronic

return using a Personal Identification Number (PIN) signature method.

(2) The taxpayer will use tax preparation software bought off-the-shelf to create an electronic income tax return using

a personal computer with a modem. Online returns will be transmitted to IRS through the online filing company.

The online filing company will transmit al on-line returns from taxpayers to the appropriate Campus within 24

hours; retrieve the taxpayer acknowledgment and provide the acceptance and rejection notification to the

taxpayer. Online filing companies will translate IRS reject codes into language easy for taxpayers to understand

and provide assistance in the correction process as a service to their clients. The taxpayer is instructed to send

the completed Form 8453-OL and required attachments to the appropriate Campus.

D. Requesting Electronically Filed IMF Returns and Forms 8453/8453-OL

(1) Electronically filed returns can be requested by using IDRS Command Codes (CCs) ELFRQ or ESTAB.

(2) CC ELFRQ can be accessed only by the Campus that processed the electronic return and the Form 8453 or 8453

OL, or by Campuses that are linked with an IDRS line to the Campus that processed them.

-

(3) The Electronic Filing Unit is required to fill print requests in the same priority order that is outlined in Files IRM

3.5.61 and Electronic Filing IRM 3.42.5 as follows:

(a) Special expedite requests (Appeals, court cases, TAS, congressional, etc.)

(b) Statistics of Income (SOI)

(c) Examination cases that are “L” coded

(d) Error resolution (ERS) rejects

(e) Unpostables

(f) Criminal Investigation

(g) Output review

(h) Examination requests on Form 5546

(i) Internal notices (CP-36, CP-55)

(j) All other requests (oldest date first)

(4) Some requesters may not require the original electronic return but need a photocopy instead. If this is the case,

annotate the Remarks area of the request “photocopy requested”.

(5) When a request for both the electronic return and the Form 8453 is received in the Electronic Filing Unit, the

requester will not automatically receive Form 8453. The return will be sent from the EFU and Form 8453 will be

sent from Files after it’s been pulled.

(6) If Form 8453 is required, it can be requested by:

(a) Forms 8453 for TY2003 and subsequent years can be requested by using IDRS CC ESTAB; using the 8453

DLN available on CC TRDBV.

(b) Entering IDRS CC ELFRQ with Action Code 2, or

(c) Notating “Please pull 8453” in the remarks section of IDRS CC ESTAB.

E. Refilling Electronic Returns

(1) When the requester no longer needs the original electronic return (a hardcopy print is an original return unless

stamped “PHOTOCOPY”) it will be returned to the Electronic Filing Unit. NOTE: Photocopies of electronic

returns/GEL prints should not be returned to EFU. They can be destroyed.

(2) When the original return is sent back to the Electronic Filing Unit, they will:

(a) Refile the return on the LAN system.

(b) Separate the hardcopy return from the Form 8453 and/or other attachments.

(c) Route Form 8453 to the Files Unit.

(d) Dispose of the hardcopy Form 1040 as classified waste.

(3) If an adjustment is made to the original return and the requester has used the return as a source document, it will

have a renumbered DLN. A renumbered DLN can be identified by a Document Code 47 or 54 and one of the

following blocking series:

Any line marked with # is for official use only

4-14

000-049 290-309 540-589 630-698 800-809 920 950-999

180-198 500-519 600-619 700-799 900-909 930-939

(4) If information on the original return is needed in the future, request the controlling DLN found on IDRS.

(5) When an adjustment is made to an electronic return without the original document, and the IRM instructs the

adjustment document to be associated with the return, the tax examiner will use the appropriate refile blocking

series. A CP-55 will be generated and forwarded to the EFU.

6 1040 Online Filing Program

A. General

Filing from home using a personal computer is a method for taxpayers to prepare and send their Form 1040 tax return to

the IRS. Anyone who has a computer, modem and approved IRS tax preparation software available at local computer

retailers or through various online filing companies’ Internet websites may transmit their tax return to the IRS via an online

filing company (internet service provider or transmitter). There is no charge made by the IRS. However, online filing

companies (internet service providers or transmitters) offering this service to taxpayers may charge a fee for transmission.

In order to prevent potential fraud from the home filer in the 1040 Online Filing Program, Department of Treasury requires

that an online company must not allow any more than five returns be filed from one software package or e-mail address.

As stated in the Publication 1345, software developers are required to ensure that no more than five accepted returns are

sent to the IRS. See Revenue Procedure 98-51 and Publication 1345.

The online filing program uses commercial, state of the art user-friendly software and accepts all individual returns and

schedules that are available using IRS e-file. It provides taxpayers with an IRS acknowledgement, improved return

accuracy, direct deposit of refunds, early filing with tax payment deferred until April 15th, and ability to file state returns.

For Filing Season 2009, the Self-Select PIN will be the only IRS e-file signature method available to taxpayers filing online.

The Form 8453-OL U.S. Individual Income Tax Declaration for an IRS Online e-file Return and Form 8453-OL(SP) U.S.

Individual Income Tax Declaration for an IRS Online e-file Return (Spanish Version) will be eliminated as signature

documents for individual taxpayers that use tax preparation software. This policy change is designed to promote a

paperless and secure method of signing individual returns electronica

lly.

B. Form 8633 procedures for Online Filing (OLF) Applicants:

(Applicants must register for e-Services before initiating an IRS e-file Application. It is recommended that all new or

revised e-file Applications be completed using the IRS e-file Application. Until mandated Form 8633 , Application to

Participate in IRS e-file Program can be accepted. Form 8633 should be mailed to the IRS Andover Submission

Procession Center.

1. Applicants interested in participating in Online Filing must select Online Provider from the Provider Options drop-

down menu on the "Programs Applying For" page of the application or select the "Yes" check box located on line

2d of Form 8633, paper version.

2. should be marked as a

new e-file Application. If the applicant has previously participated in the OLF Program and made changes since

its last e-file Application, the form will be marked as a revised e-file Application.

If the applicant has not participated in the 1040 OLF Program previously, the Form 8633

3. to Andover Submission

Processing Campus (ANSPC). Required supporting documentation should be included with each application.

Applicants should submit the electronic application or complete and mail the Form 8633

4. ANSPC will follow normal Form 8633 review procedures (e.g., checking for signatures, completeness). Each

application will be entered on the Third-Party Data Store (TPDS) and will be assigned a unique OLF electronic

filer identification number (EFIN).

5. OLF companies (new and current) will receive a “unique” EFIN for OLF. A unique EFIN will be generated that

begins with the following location codes: “10” ANSPC, “21” AUSPC, “32” CSPC, “44” OSPC and “53” MSPC.

Any line marked with # is for official use only

4-15

7 Modernized e-File

A. Filing Individual Income Tax Returns through an Authorized e-file Provider

Businesses authorized by the IRS to participate in the IRS e-file Program are known as Authorized IRS e-file Providers.

Some taxpayers prefer the convenience of filing their individual income tax return through an Authorized e-file Provider

and gain e-file benefits such as improved return accuracy, quicker processing time and quicker refunds. These taxpayers

also have the options of electronically signing their tax return using one of the methods described below.

B. Electronic Signature Methods

There are two methods of signing individual income tax returns electronically through the use of a Personal Identification

Number (PIN). Taxpayers may self-select a PIN and use it to sign the return. Taxpayers may also authorize EROs to enter

their PIN in the electronic record. The two electronic signature methods available for taxpayers to sign their tax return is

the Self-Select PIN method and the Practitioner PIN method.

In general, most taxpayers who file Form 1040, 1040A, 1040EZ in the prior tax year may use a self-selected PIN to sign

their return.

Note: If the taxpayer agrees, it is acceptable for an ERO and/or software program to generate or assign the

taxpayer PIN for individual income tax returns and documents. The taxpayer consents to the ERO’s

choice by completing and signing an IRS e-file signature authorization containing the intended taxpayer

PIN. The taxpayer’s PIN can be systemically generated or manually assigned into the electronic format

and/or signature authorization form. However, the ERO must receive the signature authorization signed

by the taxpayer(s) before they transmit the return or release it for transmission to the IRS. This guidance

refers to the return filed using the Self-Select PIN or Practitioner PIN method.

C. Self-Select PIN Method

The Self-Select PIN method allows taxpayers to electronically sign their e-file returns by entering a five digit PIN. The five-

digit PIN can be any five numbers except all zeros. The Self-Select PIN Method requires taxpayers to provide their Prior

Year Adjusted Gross Income (AGI) amount or Prior Year PIN for use by the IRS to authenticate the taxpayers. For Filing

Season 2011, the Internal Revenue Service will implement a web-based application called, “Electronic Filing PIN Help”.

This application will provide taxpayers with a PIN to be used when they cannot locate their Prior Year AGI or Prior Year

PIN. The original Adjusted Gross Income is the amount from the originally accepted return, NOT the amount from an

amended return, a corrected amount from a math error notice, or a changed amount from IRS.

Taxpayers who authorize the ERO to enter their self-select PIN into the electronic record on their behalf must complete a

Form 8879, IRS e-file Signature Authorization or Form 8878, IRS e-file Signature authorization for Application for

Extension of Time to File.

D. Practitioner PIN Method

The Practitioner PIN method is an additional electronic signature option for taxpayers who use an Authorized IRS e-file

Provider (ERO) to e-file. This method also requires the taxpayer to sign their return using a five-digit PIN. The taxpayers

eligible to use the Self-Select PIN method are also eligible to use the Practitioner PIN method. However, this method does

not require the entry of the taxpayer’s Date of Birth and Prior Year Original Adjusted Gross Income, and there is no age

requirement. The ERO must complete Form 8879, including Part III, for each return that is prepared using the Practitioner

PIN method. The ERO must complete Form 8878, including Part III, for each Form 4868 extension request that is

prepared using the Practitioner PIN method.

An Authentication Record must be present when the Practitioner PIN, Self-Select by Practitioner or, Online Self-Select PIN

is used.

E. Refund Anticipation Loan (RAL) Code

The IRS removed the Debt Indicator for the 2011 Tax Filing Season. Beginning with the 2011 tax filing season we will no

longer provide tax preparers and associated financial institutions with the “debt indicator,” which is used to facilitate refund

anticipation loans (RALs). Taxpayers will continue to have access to information about their tax refunds and any offsets

through the “Where’s My Refund?” service on IRS.gov.

Any line marked with # is for official use only

4-16

8 EFTPS

Reference IRM 2.3 Chapter 70 - Command Code EFTPS

The Electronic Federal Tax Payment System (EFTPS) is a system designed to

utilize Electronic Funds Transfer (EFT) to pay all federal taxes.

Use Command Code EFTPS to research payments on the EFTPS database.

Reference IRM 2.3 Chapter 70. Depending on the information available,

Command Code EFTPS may be used with any of three definers:

E - Research a specific EFT number

R - Research a specific Reference Number (not valid for bulk filers)

T - Research a specific TIN, payment date and amount

EFTPS DLN

Master File Processing of an EFTPS transaction is the same as other payment processes. The DLN is a number

assigned by the EFTPS and configured as follows:

81 2 19 161 600 25 2

FLC Tax Class Doc Code Julian Date Block

Number

Serial

Number

List Year

1. The first two digits are the File Location Code (FLC). FLC 71 was used in 1996. From January 1, 1997

to June 30, 2005, FLC 72 was used for electronic payments processed and worked in ECC-Memphis. On

and after July 1, 2005 the FLC was and still is 81 for electronic payments processed in ECC-Memphis but

worked in Ogden. As of September 2012, 81 is the primary FLC with 82 and 83 as overflow FLC’s. Please

refer to the chart after #4, below.

2. The third digit is the Tax Class. This identifies the type of tax each transaction involves.

1 Withholding and Social Security 4 Excise Tax 7 CT-1

2 Individual Income Tax 5 Estate and Gift Tax 8 FUTA

3 Corporate Income Tax 6 NMF

3. The 4th and 5th digits represents the Document Code - All EFTPS payments will be processed as a

Revenue Receipt (Doc Code 19).

4. The 6

th

, 7

th

, and 8

th

digits are the Julian Date – Settlement Date. In EFTPS, this is the day money moves to

Treasury’s account.

5. The 9th through 11th digits are the Block Numbers, non-unique.

6. The 12th and 13th digits represent the Serial Number — assigned sequentially, then repeated.

7. The 14th digit is the last digit of the year the DLN is assigned.

8. Electronic Funds Transfer (EFT) Number

Each payment transaction is assigned a 15-digit Electronic Funds Transfer (EFT) number by the Treasury

Financial Agent (TFA). The EFT number is used as the unique identifier and to research payments on Master

File and IDRS. DO NOT use the EFTPS DLN to perform research on EFTPS transactions as these are not

unique numbers and can be duplicated.

The EFT number is configured as follows:

2 Leading

Digits

15 Digit EFT Number

29 2 2 3 3 137 01 123456

Any line marked with # is for official use only

4-17

FLC only

appears on

IDRS & MF

Financial

Agent

Number

Payment

Method

Input

Method or

CPI

Year

Digit

Julian

Date

Source Code Serial Number

The TEP assigns two additional leading digits to denote the Filing Location Code (FLC) for the processing Campus (29,

81, 82 and 83 for Ogden; 49 for Memphis) to make an EFT number appear as 17 positions on Master File (MF) and IDRS.

However, these digits are not used for payment research with command code EFTPS.

The first digit is the Financial Agent Number (1 = Bank One*, 2 = Bank of America, 3 = Treasury Offset Program, 4 =

SSA Levy, 5 = RS-PCC, 6 = Reserved).

The second digit identifies the Payment Method as follows: (0 = IRS E-file (Direct Debit), 1 = ACH Credit, 2 = ACH Debit,

3 = Federal Tax Collection Service (Same-Day Wire), 4 = (Reserved), 5 = Levy, 6 = Credit Card, 7 = Online, 8 = Railroad

Retirement Board (RRB) Link*, 9 = Government Payment (EFTPS for Federal Agencies (formerly FEDTAXII) Federal

Payment Levy Program, or SSA Levy).

The third digit is the Input Method or Combined Payment Indicator (CPI) (0 - 9). The various values and meanings are

dependent on the value of the Payment Method. See table in IRM 3.17.277.5.3.

The fourth represent the last digit of the year (3 = 2013).

The fifth, sixth and seventh digits represent the Julian Date 001-366. The Julian Date of 137 represents May 16, 2013. If

an overflow condition exists, 401-766 may be used. This is the date the EFT number was assigned.

The eighth and ninth digits represent the Source Code. This is the Bulk Provider Number, RS-PCC Originating Location,

or a semi-random number depending on the Payment Method. See IRM 3.17.277.5.3.

The eighth or tenth through fifteenth digits represent the Serial Number which is a sequentially assigned unique number.

* Historical purposes only, Bank One is no longer a Financial Agent as of 2004; Railroad Retirement Board (RRB) Link

was decommissioned in 2008.

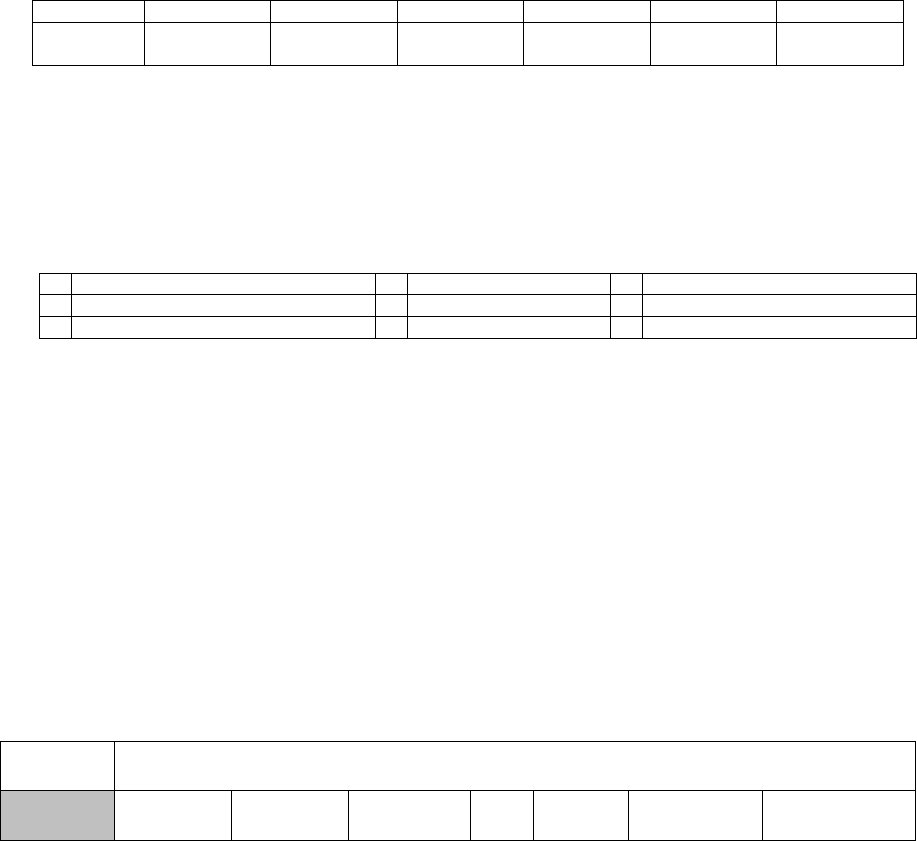

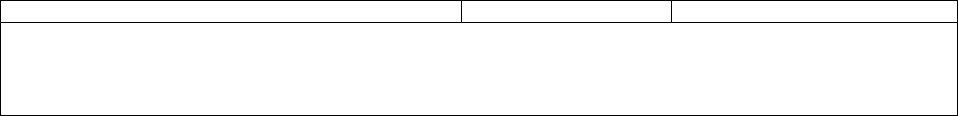

9 Master File and Non-Master File Tax Account Codes

Master File Tax Account Codes (MFT Codes) are required in each transaction to identify the specific module to which a

transaction is to be posted. They are listed below with their corresponding tax class and document code.

MFT Form Tax

Class

Doc.

Codes

MFT Form Tax

Class

Doc. Codes

00 Entity Section 2, 9 Various

BMF BMF

01 941PR, 941SS

FICA

1 41 46 8038, 8038-

CP,8038-G, 8038-

GC, 8038-T and

8328

3 61, 62, 72, 74,

75,88

01 941 1 41 47 8871 4

02 1120 3 Various 48 3809 All

03 720 4 20 49 8872 4

04 942 1 42 50 4720 4

05 1041 2 44,36 51 709 5

05 1041QFT/1041-

N

2 39 51 709A 5

05 1041ES 2 17,19 52 706 5

05 1041-K1 5 66 57 5227 4

06 1065 2 65 58 3809 All

06 1065-K1 5 65 60 2290/2290-EZ 4

07 1066 3 60 60 2290A 4

08 8804 1 29 63 11C 4

Any line marked with # is for official use only

4-18

MFT Form Tax

Class

Doc.

Codes

MFT Form Tax

Class

Doc. Codes

08 Note: MFT 08 will be valid as a Master File

record for Form 8804, Annual Return for

Partnership Withholding Tax (Section 1446)

with Activity Code 488.

64

09 CT-1 7 11 67 990 4

10 940,940PR 8 40 67 990EZ 4

10 940-EZ 8 38,39(ma

g tape)

74 5500 4

11 943,943PR 1 43 74 5500EZ 4

12 1042 1 25,66 76 5330 4

13 8278 3 54 77 706GS(T) 5

14 1099 9 78 706GS(D) 5

14 944/944PR/94

4-SS

1 49 84 8703 3

15 8752 2 23 85 80c8-b 3

16 945 1 97,37,44 86 88 W-

3/W-

3G

17 8288 1 40

33 990C 3 92

34 990T 3 93

36 1041A 4 81

37 5227 4 83

42 3520-A 3 82

44 990PF 4 91

EPMF EPMF

74 5300,5301,530

3, 5307,5309,

5310, 5310A

0 53, 03,

07, 09,

10, 11

74 5500, 5500C, 5500-

EZ, 5558 and 5500-

SF

0 37, 38 31, 55, 32

75 4461, 4461A,

8955-SSA

06 61, 62 75

79 8963 2

IMF IMF

29 5329 0 Various

30,31 1040, 1040A,

1040NR,

1040SS,

1040PR,

1040ES,

1040EZ,1040T

2 Various 55 8278 2 54

8453 2 59 56 1099 2

NMF NMF

03 6009 6 68 12 1042 3 48

07 1066 6 60 14 8613 6 22

16 Note: MFT 08 will be valid as a Master File record

for Form 8804, Annual Return for Partnership

Withholding Tax (Section 1446) with Activity Code

488. (This MFT is currently valid for NMF).

08 8813,8804,880

5

6 29 17 941, 8288 6 41

NMF NMF

17 2749 6 41 52 706NA 6 05

18 942 6 42 53 706A 6 53

19 943 6 43 53 706NA 6 53

20 1040, 5734 6 10, 55,

56

53 706 6 06

Any line marked with # is for official use only

4-19

MFT Form Tax

Class

Doc.

Codes

MFT Form Tax

Class

Doc. Codes

21 1041 6 44, 46 54 709 6 09

22 1041PR 6 33 56 990BL 6 88

23 1120-DISC 6 69 57 6069 6 89

24 957 6 59 5734 6 55

25 958 6 66 4720 6 77

26 959 6 67 990 6 90

28 CVPN 6 69 8697 6 23

29 5329 6 70 5811 6 47

31 1120S 6 16, 17 71 CT-1 6 01

32 1120 6 20 72 CT-2 6 02

33 990C 6 92 74 5500C 6 37,38

34 990T 6 93 5500 & 5500EZ

35 1065 6 65, 66,

67

76 5330 6 35

36 1041 6 77 706GS(T) 6 29

36 1041A 6 81 78 706GS(D) 6 59

37 5227 6 83 80 940 6 40

38 2438 6 86 81 926

6 32

44 990PF 6 91 89 8612 6 21

45 720 6 30 93 2290 6 95

46 5734 6 55 94 11 6 11

50 4720 6 71 96 11C 6 03

52 706QDT,706A 6 85 97 730 6 13

52 706B 6 85

10 Reduce Unnecessary Filers (RUF) Program DLN

The Reduce Unnecessary Filers (RUF) program has been assigned two unique DLNs and two Master File filing

requirements (MFR):

▪ Pension withholding RUF only filers assigned DLN is 28263999000YYZ and MFR 17 - where “999” equal to

Pension RUF, “YY” is the tax return year and “Z” is the year digit of the processing year

▪ Regular RUF filers assigned DLN is 28263998000967 and MFR 16 where “998” equal to Regular RUF, “YY” is the

tax return year and “Z” is the year digit of the processing year.

11 Master File Endorsement Data

Forms 1040 received in the Campuses with remittances that fully pay the tax liability are not processed until the refund

returns are processed. If it is necessary to request a fully paid Form 1040 prior to completion of processing, check

endorsement data found on the back of the check should be entered on Form 2275. The endorsement data, such as the

deposit date, tax class code, document code, sequence number, and machine number, along with the amount of the

check should be entered in block 9 of Form 2275 (Rev. 4-72), or on Form 4251(Return Chargeout-IDRS). Sometimes the

endorsement is quite difficult to read from the back of the check. However, it is the only way full paid returns can be

secured prior to the processing completion date.

This endorsement data is also used to locate missing payments for payment tracing cases.

Note: Deposit Sequence Number is encoded on the front of the check.

12 IDRS Sequence Number

Any line marked with # is for official use only

4-20

As payments are posted directly and correctly to the IDRS system with command code PAYMT, a 13-digit remittance

sequence number is generated. The sequence number is stamped on the front of the remittance relating to the posted

payment and posting vouchers.

The sequence number is established as follows:

▪ Julian date—3 digits—from input date

▪ District Office—2 digits—generated from IDRS terminal

▪ Area Office—2 digits—generated from terminal

▪ Terminal Number—2 digits—generated from terminal

▪ Operator Number—1 digit—last digit of employee’s number generated from entry code

▪ Sequence number—3 digits—existing sequence number

Note: The transaction DLN can be determined from this sequence number.

13 Residual Remittance Processing System (RRPS)

A Residual Remittance Processing System (RRPS) is in place at all Campuses. The RRPS system is Y2K compliant,

using Micron OE/KV terminals equipped with NT Windows software. The system processes paper vouchers and electronic

vouchers and the remittances accompanying the vouchers. The vouchers and remittances are processed on a NDP 500

transport system from Unisys. The system processes IMF, BMF, NMF, multiples, splits, and user fees transactions.

The NDP500 transport system requires two passes to complete processing each batch of work. The paper vouchers and

remittances will be processed on the transport i Pass 1, an RPSID Number will be printed on the back upper left corner on

the voucher and the remittance. The RPSID Number contains the batch number, sequence number and the date

processed. All correction data is sent to an image correction operator who makes the necessary changes for the

transaction to be perfected and ready for balancing the batch. The remittances only, (checks, money orders, etc.) are then

processed through Pass 2 on the NDP transport system. In Pass 2 the remittance amount is encoded at the bottom right

front of the remittance, the IRS audit trail is printed on the back of the remittance to the right of the RPSID Number. The

audit trail consists of up to 56 numeric/alpha and special characters. The audit trail contains the following fields:

4

digits

Alpha - Name Control or Check Digits

14

digits

Numeric - DLN

3

digits

Numeric - Transaction Code

2

digits

Numeric - MFT Code

9

digits

Numeric - TIN

6

digits

Numeric - Tax Period

1

digits

Alpha - Split/Multiple Remittance Indicator (S/M)

8

digits

Numeric - Transaction Date (TD)

9

digits

Numeric/Special Characters Accounting supplied

information

The system also stamps the U.S. Treasury endorsement on the back side of the remittance. The endorsement stamp

contains the following information:

Name of Financial Institution; City and State Location of Bank; IRS Campus Account Identification Number; DIR, IRS

Center; City and State Location of Campus; For Credit to the U.S. Treasury; Financial Institution American Banking

Association Number (ABA)

The RRPS is an imaging system which archives the front of the vouchers and the front and back of the remittances (i.e.;

checks, money orders, etc.). Using an image display terminal(s) you can access the archive system to view or print a copy

of an electronic or paper voucher, or a remittance. The image of the voucher and remittance can be accessed by using the

Any line marked with # is for official use only

4-21

taxpayer’s Name, SSN, DLN or RPSID Number, to bring the image up on the display terminal(s).

302014134-2002105-109190-0001-EC Index Form

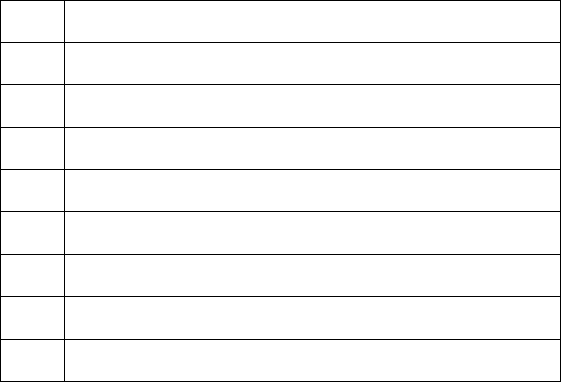

14 Adjustment Blocking Series

Campus processing of taxpayer accounts for adjustment purposes must use the following blocking series to indicate the

nature of the adjustment. The return must be associated with the subsequently generated IDRS transaction record unless

the blocking series is specified as non-refile DLN. A complete list of blocking series, including other than adjustments, can

be found in IRM 3.10.73, Batching and Numbering.

Any line marked with # is for official use only

4-22

IMF

Description

000-049

Adjustments with original return unless specified otherwise below.

050-070

Tax, Penalty, interest, or freeze release without original IMF returns. Non-refile DLN.

100-129

Reserved.

150-179

Tax, Penalty, interest, or freeze release without original BMF returns. Non-refile DLN.

180-198

Tax, penalty, interest, or freeze release without original return. CP 55 generated. Not valid for MFTs 29 and

55.

199

Expired balance write-offs (TC 534/535) Non-refile DLN.

300-309

Barred assessment. CP 55 generated. Valid for MFT 30 and 29.

310

Reserved

320-349

SFR assessments (statutory notice) 90-day letter issued.

400-439

Excise Tax Fuel Claims with Form 843. Pre-assessment Refund only.

440-449

Disallowed claims with no filing requirements. Not valid for MFTs 29 and 55.

480-489

Form 6249 claim with Form 843. Non-refile DLN. Pre-assessment refund only.

490-499

Gasohol claim with Form 843. Non-refile DLN. Pre-assessment refund only.

500-519

URP (Timely, full paid) Adjustments (CP-2000)

520-539

Adjustments to Civil Penalty Modules. CP 55 generated for TC 290 blocked 530-539 (except if the prior

DLN is 59X)

540-549

SFR Assessments (1st Notice)

550-589

URP (Other than timely, full paid) adjustments (CP-2000)

590-599

W-4 Civil Penalty Adjustments

600-619

URP (Timely, full paid) adjustments (Statutory Notices)

630-639

Reserved

640 - 49

BMF-URP Refile DLN (Tax Class 2 accounts)

650-679

URP (Other than timely) adjustments (Statutory Notice)

680-698

Sick Pay Claims-Public Law 95-30.

700-739

Substantiated Math Error Protest with a TC 576 on the module.

740-769

Unsubstantiated Math Error Protest. Refile DLN - CP 55 is NOT generated.

770-779

Adjustment to set math error deferred action on a module.

780-789

Adjustment without original return to set math error deferred action on module (CP 55 generated)

790-799

Technical Unit Adjustments

800-809

Offer in Compromise

900-909

Carryback Adjustments without original return (CP 55 generated).

910-919

Carryback adjustments below tolerance without original return–no CP 55 generated.

920-929

Injured Spouse Claims.

930-939

Reserved

950-959

Carryback claim reassessments processed with TC 298 for statute imminent years.

960-969

Penalty appeals indicator set. CP 55 generated. Refile DLN. Does not generate CP55 on a civil penalty

module if prior control DLN is 59X.

970-979

Penalty appeals indicator released. Refile DLN.

980-989

Complete claim disallowance without original return (generates CP 55). Does not generate CP55 on a civil

penalty module if prior control DLN is 59X.

990-999

Complete claim disallowance with original return (does not generate CP 55).

IRA

Description

000-099

All Adjustments except those specified below. Non-refile DL N.

500-599

Adjustments created by the Revenue Act of 1978 and Public Law 95-458. Non-refile DLN.

700-769

Mathematical/clerical errors.

800-899

Offers in Compromise

960-969

Penalty Appeals Indicator Set. Refile DLN.

970-979

Penalty Appeals Indicator Released. Refile DLN.

BMF

Description

000-049

Adjustments with original return attached, except those with math/clerical error adjustments, SC Technical

adjustments, Offers in Compromise. Not valid for Forms 11C, 706, 709 and 730.

050-059

Same as above, except for Forms 2290 and 4638* only.

060-069

Same as above, except for Forms 706 and 709 only.

070-079

Forms 11 and 11B

080-089

Same as above, except for Form 11C only.

090-099

Same as above, except for Form 730 only.

100-129

Adjustments to non-tax returns without the original return - Non-tax EO returns.

Any line marked with # is for official use only

4-23

BMF

Description

130-139

FTD penalty adjustment with CP 194 or CP 207. Refile DLN.

140-149

FTD penalty CP 207 or CP 194 per processing. Non-refile DLN.

150-179

Tax, Penalty, interest, or freeze release without original return. Non-refile DLN. When using this blocking

series, no unpostable checks are made for prior examination or math/clerical error because the original

return has not been secured. Exercise caution when adjusting accounts using this blocking series.

180-198

Tax, penalty, interest, or freeze release without original return. CP 155 generated. Not valid for MFTs 06, 13,

36 and 67.

199

Expired balance write-offs (TC 534/535) Non-refile DLN.

200-289

Adjustments resulting from 941-X, 943-X, 944-X, 945-X, CT-1X being filed.

290-299

Adjustments resulting from 941-X, 943-X, 944-X, 945-X, CT-1X being filed.

300-309

Barred assessment. CP 155 generated.

390-398

U.S./U.K. Tax Treaty claims

399

Ottiger Bill, P.L. 94-563

400-439

Excise Tax Fuel claims

400-439

Forms 940/942 to report FICA and FUTA taxes filed with Schedule H received with Form 1041.

440-449

Disallowed claims with no filing requirements

450-479

Reserved

480-489

WPT, from 6249 Claim with Form 843. Pre-assessment refund only.

490-499

Gasohol claim with Form 843. Non-refile DLN. Pre-assessment refund only.

500-509

Non-zero Certification, FUTA. Non-refile DLN.

510-519

Zero FUTA Certification, FUTA. Non-refile DLN.

520-529

Civil Penalty – No CP 155 generated – refile DLN.

530-539

Civil Penalty – CP 155 generated – refile DLN.

540-549

IRP/SFR assessments

550-559

CAWR related adjustments. Non-refile DLN.

550-569

BMF-URP Refile DLN (Tax Class 3 accounts).

570-579

BMF-URP Non-refile DLN (Tax Class 3 accounts).

580-589

BMF-URP Adj Stat Notice Refile DLN (Tax Class 3 accounts).

590-599

BMF-URP Adj Stat Notice Non-refile DLN (Tax Class 3 accounts).

600-619

Overstated Deposit Claimed. Non-refile DLN after cycle 198335.

620-629

Category B, Examination Criteria. Refile DLN.

630-639

Category B, Examination Criteria. Non-refile DLN.

640-649

BMF-URP Refile DLN (Tax Class 2 accounts).

650-659

Category B – Examination criteria.

660-669

Category B – Examination criteria.

670-679

Category B – Examination criteria.

680-689

Category B – Examination criteria.

690-699

Category B – Examination criteria.

700-739

Substantiated math error with TC 420 in the module. Refile DLN.

740-769

Unsubstantiated math error protest. Refile DLN.

770-779

Adjustment to set math error deferred action on module. Refile DLN.

780-789

Adjustment without original return to set math error deferred action on module (CP 155 generated).

790-799

Technical Unit adjustments

800-809

Offers in Compromise except for Forms 11*, 11C, 706, 709, 730, 2290 and 4638*.

850-859

Offers in Compromise Forms 2290 and 4638* only.

860-869

Offers in Compromise Forms 706 and 709 only.

870-879

Offers in Compromise Forms 11* and 11B* only.

880-889

Offers in Compromise Form 11C only.

890-899

BMF URP Non-refile DLN (Tax Class 3 accounts).

900-909

Tentative Carryback Adjustments without original return. (CP 155 generated).

910-919

Carryback adjustments below tolerance without original return – No CP 155 generated. Non-refile DLN.

920-929

Tentative Carryback Adjustment with original return. (No CP 155 generated.) Also use whenever a TCB

adjustment requires a manual adjustment from the Retention Register.

930-939

ETAP Adjustment non-refile DLN.

940-949

Reserved.

950-959

Carryback reassessments for statute imminent years. CC Claim Reassessments processed with TC 298 for

expired statute years.

960-969

Penalty Appeals Indicator Set. Refile DLN. (CP 155 generated)

970-979

Penalty Appeals Indicator Released. Refile DLN.

980-989

Complete claim disallowance without original return (generates CP 155).

Any line marked with # is for official use only

4-24

BMF Description

990-999 Complete claim disallowance with original return. No CP 155 generated.

* Historical use only – Forms 11, 11B and 4638 are obsolete.

15 How to Identify the DLN of the Return

The ideal source for determining the DLN of the return is an up-to-date transcript of the account. However, you can usually

rely on the DLN printed on a computer-generated notice if it is no more than two or three weeks old.

When analyzing a transcript use the transaction codes, the” X” indicator denoting refile DLNs, and the document code and

blocking series to decide where the original return is filed. Transaction Codes 150, 29X, 30X and 421 with 6XX blocking

series, are the only codes involving returns. An “X” shown on the transcript to the far right of the DLN indicates that DLN is

the refile DLN (or Control DLN) and the original return will ordinarily be found attached to that document. If an account has

several DLNs with an “X” indicator, the last one on the transcript will be the refile DLN. If the DLN on a retention register

has a “D” indicator then the return has been destroyed.

There are some instances where you also need to look at the document code and blocking series of the DLN to determine

whether or not the original return is attached. Document Code 47 identifies an Examination adjustment and is used for TC

30X. Document Code 54 identifies a data processing adjustment and is used for TC 29X; and Document Code 51

identifies transactions transferred into the Master File (for example, prompt or quick assessments).

The following chart can serve as a guideline to help determine which refile DLNs will have original returns attached. Note:

If the return cannot be located under a current refile DLN, research a Master File transcript or IDRS for a possible prior

refile DLN. Request the return again using the prior refile DLN.

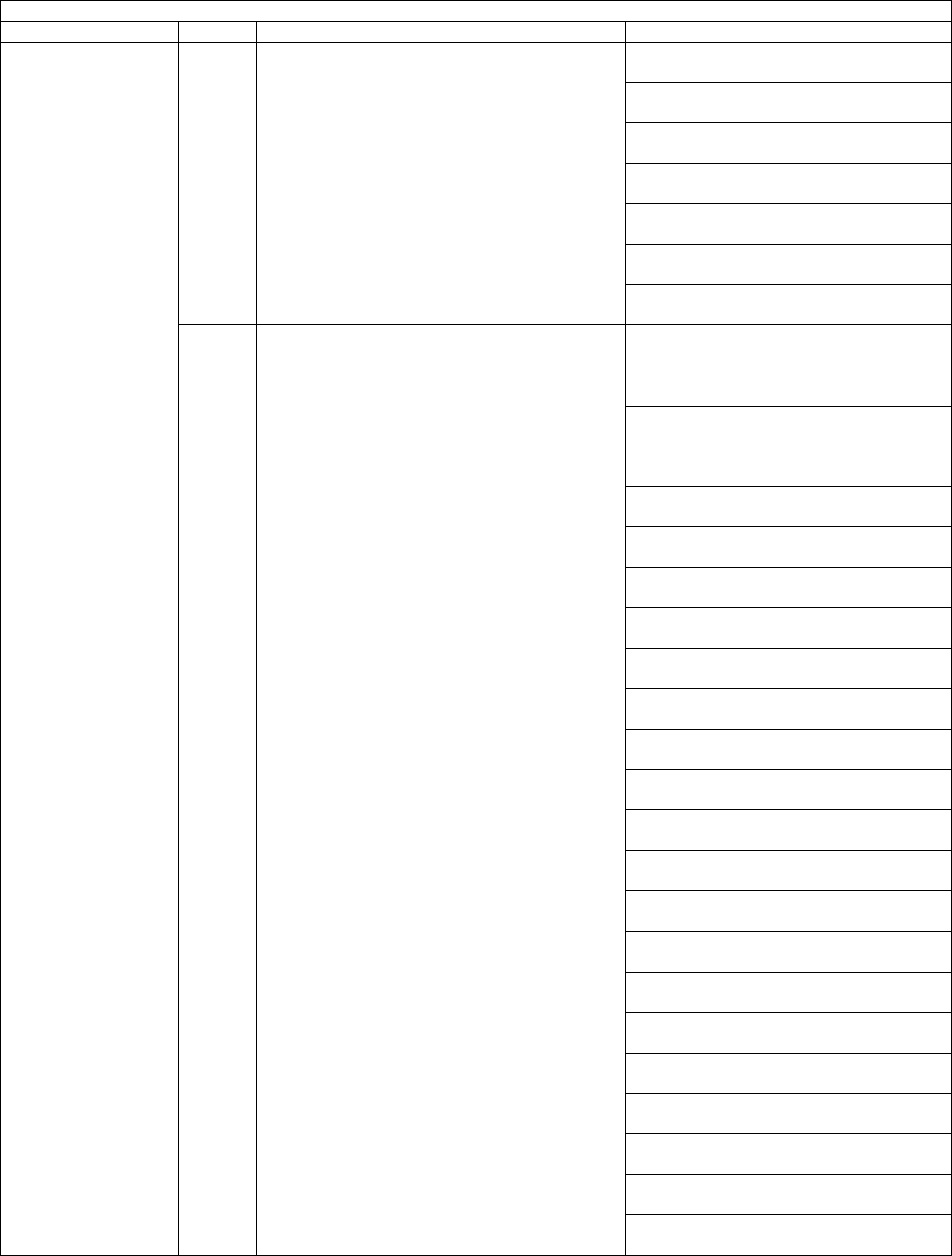

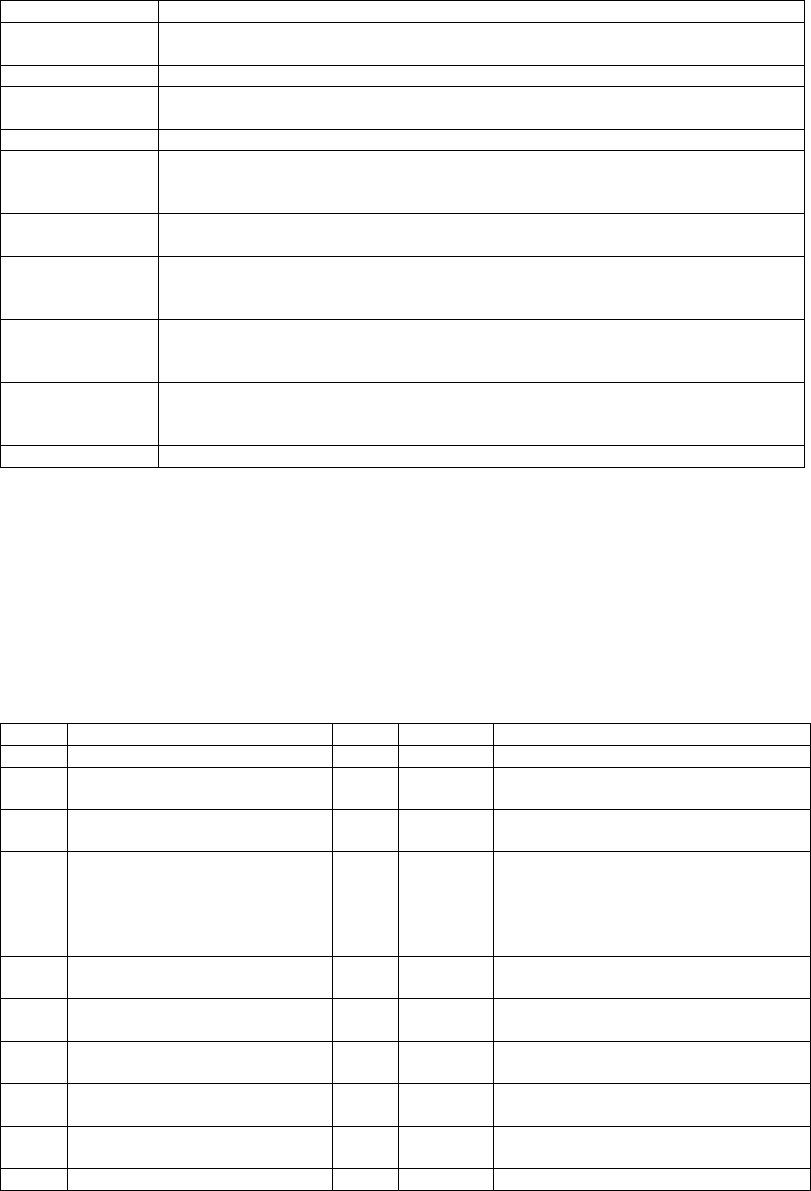

Doc.

Code

Blockin

g

Series

Original Returns Associated Doc.

Code

Blocking

Series

Original Returns Associated

47 000-079 Original/SFR – Non TEFRA 54 300-309 With Original

47 080-099 Original TEFRA 54 310-389 Reserved

47 100-199 No Return 54 390-399 Without Original—BMF

47 200-299 No

Return/BRTVU/RTVUE/ERTVU

print

54 400-499 Without Original

47 300-379 Electronic Prints 54 500-519 With Original—IMF

47 400-479 Paperless Examined — EGC

5XXX only & TREES Closures

Without Original—BMF

47 600-699 Original/ELF/SFR 54 520-539 With Original—IMF

47 760-769 Copy/BRTVU/RTVUE Print With Original—BMF

47 780-789 No Return 54 540-589 With Original—IMF

47 790-799 Copy/BRTVU/RTVUE Print Without Original—BMF

47 900-999 EP/EO/GE Copy of Return 54 590-599 With Original

51 000-099 Without Original 54 600-619 Without Original—BMF

51 100-159 With Original With Original—IMF

51 160-199 With Original (941M or 720M) 54 620-629 With Original—BMF

51 850-899 With Original 54 630-639 Without Original—BMF

52 ALL Without Original 54 640-649 With Original—IMF

54 00/NSD Without Original* 54 650-699 With Original

54 000-049 With Original 54 700-779 With Original

54 050-079 Without Original 54 780-799 Without Original

54 100-129 Without Original—BMF 54 800-909 With Original

54 130-139 With Original—BMF 54

910-919 Without Original

54 140-149 Without Original—BMF 54 920-929 With Original

54 150-179 Without Original 54 930-939 Without Original—BMF

54 180-198 With Original 54 940-949 Reserved

54 199 Without Original 54 950-979 With Original

54 200-289 Without Original 54 980-989 Without Original

54 290-299 Without Original—BMF 73 900-999 With Original

With Original—BMF

Any line marked with # is for official use only

4-25

* IMF Adjustments (Document 54) made to tax returns that have been scanned into the Correspondence

Imaging System (CIS) using Blocking Series 00/NSD (Non-Source Document) will NOT have the

original return attached. A CIS returns can be identified by the CIS return indicator ("CIS 1") which is

shown below the TC 290 on the taxpayer's account.

16 Forms 2275, 4251 and 5546

Form 2275 is a two-part manually prepared document used for requesting returns. This document should only be used in

emergency situations.

Form 4251 is a two-part computer-printed charge-out document which results from the input of a document request into

the Integrated Data Retrieval System (IDRS).

Forms 5546, Examination Return Charge-out serves the same purpose as Form 4251.

17 Priorities

When a request is prepared, the requester must indicate if a photocopy is needed, otherwise the original return will be

furnished.

The following is a priority list to be used by the files area for pulling returns. Deviation from the list can be made, at the

discretion of files management.

(1) Special EXPEDITE Requests (examples: court cases, TAS, Criminal Investigation).

(2) Daily requests for returns and documents not yet processed to good tape (examples: Error Correction Rejects)

(3) Daily requests for the Questionable Refund Detection Team

(4) Weekly (cyclic) requests

▪ Statistics of Income

▪ Refund and Notice Review

▪ Unpostables

▪ AIMS

▪ Internal Notices

(5) Other requests.

18 Requesting Returns through the IDRS

A. DLN KNOWN

Refer to IRM Handbook 2.3.17 for proper input format and request codes.

Any line marked with # is for official use only

4-26

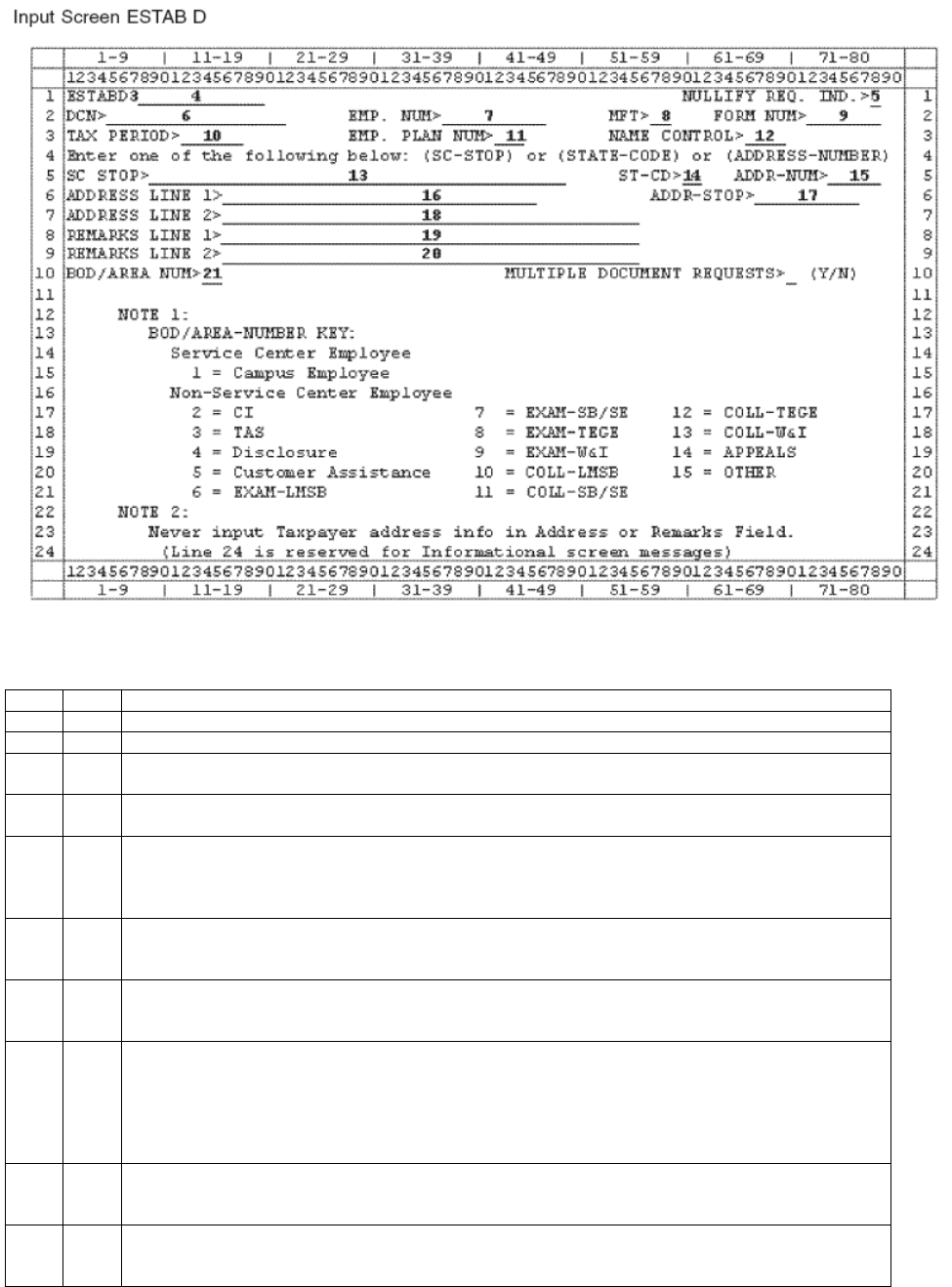

B. Record Element Description

Item

Line

Description

1

1

CC- ESTAB

2

1

CC MODIFIER- Must be entered and must be D for document request.

3

1

DOCUMENT REQUEST CODE- Must be entered and must be B, C, E, F, G, I, K, M, O, P, R, S,

T, U, V, W or X.

4

1

TIN INFORMATION FIELD- Must be “]” or a TIN. If TIN is entered, it must meet standard

validity criteria.

When a right-hand bracket “]” is entered in the first position of this field, it indicates that the TIN

was entered in the immediately preceding CC ACTON, ENMOD, REINF, SUMRY or TXMOD,

and that TIN will be displayed back to the screen. If the request requires research, that TIN will

be used. It will also be printed on the Form 4251.

Note: See IRM 2.3.17.7, Command Code ESTAB—Error Messages, for validity checks of the

TIN INFORMATION FIELD. Also see IRM 2.3.17.8, Command Code ESTAB—Consistency

Messages.

5

1

NULLIFY REQUEST INDICATOR- Indicates that a previous CC ESTAB request input the same

day is to be cancelled. Indicator must be blank or N. Also see IRM 2.3.17, 8, Command Code

ESTAB—Consistency Messages.

6

2

DOCUMENT REQUEST NUMBER FIELD- Must be entered. Must be in the format “nnnnn-nnn-

nnnnn-n” for standard 14-digit edited DLN. If the DLN is unknown enter first three digits of DLN.

(The first two positions are the D.O. or S.C. Code, the third position is the Tax Class). If the