Information subject to change

without notice.

(808) 768-3205

Email: bfstreasmailbox@honolulu.gov

REAL PROPERTY

TAX CREDIT FOR

HOMEOWNERS

Tax Year July 1, 2023 – June 30, 2024

Refer to the Revised Ordinance of

the City and County of Honolulu,

ROH 1990 Section 8-13.

ity and County of Honolulu ROH

1990 Section 8-13

EMAIL OR SEND COMPLETED TAX RELIEF

APPLICATION TO THE TAX RELIEF SECTION BY

SEPTEMBER 30, 2022 TO:

EMAIL:

MAIL:

City and County of Honolulu

Department of Budget and Fiscal Services

Division of Treasury, Tax Relief Section

Standard Financial Building

715 South King St. Room 505

Honolulu, HI 96813

Privacy Notification

The principal purpose for requesting information is to administer the Real Property Tax

Credit for Homeowners, an ordinance of the City and County of Honolulu. The applicant’s

social security number must be included to provide proper identification to permit

processing of the application and to efficiently administer the tax credit program.

Furnishing all of the appropriate information requested on the forms and accompanying

instructions is required to enable the Director of Budget and Fiscal Services to determine

eligibility. Failure to furnish the specified information requested on the forms may result

in the denial of the application, delay in the approval of the property tax credit, or other

disadvantage to the applicant. Information furnished on the claim for tax credit may be

transferred to other governmental agencies as authorized by law. Individuals have the

right to review their own records maintained by the Dept. of Budget and Fiscal Services.

The official responsible for maintaining the information is the Director of the Dept. of

Budget and Fiscal Services, City and County of Honolulu, 530 South King St. Honolulu, HI

96813.

Paid for by the taxpayers of the City and County of Honolulu.

IF YOU NEED MORE INFORMATION, PLEASE CALL

THE TAX RELIEF SECTION AT (808) 768-3205.

OR VISIT OUR WEBSITE AT:

https://www.honolulu.gov/treasury

DEPARTMENT OF BUDGET AND FISCAL SERVICES

DIVISION OF TREASURY

ACCOUNTS RECEIVABLE BRANCH

TAX RELIEF SECTION

Important Information

Definition of Income for the Tax Credit Program:

Section 8.13.1 of the Revised Ordinance of Honolulu 1990 “Income” means the sum of

federal total income as defined in the Internal Revenue Code of the United States of

1954, as amended, and all nontaxable income, including but not limited to (1) tax-

exempt interest received from the federal government or any of its instrumentalities,

(2) the gross amount of any IRA distribution, pension or annuity benefits received

(including Railroad Retirement Act benefits and veterans disability pensions), excluding

rollovers, (3) all payments received under the federal Social Security and state

unemployment insurance laws, (4) nontaxable contributions to public or private

pension, annuity and/or deferred compensation plans, and (5) federal cost of living

allowances. All income set forth in the tax return filed by the titleholder, whether the

tax return is a joint tax return or an individual tax return, shall be considered the

titleholder’s income. “Income” does not include nonmonetary gifts from private sources,

or surplus foods or other relief in kind provided by public or private agencies.

Information provided in the application and supporting documents must be complete

and accurate. Erroneous or incomplete information may result in disqualification and

prevent the applicant from receiving the real property tax credit.

Applications filed by September 30, 2022 will be used to apply real property tax credits

to real property taxes due July 1, 2023 to June 30, 2024.

You must notify the Dept. of Budget and Fiscal Services, Div. of Treasury, Tax Relief

Section immediately if the Eligibility Requirements listed under “Who Should File an

Application”, are no longer met or if the title to the property has been transferred.

Failure to provide proper notification may result in the revocation of the real property

tax credit and other penalties.

Applicants will be notified in writing by December 31, 2022 if their application is denied

and will have the right to appeal.

Penalties (ROH) Section 8-13.5. (a) Any person who (1) files a fraudulent application or

attests to any false statement with the intent to defraud the city or evade the payment

of real property taxes or any part thereof: Or (2) in any manner intentionally deceives

or attempts to deceive the city, shall be guilty of a violation and be subject to a criminal

fine of not more than $2,000, in addition to being responsible for paying any

outstanding taxes, interest and penalties. (b) During the tax year for which a tax credit

was granted to an owner of property pursuant to this article, if the owner fails to notify

the city within 30 days that the requirements of (ROH) Section 8-13.2 (a) are no longer

met, in addition to the consequences provided in ROH Section 8-13.6, the owner shall

be subject to a fine of $200.

Revocation of Credit (ROH) Section 8-13.6. During the tax year for which a tax credit is

granted pursuant to this article if: (a) Title to the property is transferred to a new

owner by gift, sale, devise, operation of law, or otherwise, except when title is

transferred to a qualified surviving spouse, or (b) The requirements of Section 8-13.2

(a) are no longer met, then the credit shall be revoked and the owner shall owe

property taxes in the amount of the tax credit. The additional taxes shall be billed and

shall be deemed delinquent if not paid within 30 days after the date of mailing of the

tax bill, or if the credit is revoked within the tax year for which the credit was granted,

within 30 days after the date of mailing of the tax bill, or on or before the next

installment date, if any, for such taxes, whichever is later.

CITY AND COUNTY

OF HONOLULU

The City and County of Honolulu offers a real

property tax credit to property owners who

meet certain eligibility requirements. If you

qualify, you are entitled to a tax credit equal

to the amount of taxes owed for the 2022 –

2023 tax year that exceed 3% of the

titleholders’ combined total gross income.

You May Qualify but not Benefit

If the assessed tax for 2022 - 2023 is less than 3% of

total gross income, no tax credit will be applicable.

(See Example 2)

What are the Eligibility Requirements?

Any property owner(s) who applies and meets all the

following eligibility requirements will be granted a real

property tax credit:

1. You must have a home exemption in effect on the

property at the time of application and during the

tax year July 1, 2023 – June 30, 2024.

2. Any of the titleholders do not own any other

property anywhere.

3. Combined total gross income of all titleholders for

the 2021 calendar year does not exceed $60,000.

Gross income includes all taxable and non-taxable

income for the 2021 calendar year.

4. None of the titleholders have violated ROH Sec. 8-

13.5, Penalties, by filing a fraudulent application or

attesting to any false statements with the intent to

defraud the city or evade the payment of real

property taxes or in any manner intentionally

deceives or attempts to deceive the city.

Real Property Tax Credit

For Homeowners

What is the Application Deadline?

September 30, 2022.

Applications must be received at the Division of

Treasury by 4:30 p.m. or postmarked by

September 30, 2022.

How do I get a Tax Credit Application?

Applications will be available at Satellite City Halls

yearly July through September.

Call the Tax Relief Office at (808) 768-3205 and we

will mail you an application.

Download the application online at

https://www.honolulu.gov/treasury

When will the tax credit be applied to my real

property taxes?

If approved, the tax credit will be applied to the

July 1, 2023 – June 30, 2024 tax year.

Important Reminders

-You must apply ANNUALLY for this credit.

-No credit shall apply if the real property taxes

owed, less any other one-time tax credit, are less

than or equal to three percent (3%) of the

combined total gross income of ALL titleholders.

-The amount of taxes owed after applying the tax

credit will not be less than the minimum tax a

year, outlined in Section 8-11.1 Revised

Ordinance of Honolulu 1990.

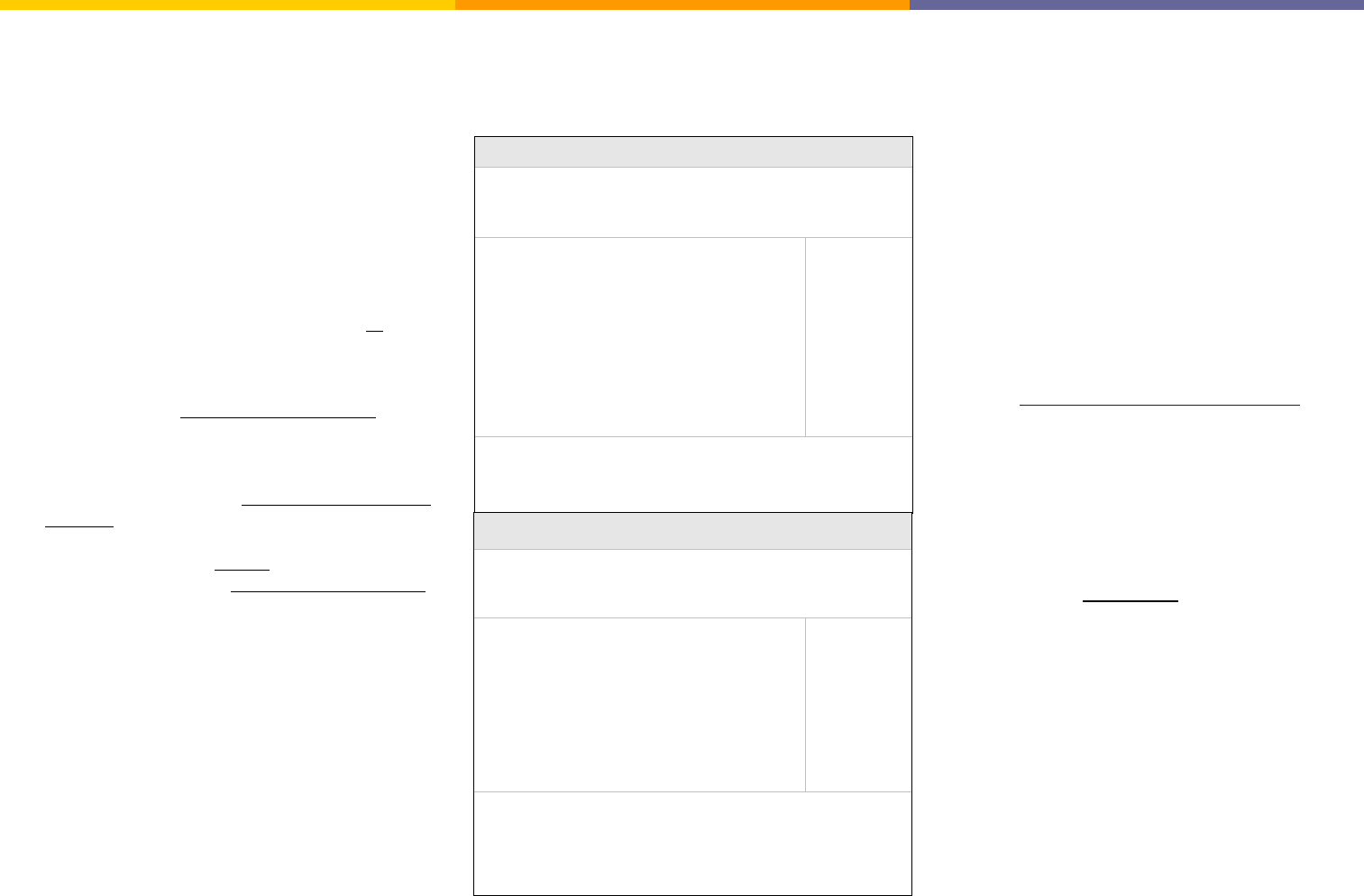

Example 1

Mr. and Mrs. Joe Aloha applied for the Real Property Tax Credit on

August 30, 2022. Their combined total gross income for 2021 was

$25,000.

Total Gross Income for 2021 of all Titleholders

Multiply total gross income by 3% (x .03)

2022 – 2023 Tax amount for the year

Less 3% of total gross income

Tax Credit Amount to be applied for Tax Year

2023 – 2024.

$ 25,000.00

$ 750.00

$ 2,500.00

$ 750.00

$ 1,750.00

Mr. and Mrs. Aloha met the Real Property Tax Credit

qualifications. Their current tax bill is greater than 3% of total

gross income. They have a tax credit of $1,750 that will be

applied to their 2023 - 2024 taxes.

taxes.

Example 2

Mr. and Mrs. John Mahalo applied for the Real Property Tax Credit

on August 15, 2022. Their combined total gross income for 2021

was $48,000.

Total Gross Income for 2021 of all Titleholders

Multiply total gross income by 3% (x .03)

2022 – 2023 Tax amount for the year

Tax Credit Amount to be applied for Tax Year

2023 – 2024.

$ 48,000.00

$ 1,440.00

$ 1,300.00

$ 0.00

Mr. and Mrs. Mahalo met the Real Property Tax Credit

qualifications. Their current tax bill is less than 3% of total gross

income. They qualify but do not benefit for a tax credit. The

assessed tax is less than 3% of total gross income.

The tax credit will be the difference between

your assessed real property tax and 3 percent of

your total gross income.